With the US still celebrating the Thanksgiving holiday, the focus has shifted to Europe. France and its budget woes along with rising inflation in the currency bloc has focused minds on the outlook for the euro. Marine Le Pen, the leader of the National Rally, holds the balance in France’s split parliament, and has given the Prime Minister Michael Barnier until Monday to meet her Budget demands, otherwise she will vote against the government in a no-confidence motion.

Political risks build in Europe

As we move into 2025, political risk lies with Europe. German elections will take place next February, and they could see smaller, radical parties win power, which could dramatically change the flavour of German politics. Fresh French election risks also cannot be ruled out. The outcome of the Budget crisis has been complicated by the no-confidence motion. Either the government collapses early next week, or Barnier has to water down his proposals so much that the Budget will not reduce the deficit by as much as is required. A weak budget could be as bad as a collapsed government for the French bond market.

France joins Greece and Italy, as the most fiscally risky countries in the Eurozone

French 10-year bond yields are currently trading at 2.94%. This is significantly higher than Spain and Portugal’s 10-year bond yields and is on par with Greece’s 10-year yield, which is trading at 2.94%. Italy, long considered the most fiscally vulnerable member of the currency bloc, has a 10-year bond yield of 3.3%. If you look at French bond yields in isolation, you would not think there was a problem. For example, the 10-year yield is lower by 14bps in the past month, compared with a decline of 7 bps for UK 10-year bond yield. In the past week, the French 10-year yield is lower by 8bps, which is line with global trends.

However, the problem for France is two-fold. Firstly, its yields are rising at a faster pace than other currency members. It is no longer considered one of the safest sovereign bonds in the currency bloc, and instead is languishing near Greece and Italy, who have a history of fiscal squeezes. Secondly, this means that the market sees an enhanced chance of a fiscal crisis for France, which leaves its bond market vulnerable at the same time it has a budget deficit of 6% of GDP.

A lose-lose situation for the French bond market

It looks like a lose-lose situation for the French bond market. Either Barnier’s government collapses if he does not give in to the National Rally’s demands on public spending, or bond yields rise anyway, because he does give in to Marine Le Pen, and the Budget does nothing to bring down the deficit. France is looking like it could become the weakest link for the currency bloc next year. French risks have weighed on the CAC 40, which is down by more than 5% so far this month and is the weakest performer in Europe. The euro is also the weakest currency in the G10 FX space this month, and is down more than 2.5% vs. the USD since the start of November.

