The United States Federal Reserve (Fed) has released a new monetary policy report, offering insights into the current economic climate, inflation, and labor market conditions. It highlights, among other things, the potential impact of AI on increasing worker efficiency and, consequently, earnings; this seems to be another argument for the 'higher for longer' approach. It seems unlikely that without any 'emergency state' situation in the economy, the Fed would aim for rate cuts again to the level of 0.5%. Here are the key points from the report:

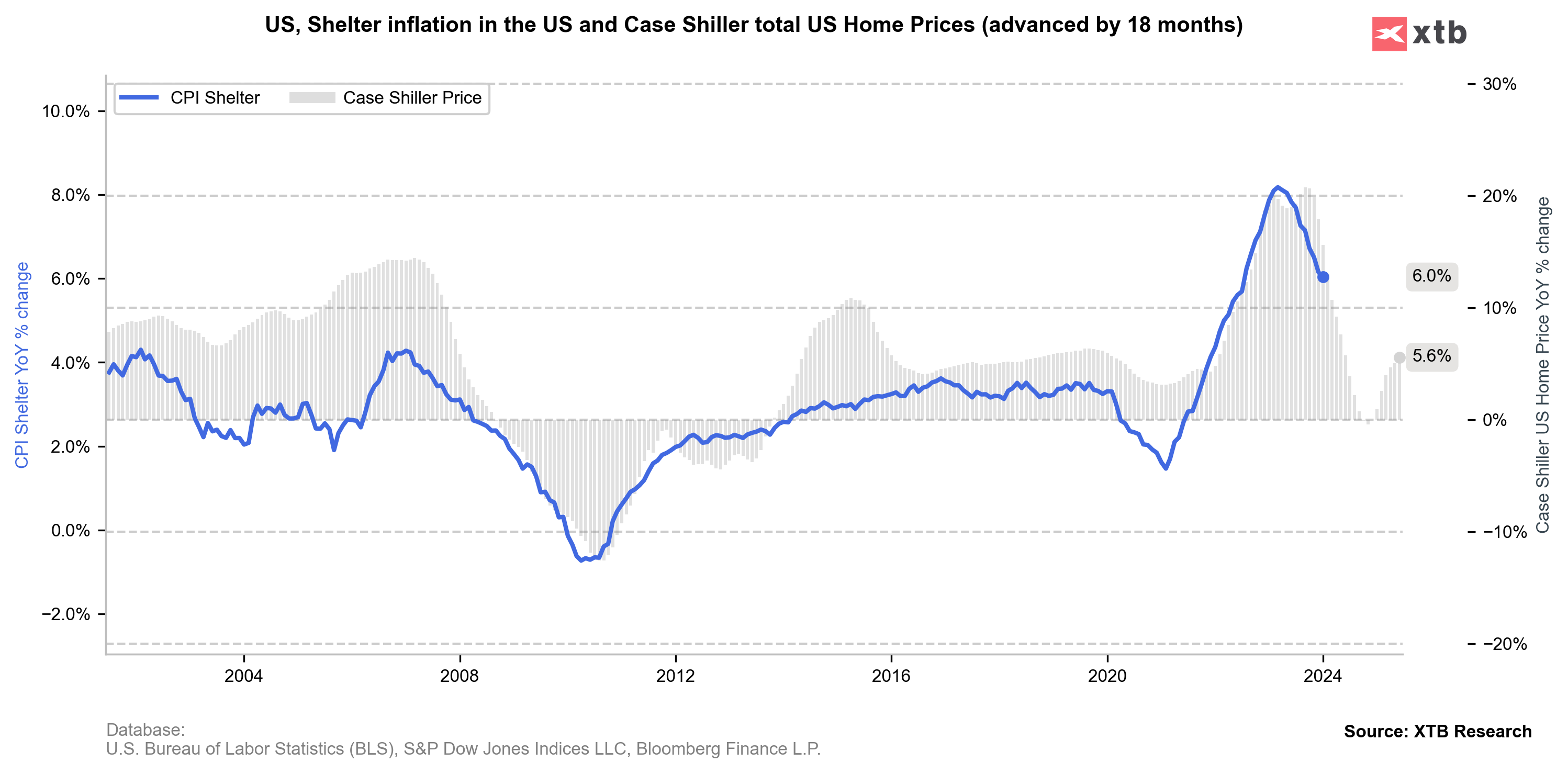

Macroeconomic Outlook and Inflation: The report highlights a notable softening in labor demand and improvements in labor supply, which are expected to contribute to a further slowing in core services price inflation. The Fed observes a softening in market rents, pointing to a continued deceleration in housing services prices over the coming year. Additionally, the rapid adoption of new technologies like AI and robotics could potentially boost productivity growth.

