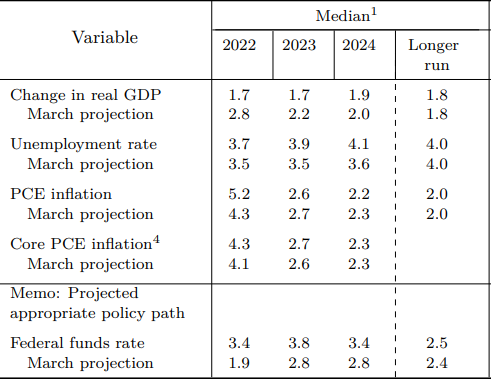

Main currency pair is hovering near 20-year lows less than an hour before the Fed announces its next monetary policy decision (7:00 pm BST). Both - economists and money markets - expect the US central bank to deliver another 75 basis point rate hike. However, hawkish bets increased following the US CPI report for August released last week and some called for a 100 basis point rate move. While this is not the base case scenario, a surprise can never be ruled out. Regardless of whether Fed hikes by 75 or 100 basis points, a lot of attention will be paid to economic forecasts. The most recent set of forecasts from June saw PCE inflation at 5.2% this year and it is almost certain to be revised higher. Also the median forecast for Fed funds rate at the end of 2022 was 3.4%. This is also likely to change given that 3.4% is less than 100 bp above current rate and, if Fed surprises to the upside, rates may jump to 3.25-3.50% range already today.

FOMC economic projections from June. Source: Federal Reserve

FOMC economic projections from June. Source: Federal Reserve

Start investing today or test a free demo

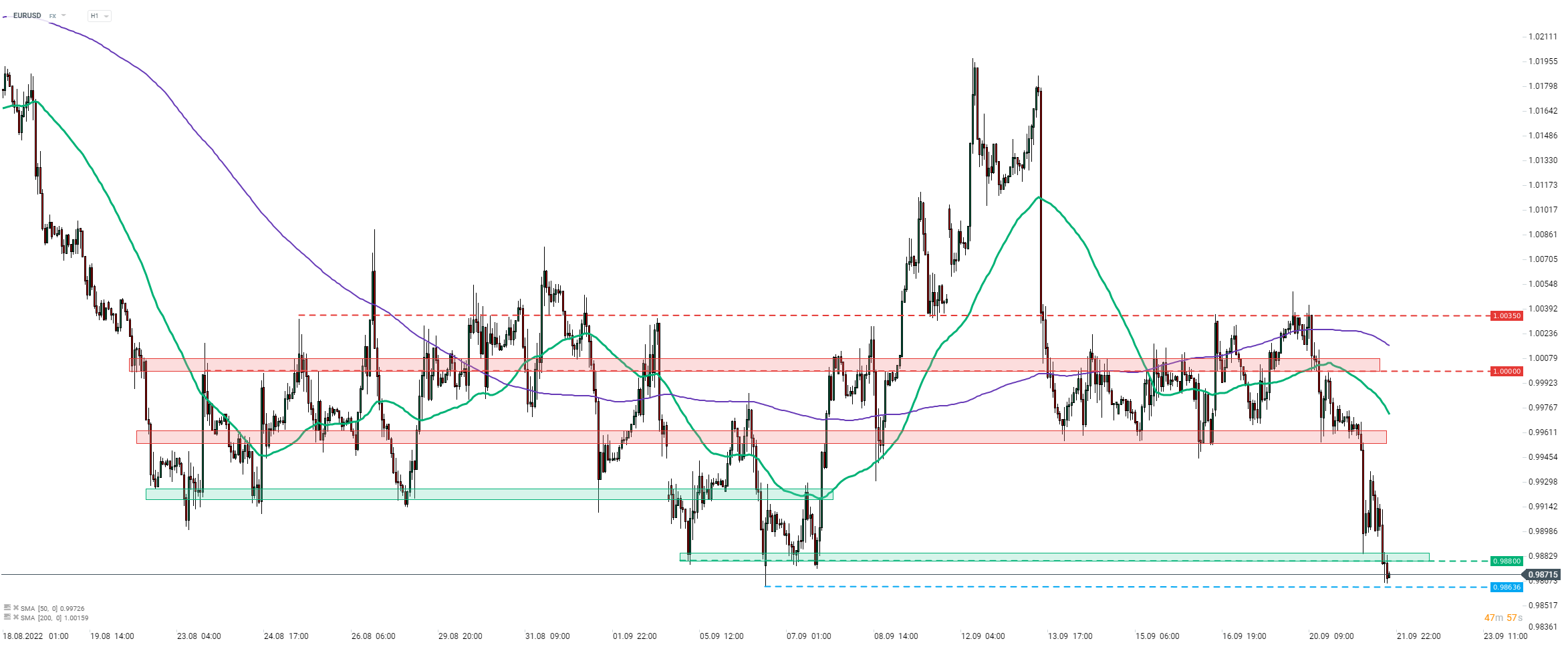

Open account Try demo Download mobile app Download mobile app EURUSD dropped below the 0.99 mark today and continued the move lower through the 0.9880 support zone. A low from early September at 0.9863 is within reach and a break below would put the main currency pair at fresh 20-year lows. Source: xStation5

EURUSD dropped below the 0.99 mark today and continued the move lower through the 0.9880 support zone. A low from early September at 0.9863 is within reach and a break below would put the main currency pair at fresh 20-year lows. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.