This Monday is being marked by corrections in most assets that experienced significant appreciation last week.

Regarding EUR/USD, the euro is beginning to benefit from the improved market sentiment after equities witnessed a strong recovery last week.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appDaily Time Frame Chart

When analyzing the pair on the D1 chart, we can see that on Friday the price began to show signs of slowing down and is currently retreating. Nevertheless, the main trend still appears to be bullish.

Source: xStation 5

Source: xStation 5

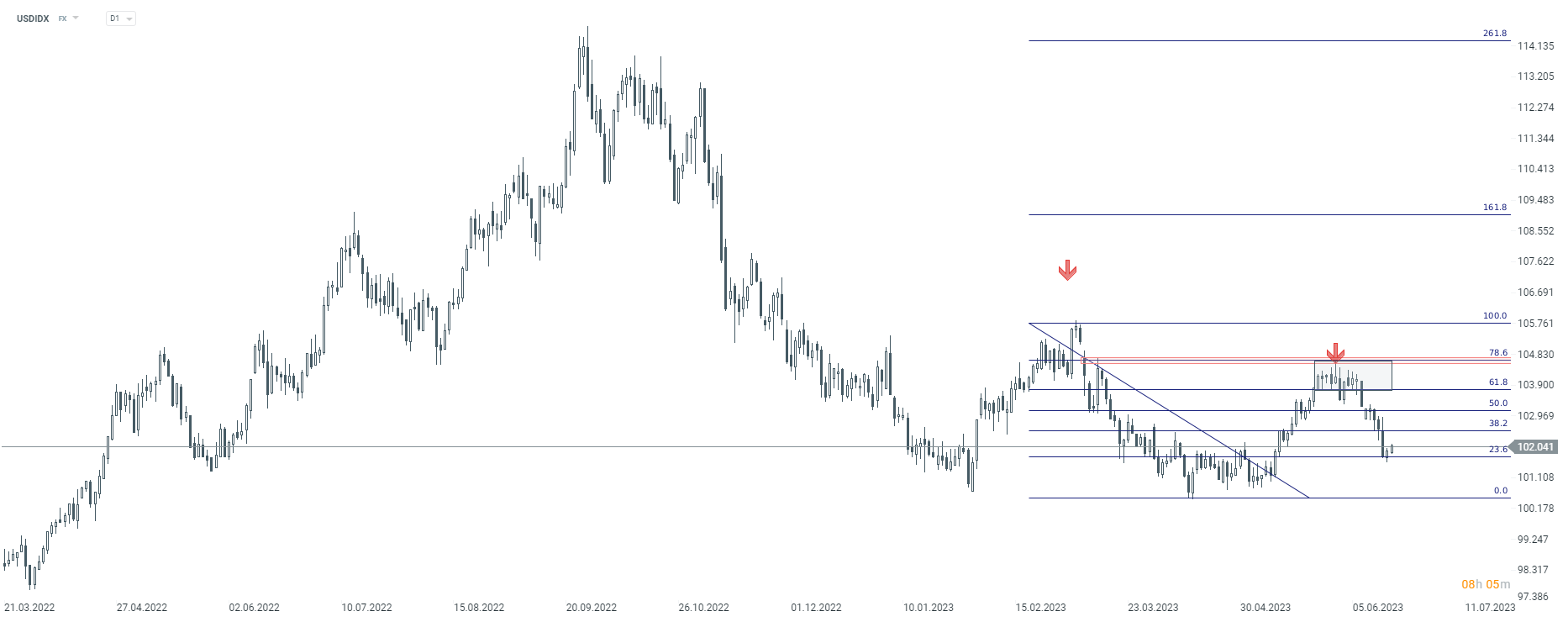

USD INDEX Daily Time Frame

In the US Dollar Index, we can observe that the bearish scenario for the USD is also confirmed according to the analysis we have. The price has tested the Fibonacci retracement levels at 78.6% multiple times, but as buyers failed to break above this zone, sellers eventually regained control of the price.

Source: xStation 5

Source: xStation 5

Henrique Tomé,

Analyst Portugal

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.