In spite of a rather poor Wall Street and Asian session for risk trades, European risk assets gained following the launch of a cash session on the Old Continent today. Sentiment improved on news of a possible joint bond sale by EU countries. According to media reports, EU will discuss this week a possibility of launching a joint bond sale in order to finance energy transformation as well as defense spending. Proposal will be discussed during a summit in France that will be held on March 10-11, 2022. Funds will be distributed as preferential loans.

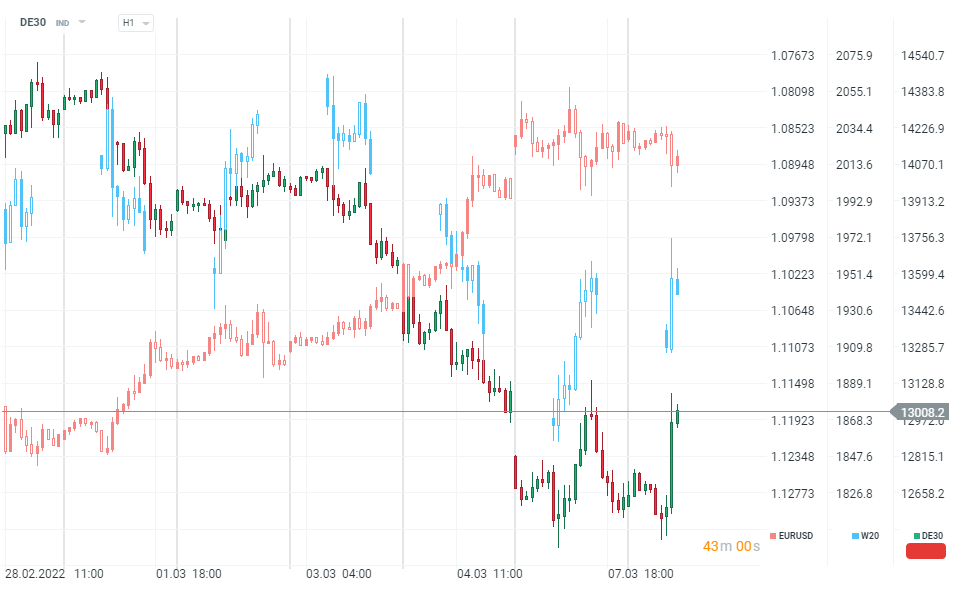

Stock market indices recovered from losses following the news while euro regained some ground against US dollar. DE30 broke back above 13,000 pts with defense, energy and fuel sectors gaining the most. EURUSD attempted to break back above 1.09 handle.

DE30, as well as other European indices, gained on news of a possible joint EU bond offering. EURUSD broke above 1.09 for a moment but has given back some of the gains later on. Source: xStation5

DE30, as well as other European indices, gained on news of a possible joint EU bond offering. EURUSD broke above 1.09 for a moment but has given back some of the gains later on. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market update: recovery takes hold, but investors remain on edge

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.