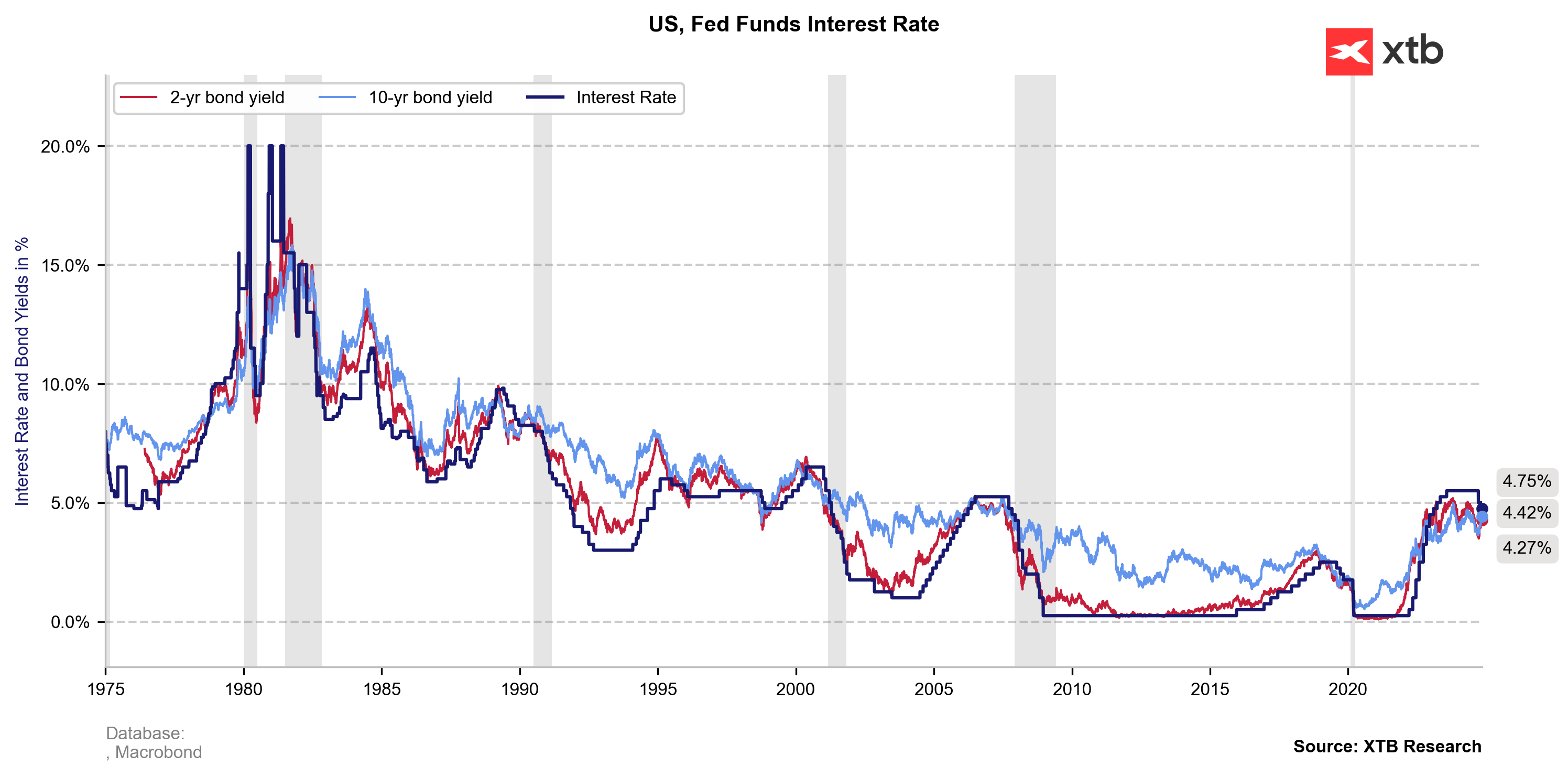

US Federal Reserve decided to cut interest rates by 25 bps to 4.75% today. Notable removal of language expressing "greater confidence" in inflation moving sustainably toward 2% target, suggesting increased caution about inflation progress.

Here is the Jerome Powell press conference highlights:

-

Economic activity has shown strength since September meeting:

-

Downside risks to economic activity have diminished

-

Overall economic data has been stronger than expected

-

-

On inflation and policy stance:

-

Powell expressed increased confidence in inflation moving toward 2% target

-

The removal of "confidence" language in statement was not meant to signal concerns about inflation stickiness

-

Policy remains restrictive despite the rate cut

-

Inflation appears to be on a sustainable path down to 2%

-

-

Labor market assessment:

-

The labor market has cooled significantly and is now essentially in balance

-

Importantly, no further cooling in labor market is needed to achieve the 2% inflation target

-

If labor market deteriorates, Fed could move more quickly with policy adjustments

-

-

On forward guidance and uncertainty:

-

Fed prefers not to provide extensive forward guidance at this time

-

Powell acknowledged a fair amount of uncertainty in the outlook

-

The Fed maintains its position of not commenting on fiscal policy

-

-

On bond market dynamics:

-

Current bond rate movements appear to be primarily driven by growth expectations rather than higher inflation expectations

-

Powell indicated the Fed is not at a stage where bond rates need to be factored into policy decisions

-

-

On political considerations:

-

Powell emphasized that in the near term, the election will have no effect on policy decisions

-

Any administration or Congressional policies' economic effects would be considered alongside other factors

-

Fed maintains its position of not commenting on fiscal policy

-

In an initial reaction, EURUSD dropped by an additional 0.12%; however, it has fully recovered following further remarks from Powell and is now up 0.59% for the day. US100 and US500 are reversing their earlier declines, with both Gold and Bitcoin also moving upward.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.