Neel Kashkari, president of the Minneapolis Federal Reserve in an interview with CNBC, commented on the current macroeconomic backdrop in the US and referred to the Fed's monetary policy on interest rates. Here are the key comments made by the banker:

- Monetary policy may not put as much pressure on demand as we think

- If we see a few more months of good inflation data, we will gain confidence in a return to 2%

- If the labour market continues to be strong, we could cut interest rates quite slowly

- At the moment, 2-3 interest rate cuts this year seem appropriate

- Most of the commercial property sector, apart from the office segment, is doing well

- The economy is showing remarkable resilience

We can interpret Kashakeri's comments as clearly hawkish and encouraging of a later interest rate cut. Despite this, the EURUSD pair is not overreacting to these comments, with the dollar recording negligible declines in their aftermath.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app

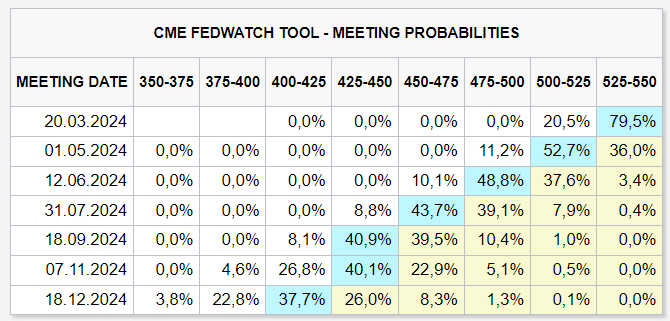

Kashkari forecasts 2-3 cuts this year. Meanwhile, the market is still pricing in around 5 cuts for 2024. Source: CME

Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.