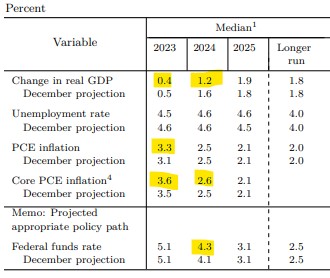

- The median for 2023 remains unchanged at 5.1%. This is quite a change, given the stance from the Fed just 2 weeks ago.

- Projection for 2024 marginally up, but still points to 3 cuts next year

The slight change in rate projections is positive news for the stock market. The Fed is giving itself room for one more hike, which is a much lower ceiling than the market might have expected just 2 weeks ago. Source: Fed, ZeroHedge

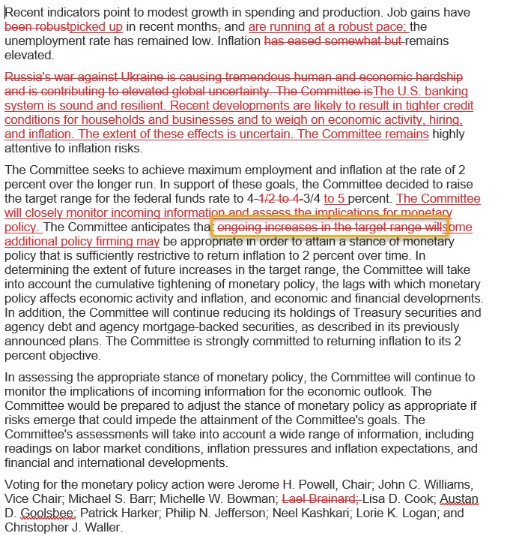

- The Fed referred to recent problems in the banking market, but indicates that the system is robust and resilient

- Nonetheless, this will affect slightly heavier credit conditions, which could theoretically help inflation to fall further

- The long-term impact is uncertain

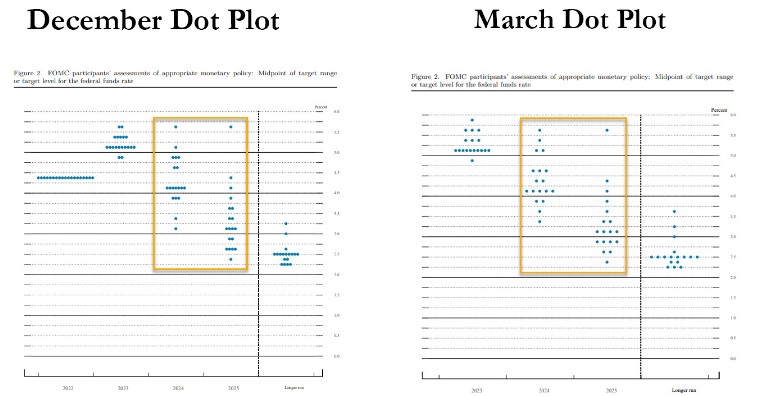

- The Fed is softening its stance on further increases. Here it indicates that further policy tightening should be assured. Abandonment of the statement on "further increases"

The Fed announcement softened. So did the interest rate projections. Source: Fed, ZeroHedge

- Projection for 2024 rate slightly upwards, but still points to 75bp cuts

- Slightly higher inflation projections, but for 2023 and 2024 raised by just 0.1 pp

- Lower growth expectations for the current year and markedly lower for the following year

- Unemployment rate expectations marginally lower for this year

Source: Fed

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.