In the first part of the European session we received 3 economic reports from Europe: labour market data from Germany and Eurozone and also Eurozone producer inflation. All the data seems to support further inflation growth.

In Germany, the unemployment rate remains at 5% and the number of unemployed fell by 13,000 for April, with an expected drop of 15,000 and a previous drop of 18,000. The data is slightly worse than expected, but still puts upward pressure on wages.

The Eurozone market is also doing well. The unemployment rate is down from 6.9% to 6.8%, although a drop to 6.7% was expected. Of course, the situation on the labor market in the Eurozone is completely different than, for example, in the USA. In the case of the euro zone we have a lot of inequalities between the economies, which does not allow for such a dynamic reaction with the monetary policy as in other economies.

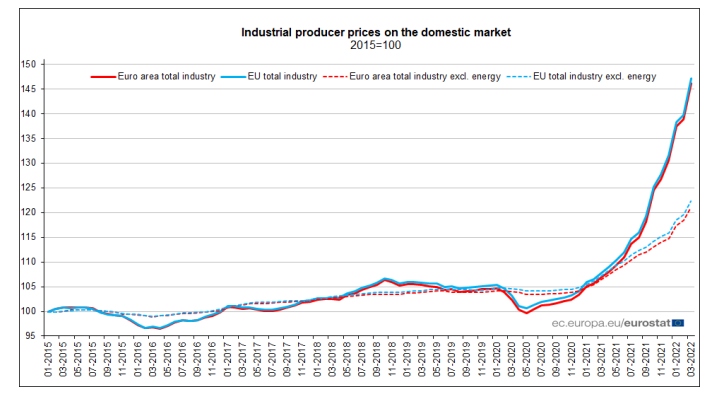

On the other hand, the PPI inflation in the Eurozone is growing by as much as 36.8% y/y with the expectation of 36.3% and the previous level of 31.5%. On a monthly basis, PPI inflation is up 5.3% m/m with expectations of 5.0% m/m and on the previous level of 1.1% m/m.

Even without energy costs, producer inflation is rising at an enormous pace in the Eurozone. Source: Eurostat

Even without energy costs, producer inflation is rising at an enormous pace in the Eurozone. Source: Eurostat

Volatility on EURUSD is negligible today. EURUSD is slightly above the level of 1.0500. At the same time the pair is below the lower limit of the downward trend channel. Near the level of 1.0600 there is resistance strengthened by the Fibo 161.8 retracement of the last large upward wave from the 2nd half of March. Tomorrow's Fed decision may slightly increase the volatility on the main currency pair. Source: xStation5

Volatility on EURUSD is negligible today. EURUSD is slightly above the level of 1.0500. At the same time the pair is below the lower limit of the downward trend channel. Near the level of 1.0600 there is resistance strengthened by the Fibo 161.8 retracement of the last large upward wave from the 2nd half of March. Tomorrow's Fed decision may slightly increase the volatility on the main currency pair. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.