Summary:

-

ECB keep all rates unchanged as widely expected

-

Bank confirm asset purchases will halt at year-end

-

Euro dips a little lower while DE30 little changed

The final ECB rate decision of the year has been a momentous occasion but unfortunately due to the announcement being widely expected it has failed to provide any large moves in the markets. All the key rates were held unchanged once more, and it now looks increasingly likely that President Draghi will serve his entire 8-year term having not presided over a single rate hike. The decision also confirmed that the ECB will halt its bond buying programme this month while stating that reinvestment of maturing debt will go beyond the date of the first interest rate increase.

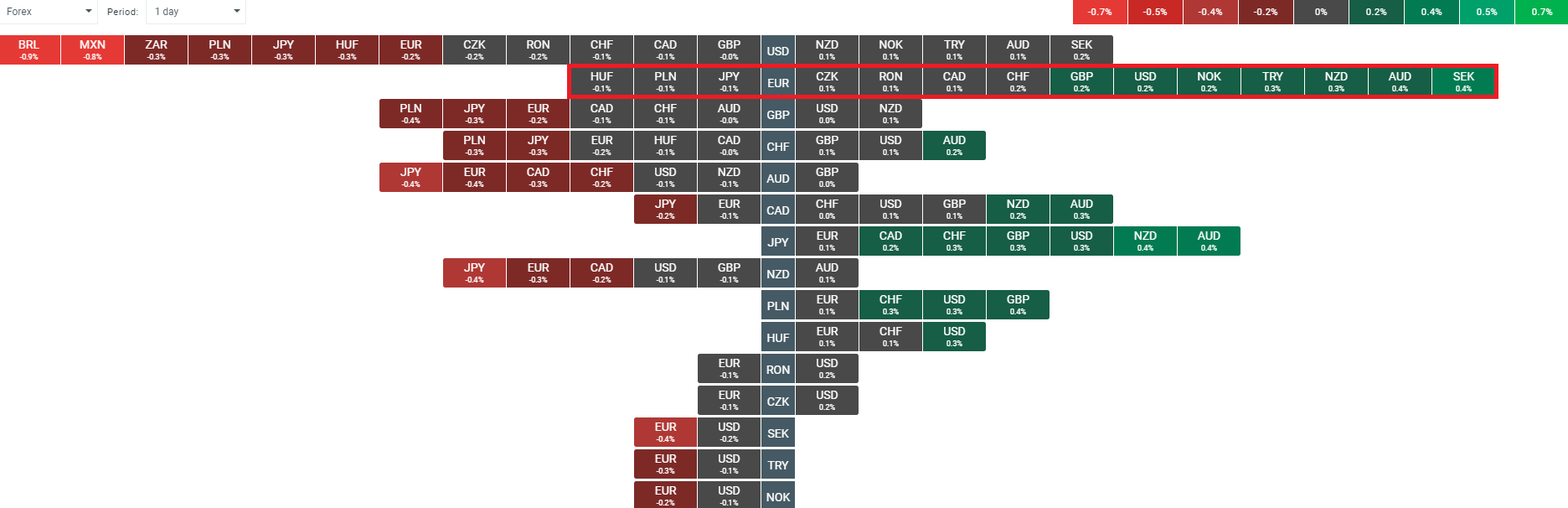

The Euro is sliding lower after the ECB although the moves remain fairly small and measured. Source: xStation

The latest ECB forecasts released today are as follows:

GDP:

2018: 1.9% vs 2.0% prior

2019: 1.7% vs 1.8% prior

2020: 1.7% vs 1.7% prior

2021: 1.5% (no prior as this was first forecast)

Inflation:

2018: 1.8% vs 1.7% prior

2019: 1.6% vs 1.7% prior

2020: 1.7% vs 1.7% prior

2021: 1.8% (no prior as this was first forecast)

Overall, there’s nothing too groundbreaking here with growth revised a little lower for the next couple of years. On the inflation front the current year has been revised higher while next year’s moved down so the net effect isn’t that large.

President Draghi’s press conference is often the main market moving event around ECB decisions but this failed to throw up too much this time out. Selected comments are shown below:

-

Inflation coming in weaker than expected

-

Weaker data reflects softer external demand

-

Inflation will continue to converge

-

See somewhat slower growth momentum ahead

-

Business investment is benefitting from domestic demand

The market reaction in the EURUSD has been a move lower with the pair also dropping a little strengthening in the US dollar following a strong initial jobless claims release. The market has been pretty quiet of late with a fairly narrow range seen in the past few months. Since the middle of October the market has exhibited a range of around 280 pips and this range seems to have narrow even further of late. Price could be coiling before a breakout, with the market getting closer to the apex of a triangle.

The EURUSD has traded in a narrowing range of late with price approaching the apex of this consolidatory triangle. Source: xStation

The EURUSD has traded in a narrowing range of late with price approaching the apex of this consolidatory triangle. Source: xStation

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.