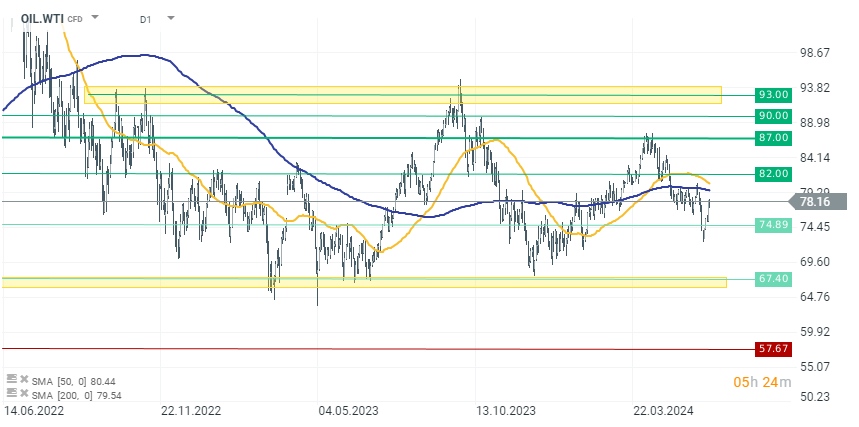

The June 2024 Short-Term Energy Outlook by the U.S. Energy Information Administration (EIA) presents several forecasts for energy prices and production through 2025. Notably, Brent crude oil prices are predicted to increase slightly reflecting adjustments due to OPEC+ production cuts extending through the third quarter of 2024. U.S. crude oil production is expected to rise.

OPEC+ is expected to start relaxing its voluntary production cuts in the fourth quarter of 2024, which is later than previously anticipated. This adjustment is expected to sustain a decline in global oil inventories through the first quarter of 2025. Despite these cuts and an anticipated rise in oil prices, the EIA has revised its Brent crude price forecast downward by 4% to $84 per barrel for 2024, based on lower-than-expected prices in May.

-

EIA now expects Brent Crude prices to average $84.15 a barrel this year, 4% lower than the previous forecast of $87.79.

-

US crude oil output to rise by 310,000 bpd in 2024, vs the previous forecast for 270,000 bpd increase, and is to grow by 470,000 bpd in 2025, vs the previous forecast of 530,000 bpd

-

EIA raises forecast for 2024 world oil demand growth by 180,000 bpd, now sees 1.10 mln bpd year-on-year increase

-

Current year crude oil production forecast 13.24 mln bpd vs. 13.2 mln bpd previously. Year-ahead crude oil production forecast 13.71 mln bpd vs. 13.73 mln bpd previously

-

EIA forecasts US retail gasoline prices to average $3.42 a gallon this year, 3% lower than previous forecast

US natural gas production is forecast to decrease by 1% in 2024 due to lower prices, with significant declines expected in the Haynesville and Appalachia regions. Conversely, production in the Permian region is projected to grow, associated with oil production increases. Additionally, US electricity consumption is set to increase slightly, influenced by warmer temperatures and growing power demand from data centers, particularly in the South Atlantic and West South Central regions.

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.