Despite the radical move by the CBRT, which that week raised rates from 17.5 to 25 percent (versus 20 percent expectations by Reuters analysts), the Turkish lira quickly resumed its downward trajectory. Speculators have been steadily playing out the scenario of further depreciation of the Turkish currency, and the radical move by the Central Bank of the Republic of Turkey ultimately failed to cause a sharp reversal of the trend. EURTRY rose above 29 points today, which makes a test of 30 points in the past and a possible complete erasure of last week's abject downward movement on the currency pair likely.

Looking at EURTRY on the H1. interval, we see that the price rose slightly above the SMA200 (red line) signaling the strength of the sell-off on TRY. After a sizable drop to the area of 27 points, the bulls managed to stop the movement and failed to test the 38.2 Fibonacci retracement of the May 2023 upward wave (before the Turkish elections). As a result, the price again defeated the SMA50, which could potentially herald a momentum advantage on the buyers' side. At the same time, the RSI indicator has risen to near overbought territory. In the current situation, the base scenario in the horizon of the coming hours seems to be consolidation at the current levels around 29 points, which may precede an upward movement and cool the relative strength index.

Source: xStation5

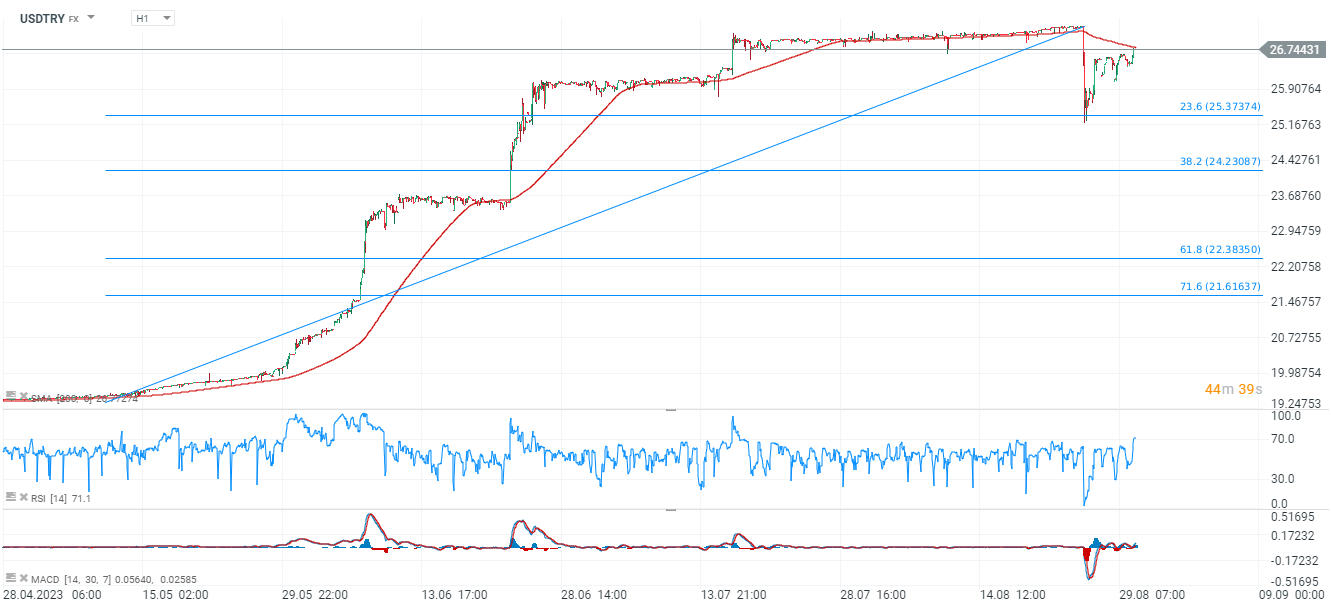

Of course, a similar situation is taking place on the USDTRY pair, where the price is still struggling with the SMA200 (red line) at 26,744 points. The 23,6 Fibonacci near 23.6 level of the upward wave from May proved to be strong support, from where speculators again saw a risk premium.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.