Wages and Labor Market: The labor market remains relatively tight, with easing demand and an increasing supply. Wage gains have slowed down in 2023 but continue to exceed the pace consistent with 2% inflation. The report also notes strong labor market conditions and trends like work from home, which have supported housing demand despite higher rates.

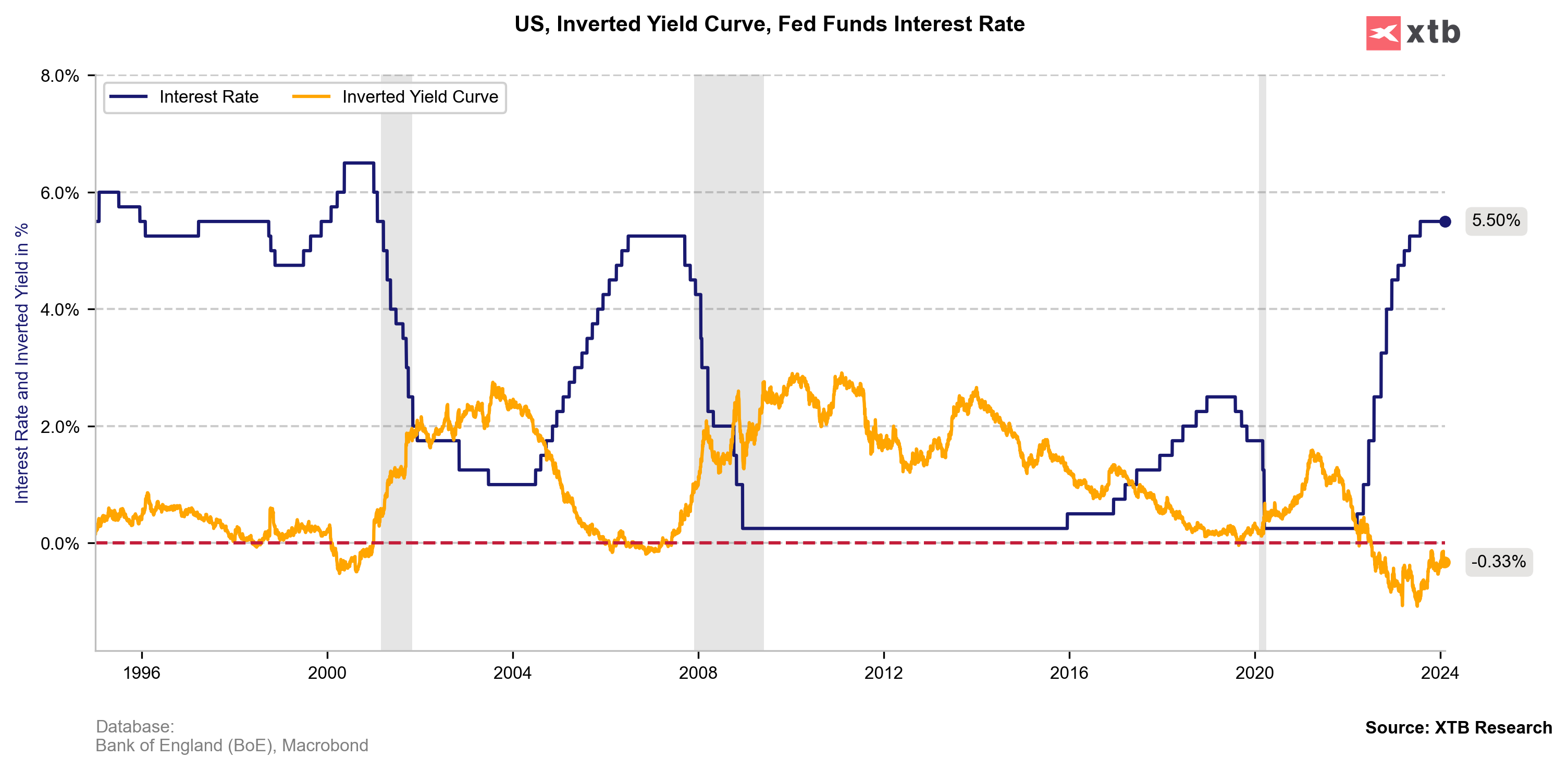

Fed Interest Rate Projections: The Fed underscores its commitment to achieving a 2% inflation rate, stating it is not appropriate to reduce the target range until there is greater confidence that inflation is moving sustainably toward this goal. The report suggests that while inflation has slowed, it remains elevated. The next interest rate-setting meeting is scheduled for March 19-20, with expectations of maintaining the current rate, followed by potential rate cuts in the coming months as inflation shows signs of returning to the 2% target.

