The latest reports of Tesla's planned production shutdown at its Shanghai factory have caused sentiment to drop against the shares of other EV manufacturers, including Rivian (RIVN.US) and (NKLA.US). Shares of China's NIO (NIO.US) are also losing ground, with the company today providing updated, lowered delivery forecasts for Q4 2022 and exacerbating the decline in industry sentiment:

- The company said it faced challenges at both the supply and production levels in December. Operations were impacted by supply chain constraints, primarily caused by restrictions due to the Omicron variant, the restrictions extended to major cities in China. The company lowered expected deliveries in Q4 2022 and said it will deliver between 38,500 and 39,500 vehicles, compared to an earlier forecast of 43,000 to 48,000 vehicles;

- On Dec. 24, the company unveiled the EC7, a smart flagship SUV with coupe suspension, and the All-New ES8, a versatile electric flagship SUV using NIO 2.0 (NT2.0) autonomous technology. The company expects deliveries of the new EC7 and All-New ES8 models to begin in May and June 2023, respectively;

- Former CEO of electric truck company Nikola (NKLA.US), Mark Russell has been selling off shares almost daily since September 15. Bloomberg reports that he has since liquidated nearly 1 million shares in the company, worth more than $17 million. The company declined to comment on the matter. The former CEO still holds about 1.96 million shares;

- Russell was named CEO just before Nikola's merger in June 2020, replacing founder Trevor Milton. Shortly after the electric car maker's IPO, Milton's statements about the company ahead of earnings caused its market capitalization to soar, briefly surpassing Ford's stock market valuation;

- Milton was found guilty of securities fraud in October 2022. Russell told the jury during the month-long trial that Milton often made exaggerated statements and focused on daily changes in Nikola's stock price. Despite the conflict, Russell and Milton remain tied by a jointly owned entity called T&M Residual, which owns nearly 8% of Nikola, according to Bloomberg;

- Tesla's (TSLA.US) share price is doing marginally better this year than Nikola's (despite nearly 350 times higher market cap), which has slid nearly 76% since the beginning of the year compared to a 72% decline for Elon Musk's company. FactSet analysts still expect Tesla to generate $14 billion in free cash flow in 2023. According to Barron's, analysts expecting such numbers estimate that Tesla's free cash flow will account for 16% of all free cash flow generated by the global auto industry (based on FactSet data).

The automaker's shares have been hit by the prospect of lower demand in the face of worsening consumer financial health inflation and more expensive electricity. A slowdown in China, the world's largest automotive market, also proved to be significant. Despite the declines, the transition to zero-emission automotive is likely to continue, which could support a recovery in the sector's shares, despite seasonal weakness. It would also be a mistake to expect declining valuations of EV manufacturers without a simultaneous 'explosion' of news that could hit the auto market and demand for electric cars, thus some investors may see the declines as an opportunity for contrarian positioning. Most EV manufacturers are still not profitable and rely on external financing (Nikola, Rivian, NIO). Among the profitable companies, Tesla and Porsche (P911.DE), which controlled 40% of all plug-in and battery car deliviers in Europe, also 55% of all company's investments in 2021 were in electric vehicles (PHEV and BEV).

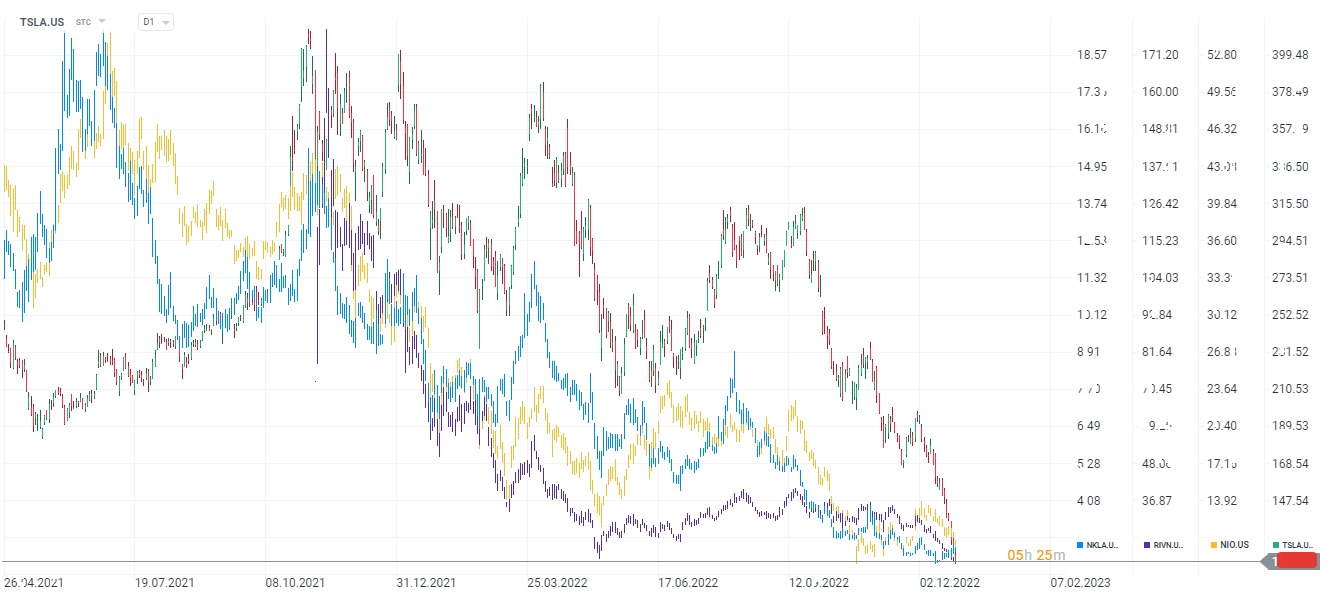

Shares of EV manufacturers have been under pressure since the beginning of 2022 and show a visible correlation among themselves. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

STM is growing stronger thanks to a new partnership with AWS!

The Week Ahead

Kongsberg Gruppen after earnings: The company catches up with the sector

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.