Following today's comments from Fed members, specifically dovish remarks from Bowman and Waller, the market has returned to euphoric gains. We are observing a shift away from low-risk assets such as the dollar, which is breaking through successive key levels. Meanwhile, stocks and cryptocurrencies are gaining. The S&P 500 index is very close to this year's highs, Bitcoin has just broken above 38,000 USD, and gold is up 1.35%, reaching 2,040 USD per ounce. The rises are driven by a weakening dollar, and bond yields are also retreating.

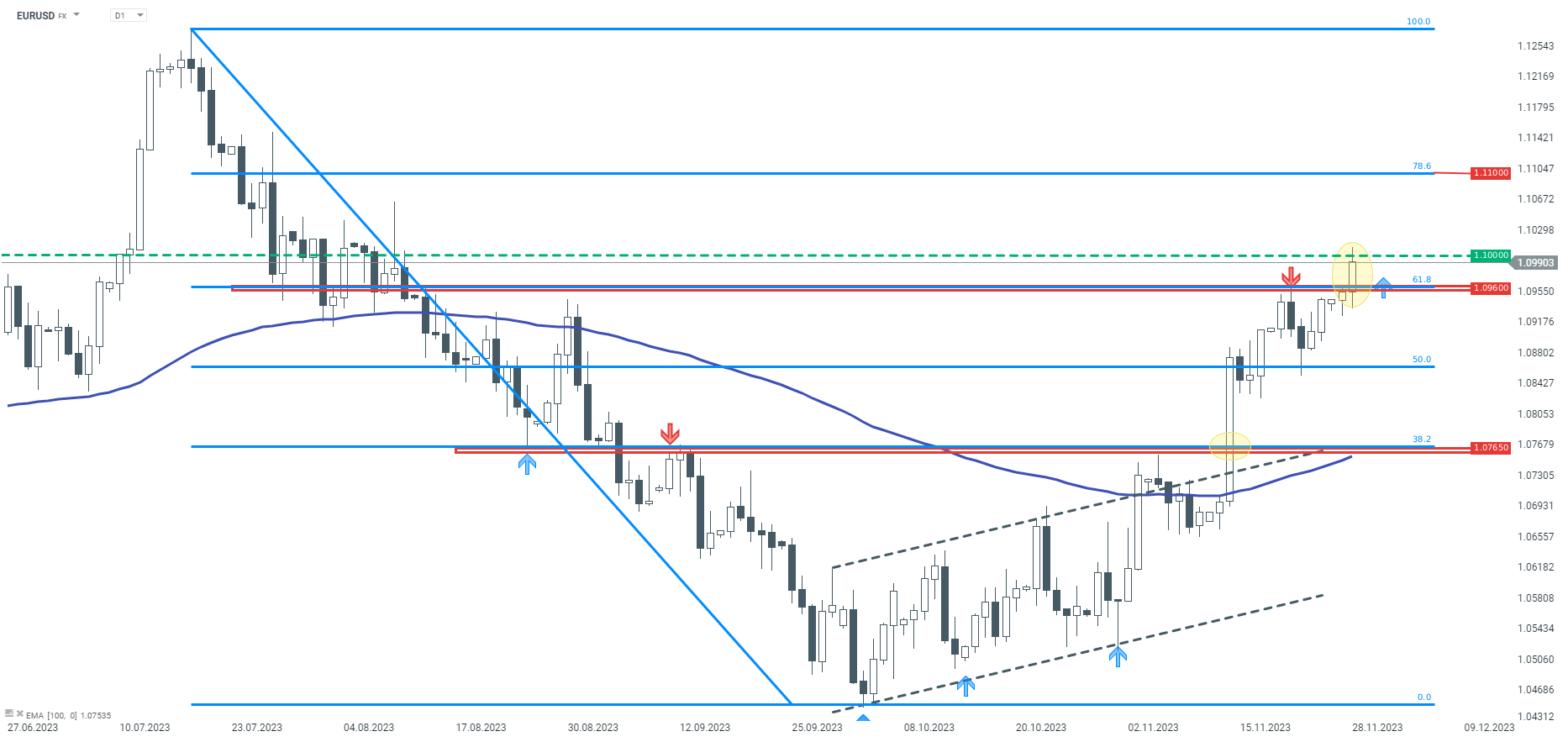

EURUSD quotations have risen above the round level of 1.1000 for the first time since mid-August this year. Looking at the technical situation, bullish sentiment has been prevailing since the beginning of October. The upward movement gained strength on November 14 when CPI inflation data from the USA indicated a faster decline in price growth. The intensity of the upward movement continued, and sellers only appeared at the resistance level of 1.0960, which is derived from measuring 61.8% Fibonacci of the entire last downward wave, counting from the July peak. Breaking through the indicated resistance in today's session may even open the way towards the next Fibonacci retracement - at the level of 1.1100.

Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.