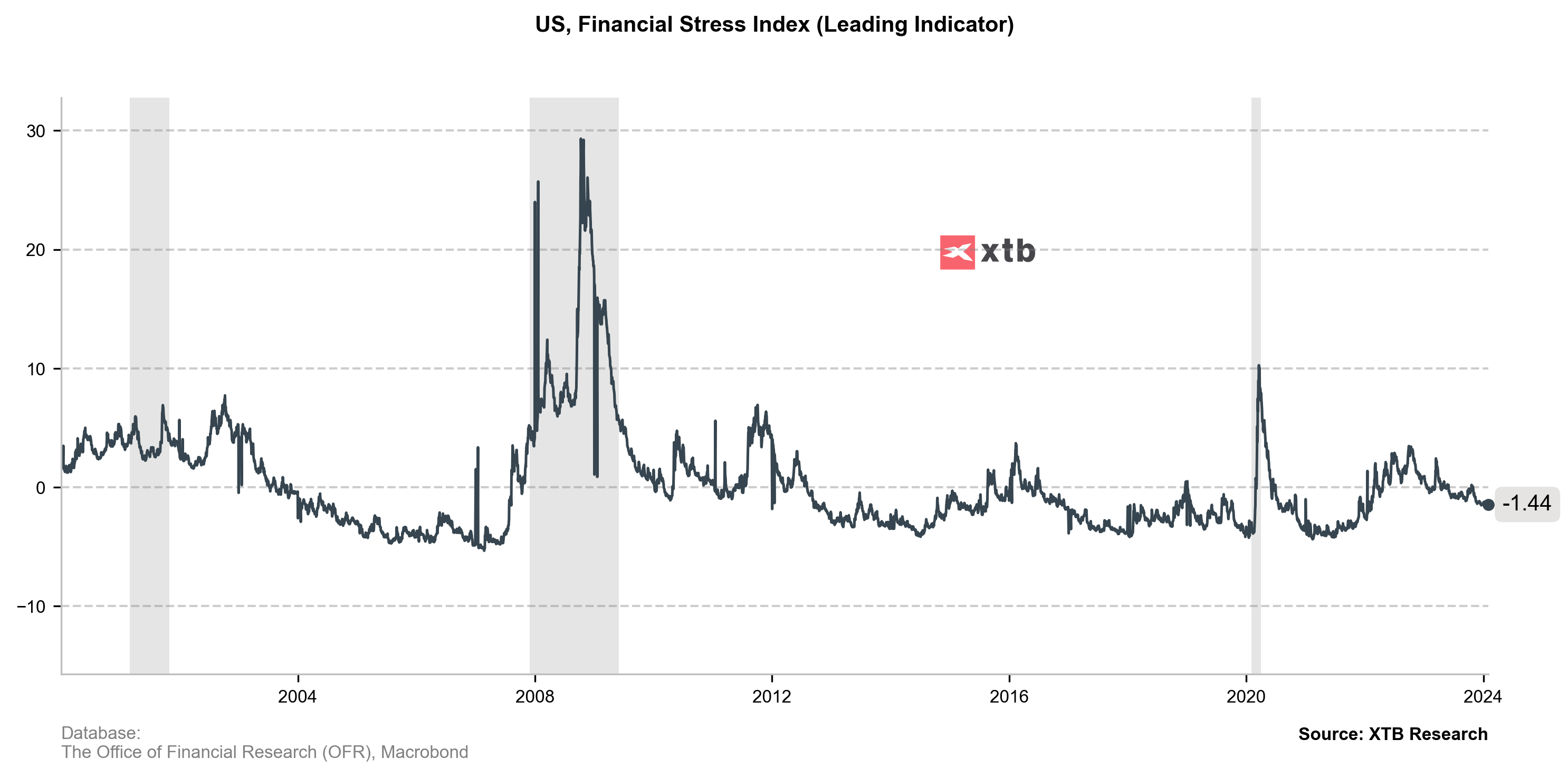

Financial Stability and Future Outlook: The report mentions "notable" vulnerabilities in financial stability, though the acute stress in the banking system has receded since last spring. The Federal Open Market Committee (FOMC) does not anticipate reducing the target range until greater confidence is gained that inflation is sustainably moving towards 2%. The report, serving as a precursor to Jerome Powell's congressional testimony, is expected to address lawmaker questions on the Fed's policy stance and expectations for easing. The Fed's upcoming decisions on interest rates will be closely watched, especially given the election year context.

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.