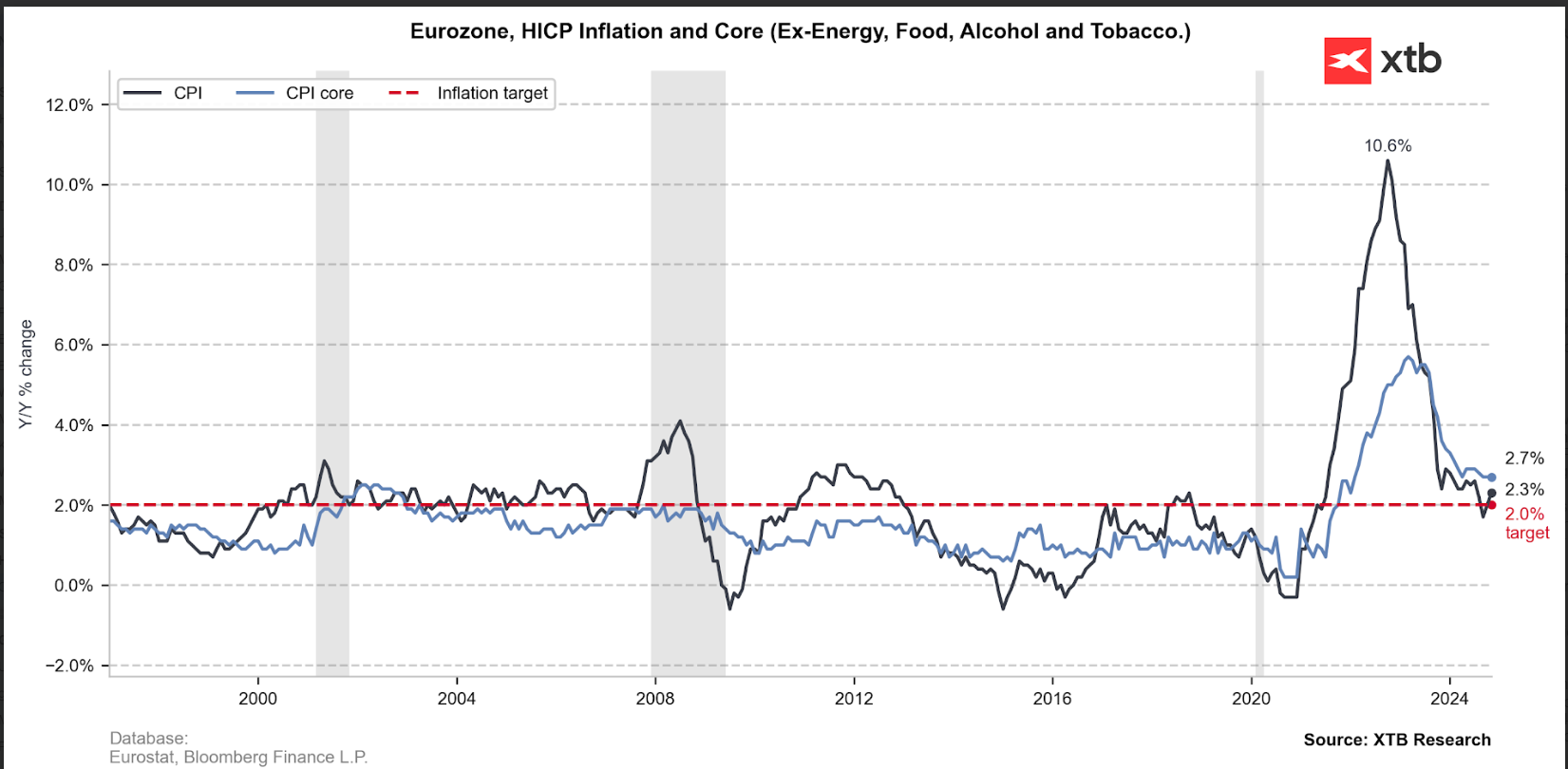

Eurozone CPI rises, but won’t derail ECB rate cut programme

The Eurozone’s CPI estimate for November was mostly in line with expectations. The headline rate rose to 2.3%, while the core rate remained steady at 2.7%, analysts had expected a rise to 2.8%. The monthly figure may give some cause for concern, it declined by 0.3%, led by a decline in volatile energy prices. Overall, we do not see this inflation print as derailing ECB rate cuts. The ECB is expected to cut rates at a much faster pace than the US or the UK next year, and this is driving euro weakness. Interest rate differentials are driving the FX market right now, and the euro is in the firing line. Add in French political risk, and it is hard to see how the euro can make a meaningful recovery in the long term.

Chart 1: Eurozone CPI

Source: XTB research

Will the euro benefit from a 50bp or 25bp cut debate?

However, there could be a chance for some short-term euro recovery. The debate surrounding European interest rates is now focused on whether the ECB will cut rates by 25bps or 50bps. The more dovish members of the ECB have called for interest rates to be cut sharply back to 2%, considered to be the neutral rate for the Eurozone economy. However, half of Eurozone members have inflation above 2%, and service price inflation is still well above the ECB’s 2% target rate at 3.9%, which could lead to some members choosing to avoid turbo charged rate cuts at this stage.

The interest rate futures market currently expects 38bps of cuts from the ECB at next month’s meeting. If this is scaled back further, and the market moves towards expecting a 25bp cut at the December meeting, then the euro could stage a mini recovery in the short term, although we continue to think that its long-term outlook is weak.

EUR/USD stages mild recovery

The dollar is fading on Friday and is set to record its worst week since August. Low volumes due to the Thanksgiving holiday in the US, and profit taking at month end, are stemming the greenback’s rally. EUR/USD is facing resistance at $1.06, so there could be a limit to how far the euro can recover on Friday, with the French government risks lingering over the currency bloc. The pound and the euro are both struggling to capitalize on the weaker dollar on Friday, instead the yen is the chief beneficiary.

The yen wraps up a strong month

USD/JPY is down nearly 0.9%, after stronger than expected Tokyo CPI for November. This has boosted the prospect of a rate hike from the BOJ next month to 60%. The market expects the BOJ will hike rates to 0.37%, up from 0.25% now. The expanding yield differential with the US and other countries, albeit small, could be a powerful driver of yen recovery in the coming months. USD/JPY is hovering around 150.00, the next key support level for this pair is 149.50. Interestingly, a strong dollar is a key plank of the Trump trade, yet since Trump’s victory the yen is the only G10 FX member to rise vs. the USD and is higher by nearly 1%. This suggests that interest rate differentials are driving the FX market, also that the yen is benefitting from haven flows driven by concerns about Trump’s economic policies.

Politics batter the UK bond market once more, as Starmer remains under pressure

STM is growing stronger thanks to a new partnership with AWS!

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.