The final pre-Christmas session on the global financial markets has been calm so far. Trading ranges are narrow as investors are looking forward to a long, holiday weekend. However, traders will be offered an important US data reading today at 1:30 pm GMT - a monthly data pack for November, including PCE inflation, which is Fed's preferred inflation measure.

What is the market expecting from today's data?

- Headline PCE inflation (annual). Expected: 2.8% YoY. Previous: 3.0% YoY

- Headline PCE inflation (monthly). Expected: 0.0% MoM. Previous: 0.0% MoM

- Core PCE inflation (annual). Expected: 3.3% YoY. Previous: 3.5% YoY

- Core PCE inflation (monthly). Expected: 0.2% MoM. Previous: 0.2% MoM

- Personal income. Expected: 0.4% MoM. Previous: 0.2% MoM

- Personal spending. Expected: 0.3% MoM. Previous: 0.2% MoM

PCE inflation and CPI inflation. Source: Macrobond, XTB Research

PCE inflation and CPI inflation. Source: Macrobond, XTB Research

How will data impact markets and Fed?

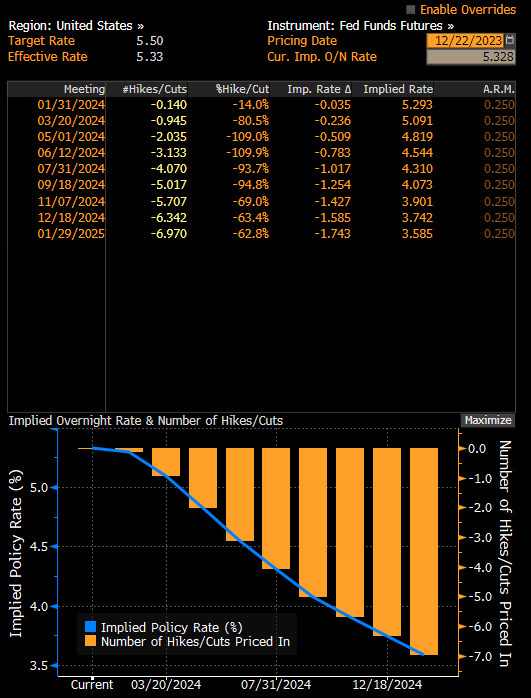

Money markets are pricing in 150 basis points of rate cuts during 2024. Fed is projecting three 25 basis point rate cuts for 2024. Market expectations seem to be high but inflation readings that are in-line or below expectations may encourage investors to continue selling USD and buying stocks. It should be noted that S&P 500 index has been climbing for the 8 weeks in a row now, and today's PCE reading may be determine whether the index will hold onto record levels.

Money markets are pricing in an around-80% chance of Fed delivering the first rate cut as soon as at March 2024 meeting. However, should inflation data came in lower-than-expected, those dovish bets may increase further and may allow indices to continue to trade at record levels, and allow EURUSD to finish the year above 1.10.

Money markets are expecting an extremely dovish Fed next year, given the number and timing of rate cuts priced in. Source: Bloomberg

EURUSD

EURUSD is trading at the highest level since August 2023. Should bulls hold above this level until the end of the year, a technical setup would hint at possibility of a test of the 78.6% retracement. Nevertheless, should PCE data came in above expectations, EURUSD may take a hit with 1.0970 area being the first support to watch.

Source: xStation5

US100

US100 continues to trade at near-record levels, but sell-off in Chinese gaming stocks is causing sentiment to deteriorate today. Should PCE inflation came in below expectations, US100 may attempt to climb above 17,000 pts mark. On the other hand, a PCE reading above expectations (3.4% YoY and 0.3% MoM for core PCE) would increase risk of downward correction, with 16,780 pts being a potential target.

Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.