Ethereum surpasses the $2400 level, gaining +1.70%, outperforming Bitcoin. Sentiment on the second-largest cryptocurrency is improving as it approaches two strong catalysts.

The first of these is, of course, the spot ETF on Ethereum, whose final deadline is in May. Investors speculate that ETH will follow Bitcoin's path, although currently, analysts see the chances as somewhat lower.

The second catalyst is be the upcoming major Dencun update. The mainnet is set to take place in March. However, a special developers' meeting dedicated to this issue is scheduled for tomorrow, where the exact date for the mainnet will be determined. Today, the third test network was also completed. The Dencun update will not only enable scalability of the blockchain network but will also significantly reduce transaction fees on layer 2 by introducing proto-danksharding to Ethereum. The direct consequences will be much lower costs for L2-type projects and much greater scalability. Direct beneficiaries, apart from Ethereum, will certainly include popular projects like Polygon (MATIC), Arbitrum (ARB), and Optimism (OP).

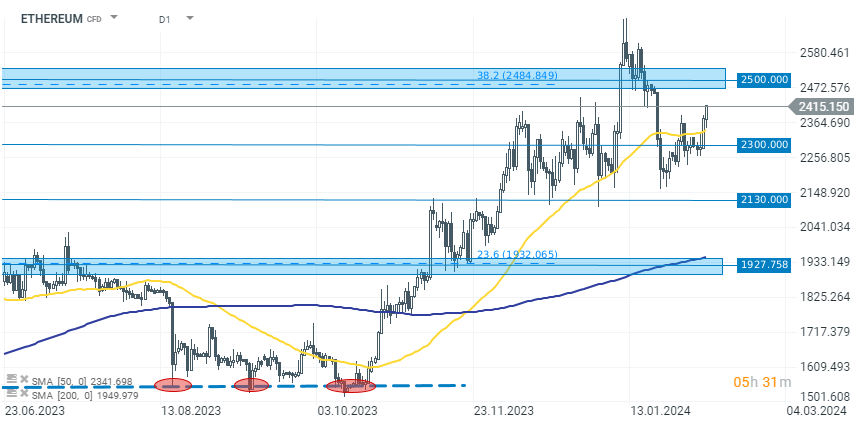

Ethereum's price has broken above the $2400 resistance zone, recording a second day of dynamic gains. If the current momentum continues, it could allow bulls to retest the zone around $2500.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.