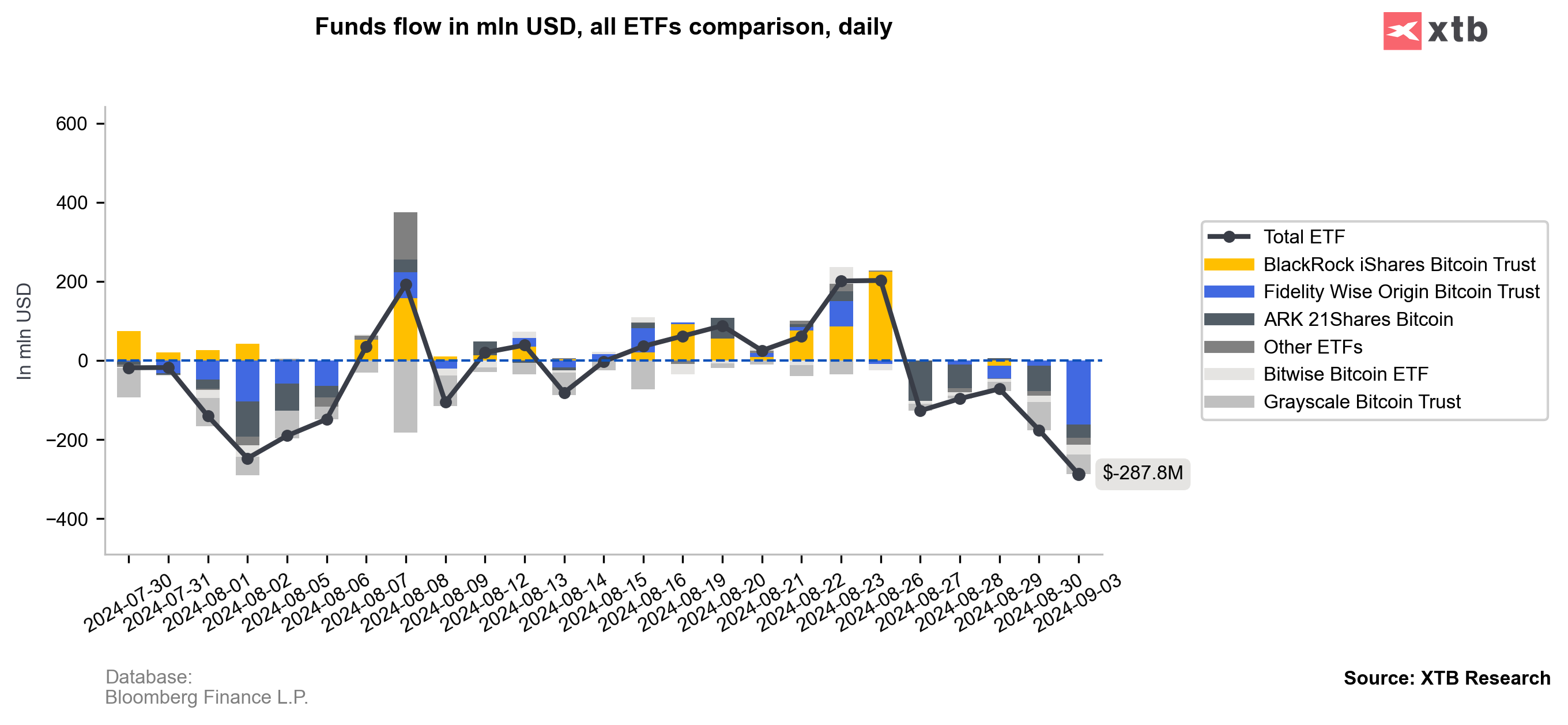

Ethereum is down nearly 3% amid risk aversion and stock market uncertainty, where sentiment is putting pressure on all risky assets. Net outflows from Bitcoin ETFs amounted to approximately -$287 million yesterday; the highest since early August.

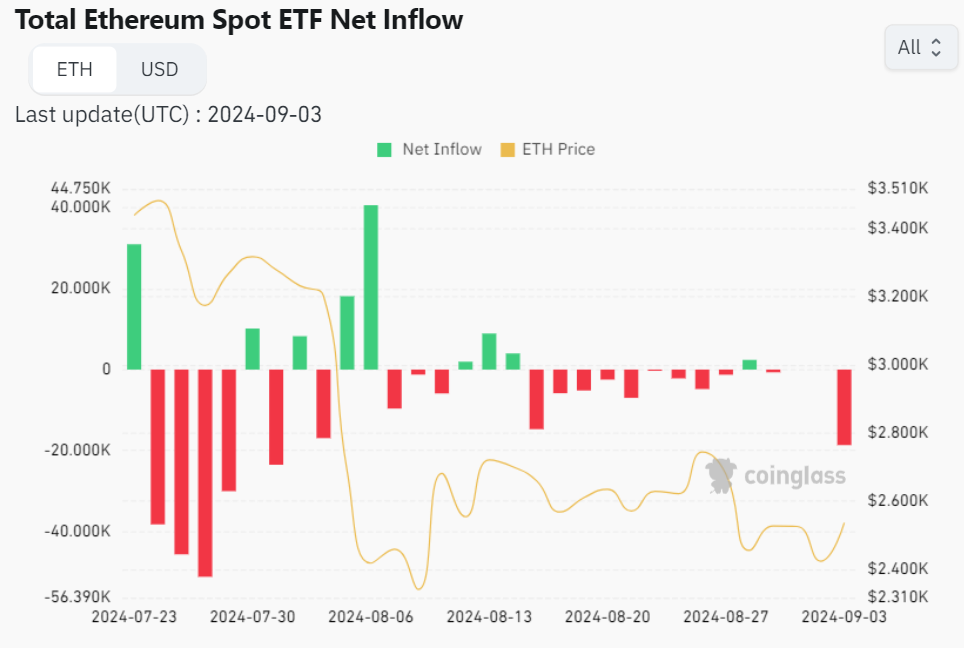

- Yesterday, Ethereum ETFs recorded net outflows, selling nearly 18,000 ETH. We also observe weaker sentiment in the Bitcoin market, which has fallen below $57,000, alongside a weakening dollar and a drop in the yield on 10-year U.S. Treasury bonds to around 3.8%, following weaker-than-expected U.S. ISM manufacturing data for August. Bitfinex analysts expect that the first Fed rate cut in September could trigger a sell-off of Bitcoin by as much as 20%, down to $45,000-$40,000.

- The team believes that such a scenario would suggest a likely 'bottom' for Bitcoin in the still ongoing post-halving 'bull market'. BTC mining difficulty increased by 9% month-on-month in August, potentially putting broader pressure on BTC miners, some of whom are forced to sell reserves. In August, Bitcoin miners' stocks listed on U.S. exchanges lost an average of about -15%. Only three companies' stocks among them performed better than Bitcoin itself during this time. Mining difficulty has increased by 4% since the spring halving.

ETFs have been selling Bitcoins over the last 5 sessions. Source: Bloomberg Finance L.P.

Net outflows for Ethereum have been observed almost continuously since mid-August. Source: CoinGlass

Ethereum (D1 interval)

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.