The Fed meeting has been and gone for another month. It mostly went as expected, interest rates remained unchanged and the FOMC statement suggested that the Fed is happy with the economic outlook, and they even acknowledged progress made on inflation after today’s lower than expected CPI report for May. As expected, the Fed dialed back its forecasts for interest rate cuts included in the Dot Plot. The median forecast for interest rates for this year is 5.1%, up from 4.6% in March. The prior expectation of 3 rate cuts this year has shifted to just over one cut.

S&P 500 hits a fresh record as dovish adjustment to CPI report continues

The Dot Plot was interesting not only for 2024 interest rate projections, but also expectations for the longer term. The median forecast for 2025 interest rates was 4.1%, up a touch from 3.9% in March. The longer run interest rate expectation, or the terminal rate, was also revised higher to 2.8% from 2.6%. The market has absorbed higher expected interest rates well. The S&P 500 is on track to close at another record high above 5,400, and the 2-year Treasury yield is currently down 8 basis points today. At one point it was lower by 15 basis points, however, yields started to rise after the FOMC meeting. Even so, the 8-point decline in Treasury yields is still a dovish adjustment.

Markets react to the Fed

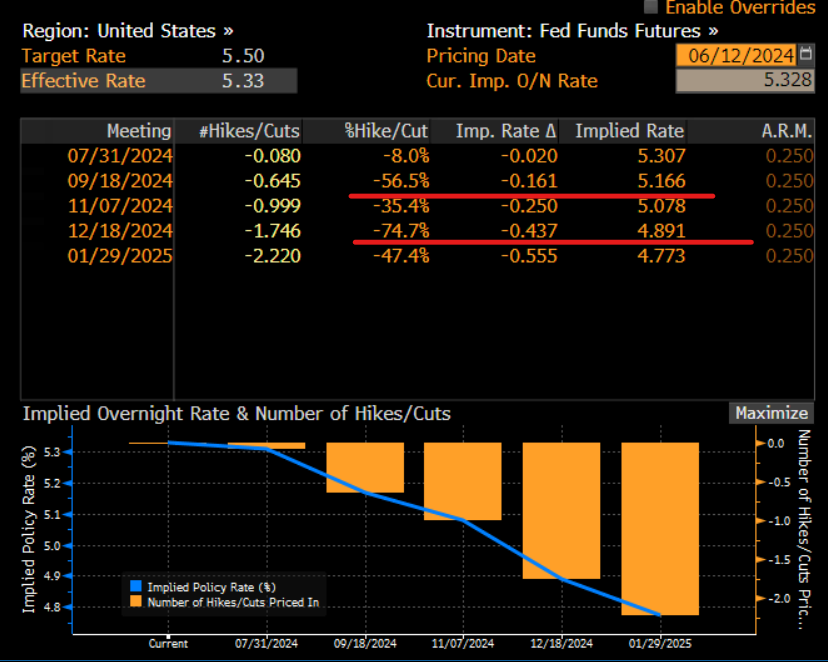

US interest rate futures had a wild ride on Wednesday. After the Fed meeting, the market is now pricing in a 55% chance of a rate cut in September, slightly lower than the 65% expected after the CPI report, and a 75% chance of a rate cut in December. Interest rates in the US are expected to end the year at 4.88%, slightly below the Fed’s median estimate, but very possible, especially if we continue to see improvement in the inflation data. Until we get the next main data print, the core PCE, that is due for release later this month, we may not see too much adjustment in financial markets. We think that interest rate expectations will stay around this level until the core PCE report. Although the dollar and US Treasury yields all started to climb after the Fed decision, we think that both the dollar and Treasury yields have taken a step lower, and the 2-year Treasury yield is likely to remain below 4.75% for the medium term. Likewise, the dollar may struggle to substantially recover in the short term and 105.00 is key resistance.

Chart 1: US Fed Fund Futures interest rate expectations

Source: Bloomberg

The prospect of a September rate cut helped global stocks to recover, especially in Europe after they sold off sharply in the aftermath of the EU elections. The FOMC meeting was never going to be a hurdle for the S&P 500, it closed on Wednesday at a record high, driven by tech stocks and another 3% gain for Apple, which has risen by nearly 10% in the last 5 days, making it the world’s most valuable company once more after its market capitalization hit £3.325 trillion. In contrast, the Dow Jones, the mostly industrial index, is struggling on the back of the reduced rate cut expectations from the Fed and is not joining in with the latest US stock market rally, as industrial stocks are struggling with higher interest rates and cuts to earnings forecasts for Q2. We also think the index of smaller US stocks, the Russell 2000, will struggle as smaller corporations are also more impacted by higher for longer interest rates. Thus, there could be a divergence in the performance for US indices as we move to the middle of the year.

Chart 2: S&P 500, Dow Jones Industrial Index and Russell 2000, 1 year chart normalized to show how they move together, and how the S&P 500 continues to pull away from the other US indices.

Source: Bloomberg and XTB

Overall, the Fed is happy with the gradual slowing in the economy and the labour market, even though NFPs were stronger than expected. The Fed has upgraded its median forecast for the terminal rate to 2.8% from 2.6%, however, we do not think that this is a big enough increase to spook the S&P 500, which may target 5,500 in the short term.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.