Monetary policy decision from the European Central Bank (1:15 pm BST) is a key event of the day. Bank is expected to deliver a 75 basis point rate hike, following a 50 basis point rate move in July. This would put the deposit rate at 0.75% - the highest level since October 2011. Inflation in the euro area exceeded 9% according to flash estimates for August, increasing pressure on the ECB to tighten policy quicker.

Such a big rate move from a usually dovish ECB may send an important message to the markets, even if it is almost 100% priced-in. EURUSD has been struggling as of late on the back of two reasons. Firstly, the common currency is underperforming amid a spike in energy costs that is threatening to push the euro area economy into recession. Secondly, pick-up in US yields is providing support for the US dollar. Having said that, a continuation of the ongoing drop in prices of energy commodities and potential drop in US yields, for example in case Fed slows tightening process, may be a chance for EUR.

Apart from that decision, press conference of ECB President Lagarde at 1:45 pm BST will also be in focus. Traders will look for hints on future rate moves and balance sheet reduction. EURUSD traders should also keep in mind that the pair may be more volatile at 2:00 pm BST during a speech from Fed Chair Powell.

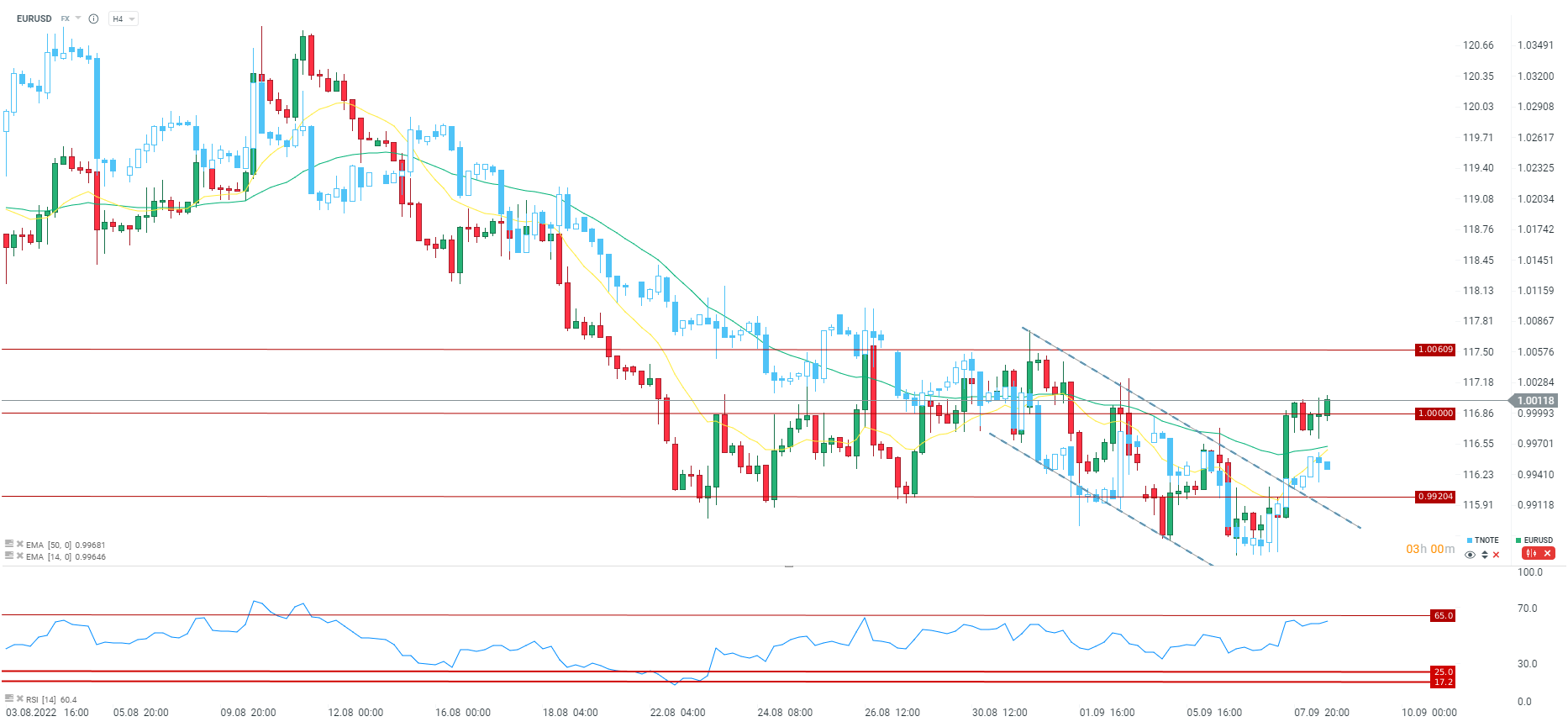

EURUSD is hovering around 1.00 handle today. The pair could benefit from a hawkish ECB guidance but the bank warned that it will make decision on meeting-by-meeting basis therefore any clear forward guidance may not be offered. If ECB fails to sound hawkish (or hikes by 50 bp) may see the pair resume recent slide. Source: xStation5

EURUSD is hovering around 1.00 handle today. The pair could benefit from a hawkish ECB guidance but the bank warned that it will make decision on meeting-by-meeting basis therefore any clear forward guidance may not be offered. If ECB fails to sound hawkish (or hikes by 50 bp) may see the pair resume recent slide. Source: xStation5

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.