EURUSD continues to move higher amid rising expectations of an imminent launch of Fed's easing cycle. Revised non-farm payroll data released today by US Bureau of Labor Statistics (BLS) showed a 818k downward revision to payrolls data for April 2023 - March 2024 period. This brings NFP increases during the aforementioned 12-month period down from unrevised 2.9 million to slightly below 2.1 million. This means that US labor market was weaker than was earlier thought and it gives Fed another argument to launch a rate cutting cycle, after inflation has largely fallen back to the central bank's target. There is one more important event scheduled for today - release of July's FOMC minutes at 7:00 pm BST). However, this could actually turn out to be a non-event as markets are already pricing in a very dovish Fed for the remainder of 2024 and attention is now on Powell's Jackson Hole speech scheduled for Friday.

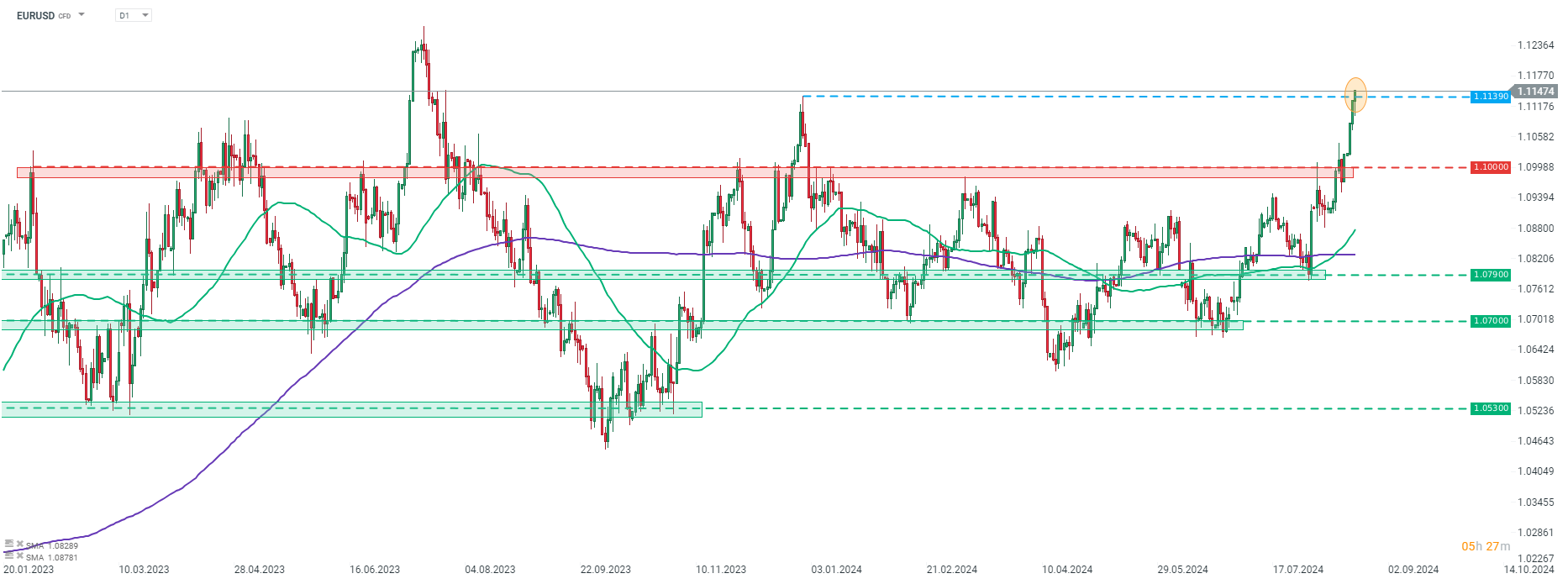

EURUSD is up around 0.2% today and is making a break above December 2023 highs at 1.1139. This means that the main currency pair is now trading at the highest levels in over a year. More precisely, the highest levels since late-July 2023.

Source: xStation5

Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.