EURUSD is trading around 1% lower on the day with EUR being one of the worst performing G10 currencies today. Common currency dropped following release of disappointing flash PMIs from France and Germany for June. French services PMI dropped from 52.0 to 48.0, meaning that the sector was contracting. Meanwhile, German manufacturing PMI dropped to 41.0 - the lowest level since May 2020. In both cases, readings were much weaker than expected.

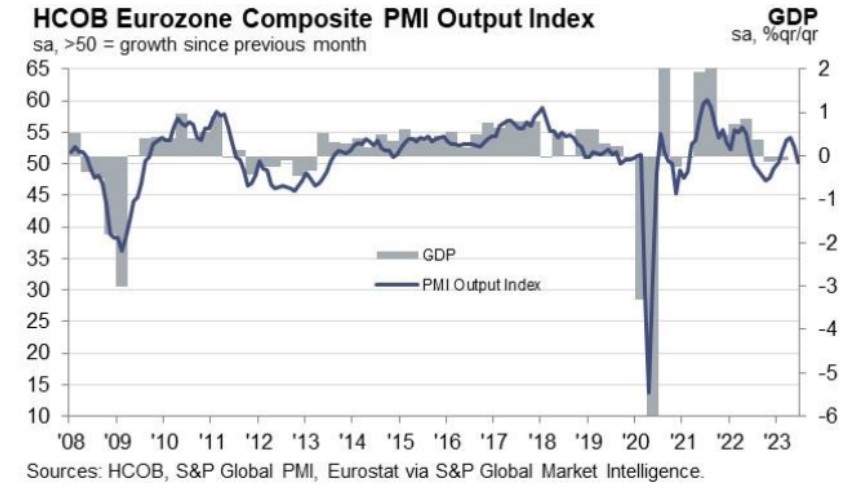

Composite PMI for the whole euro area dropped from 52.8 to 50.3 while the market expected a small drop to 52.5 pts. This means that euro area PMI is currently projecting a flat GDP growth and should it continue to slide further it may point to a risk of technical recession.

Should hard data like industrial production or retail sales start to reflect concerns of entrepreneurs, European Central Bank may have to rethink its hawkish stance, which currently suggests two more rate hikes this year. Moreover, US dollar is benefiting from hawkish comments made by Fed Chair Powell earlier this week, who has clearly hinted that two more rate hikes in the United States are the base case scenario for now.

Composite PMI for the euro area suggests that technical recession cannot be ruled out. Source: S&P Global, HCOB

EURUSD breaks below the upward trendline today and snaps a current uptrend structure by painting a lower low. The pair is also testing 50% retracement of the whole upward impulse launched at the beginning of June. The next important support in-line can be found in the 1.08 area. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Economic calendar: Delayed labour market data the key report of the week 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.