Mary Daly was interviewed on CNBC today and her statement matched the tone of recent speeches from Fed bankers. At the same time, her statement was slightly less hawkish than that from a few days ago and does not point to two guaranteed rate hikes:

- She said that pointing at 2 hikes was a way to keep optionality open

- Lower inflation is a good news

- Lags in monetary policy are 12-24 months

- The cumulative effects of monetary tightening will work their way through the system

- The Fed will continue to work on rate hikes until inflation is on the path to come back down toward 2%

- There is a risk that we over-tighten and a risk that we under-tighten. That is why we are data dependent

- I have more optionality. Fed should not be declarative

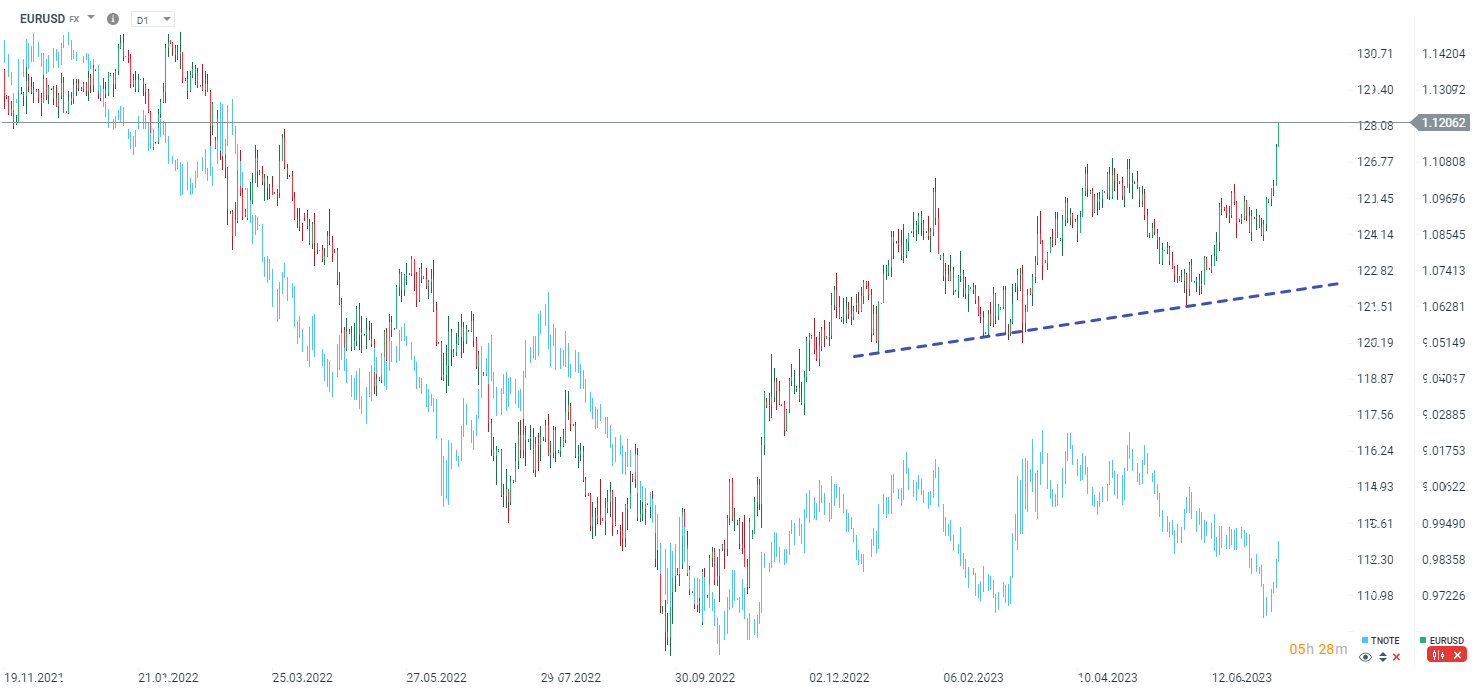

EURUSD is the highest since March 2022. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.