FOMC announced its latest monetary policy decision at 7:00 pm BST and it was in-line with market expectations - rates were increased by 75 basis point to 3.00-3.25% range. A new set of economic projections showed downward revisions to GDP forecasts as well as upward revisions to unemployment rate and PCE inflation in 2022 and 2023. Judging by the initial reaction of the markets the decision can be seen as hawkish - US dollar gained and equity indices moved lower.

Attention now shifts to the press conference of Fed Chair Powell that is scheduled to begin at 7:30 pm BST.

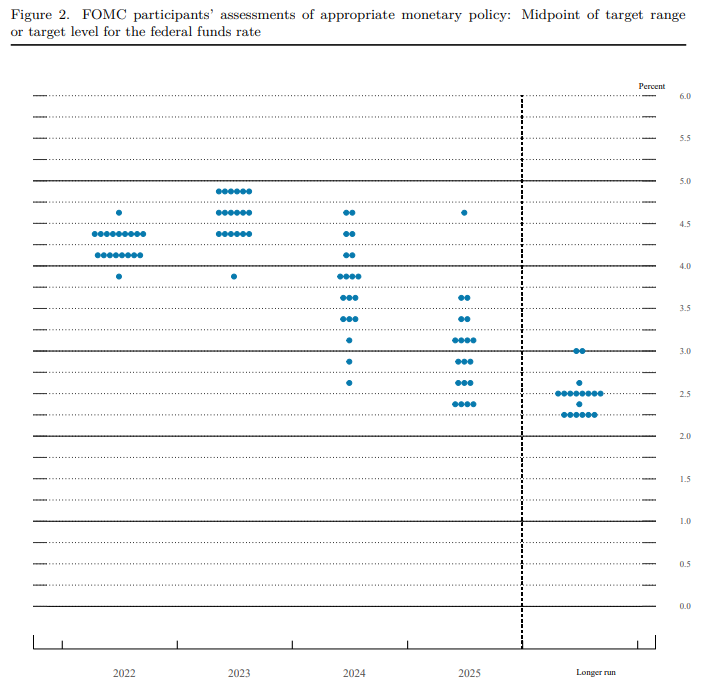

A new dot-plot showed a big upward revision - Fed funds rate is now seen at 4.4% at the end of 2022, compared to 3.4% from June projections. Source: Federal Reserve

A new dot-plot showed a big upward revision - Fed funds rate is now seen at 4.4% at the end of 2022, compared to 3.4% from June projections. Source: Federal Reserve

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.