Stock market session has been rather calm so far and things look similar on the FX market... at least when it comes to major currencies. USD is among the weakest G10 currencies and EM currencies greatly benefit. The Fed remained dovish, declining US yields make the US dollar less attractive compared to EM currencies. Turkish lira and South African rand are among top performers. TRY trades 1.1% higher against USD while ZAR gains 1.3% against greenback. Hungarian forint (HUF) gained 0.8%. There are also some country-specific reasons behind the outperformers. Hungarian central bank has launched a rate hike cycle, benefiting the currency. Lira got a lift after data today showed that Turkish manufacturing PMI reached a 6-month high at 54 pts in July. ZAR is recovering from a recent drop caused by uncertainty over social unrest. South African rand is also supported by pick-up in gold price. However, the major factor benefiting those currencies is the weakness of the US dollar.

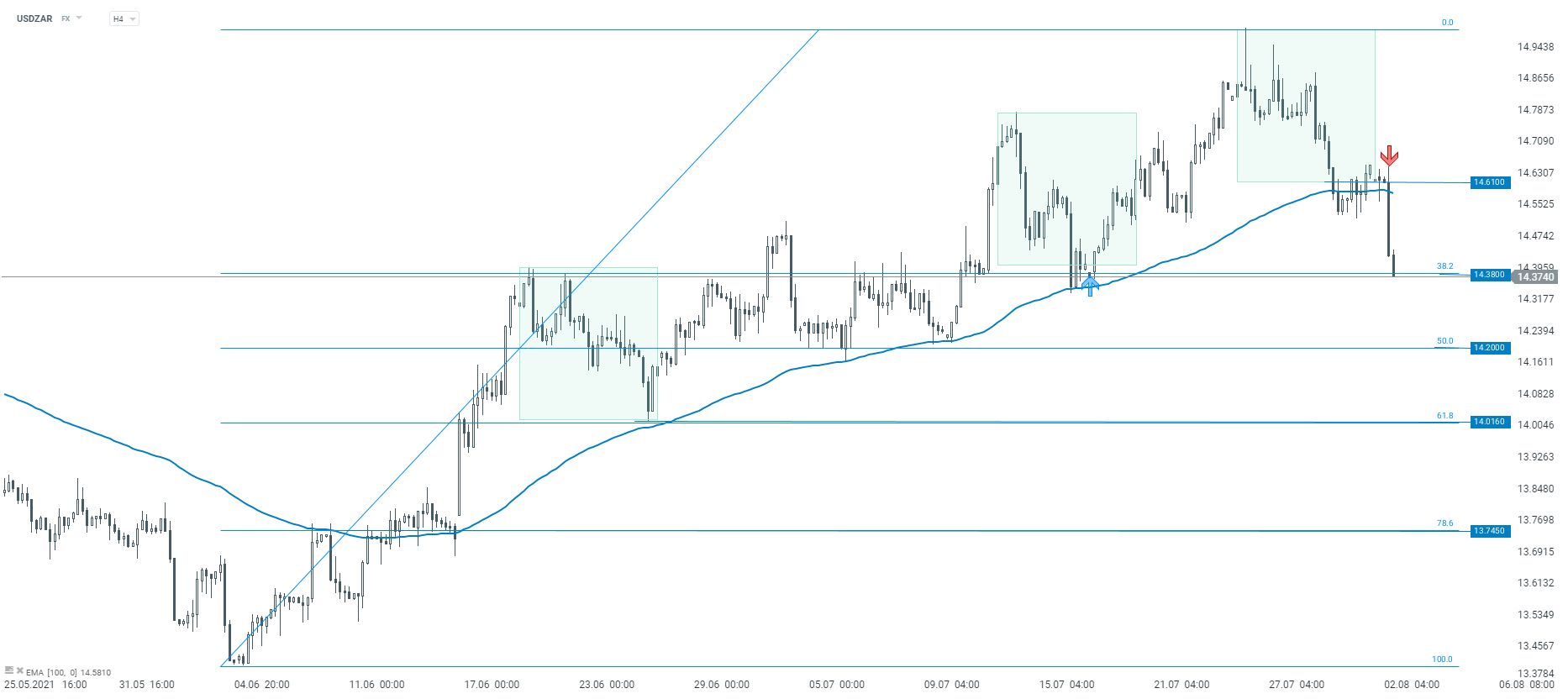

USDZAR is dropping following a recent upward move, triggered by social unrest in South Africa. The pair dropped below the lower limit of the Overbalance structure as well as the 100-period EMA (H4 interval) that acted as a support before. The pair is currently testing support marked with 38.2% retracement of the recent upward move. Source: xStation5

USDZAR is dropping following a recent upward move, triggered by social unrest in South Africa. The pair dropped below the lower limit of the Overbalance structure as well as the 100-period EMA (H4 interval) that acted as a support before. The pair is currently testing support marked with 38.2% retracement of the recent upward move. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.