Today we will learn the PCE inflation measure readings from the United States for October. As we can see, this reading is pretty much delayed, given that we learned November inflation data today from most European countries. Nevertheless, this is the Fed's preferred measure, so the market is paying close attention to it. On the other hand, today's reading does not seem likely to change the U.S. central bank's attitude toward further policy. The road to the 2% inflation target is long, so we are unlikely to expect a change in Powell's stance and communication, either in case of an excessive decline or increase.

Expectations point to a further decline in US inflation

- PCE inflation is expected to fall for October to 3.0% y/y from 3.4% y/y

- On a monthly basis, this is expected to be a gain of 0.1% m/m against a previous gain of 0.4% m/m

- Core (core) PCE inflation is expected to fall to 3.5% y/y from 3.7% y/y

- Monthly core, however, is expected to rise 0.2% m/m with a previous increase of 0.7% m/m.

It is worth noting that today we also learned November data for the eurozone as a whole. There, inflation falls to 2.4% y/y from 2.9% y/y on expectations of 2.7% y/y. The core falls to 3.6% y/y from 4.2% y/y on expectations of 3.9% y/y. Of course, inflation remains clearly above target all the time, but this will be the lowest core inflation reading since Q1, 2021. What's more, the 0.2% m/m core monthly inflation reading is in line with the Fed's projections for reaching its inflation target by the 2025 deadline. Declines in line with expectations could cool the recent dollar rally somewhat, but at the same time, higher readings could raise hawkish voices at the Fed that the current level of interest rates may not be enough.

PCE inflation versus CPI inflation. Source: Bloomberg Finance LP, XTB Research

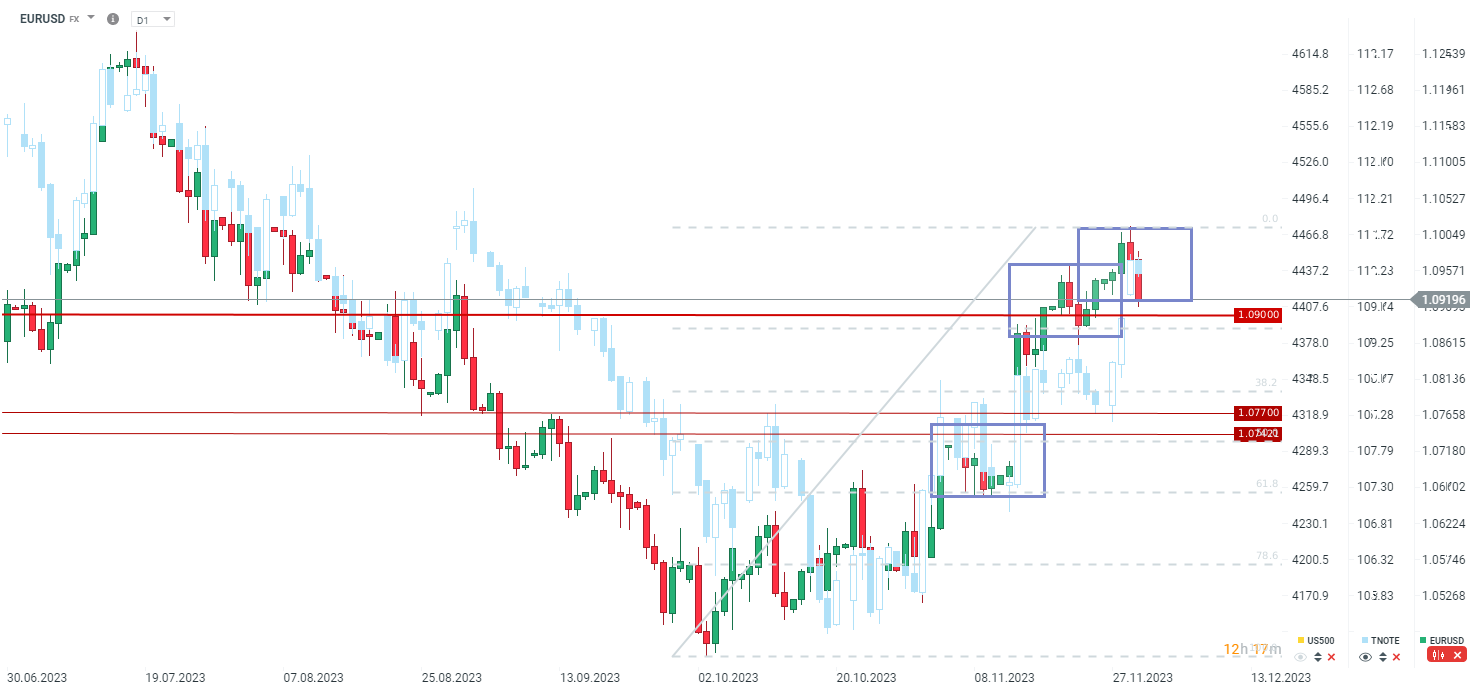

EURUSD

EURUSD is currently weakening by the strongest since October 24, and is approaching the level of 1.0900. Slightly below is key support near the elimination of 23.6 of the entire recent upward wave. In addition, if the pair closes at these levels, which we are currently observing, it could mean a potential breakout of the largest recent correction in the trend. Nevertheless, following US yields (the inverse of TNOTE), we do not see that stronger declines are warranted at this point.

Source: xStation5

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

Morning wrap (09.02.2026)

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.