Euro is having a bad start to the week. While EURUSD is trading flat today, the major currency pair experienced a strong sell-off yesterday and dropped below the 1.1400 mark for the first time since July 2020. There were two reasons behind such a move. The first one is broad US dollar strengthening. The second one, and a more important one, is yesterday's speech from ECB President Lagarde. Christine Lagarde said that ECB rate hike next year looks highly unlikely. She also said that inflation is expected to remain below a 2% target over the medium-term. Asked about 2023, Lagarde declined to specify her opinion on rate hikes. Interest rate derivatives market no longer prices in a Eurozone rate hike in 2022. Probability of such a move by the end of the next year exceeded 80% on Friday.

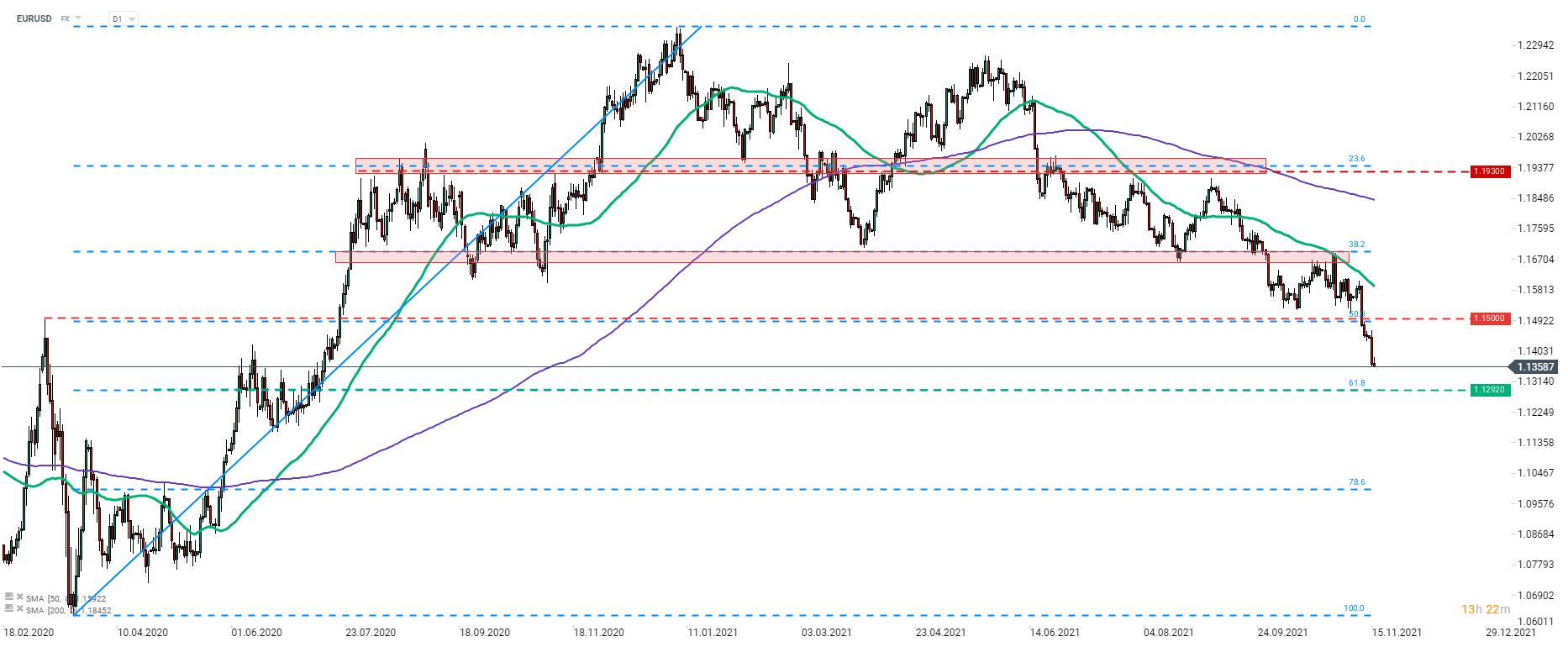

A look at the EURUSD chart shows us that the pair has been freefalling for over a week now. The pair has reacted to Fibonacci retracements of the post-pandemic recovery move during the past 10 months, making a 61.8% retracement in the 1.1292 area an important level to watch for traders. Source: xStation5

A look at the EURUSD chart shows us that the pair has been freefalling for over a week now. The pair has reacted to Fibonacci retracements of the post-pandemic recovery move during the past 10 months, making a 61.8% retracement in the 1.1292 area an important level to watch for traders. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.