- European futures point to higher opening of today's cash session

- US labor market data and FOMC decision in focus

- Investors will react to AMD and GSK results

Futures markets point to a higher opening for today's cash session in Europe. This comes after a better session in the Asia-Pacific zone, where individual stock indices posted big gains.

Today's session will bring investors a number of important macro readings. On the schedule, among others: industrial PMI data readings for many economies around the world, ADP data from the US, ISM data for manufacturing from the US, JOLTS data from the US, US oil inventory report. The day will culminate with the FOMC's interest rate decision, which is the highlight of the day.

Investors can expect increased volatility on individual companies. Among others, GSK (GSK.UK) has already presented its results today. Yesterday, AMD (AMD.US) reported its results.

GSK results:

- Adjusted EPS GBP 0.50 (expected GBP 0.46)

- Revenue GBP 8.16 billion (expected GBP 7.71 billion)

- Forecasts annual operating margin between 13% and 15%; previously it was between 11% and 13%

- Annual EPS is expected to grow between 17% and 20%; previously assumed a range between 14% and 17%

AMD results:

- Q3 revenue $5.8 billion, forecast $5.7 billion

- Q3 operating margin 22%, forecast 21.6%

- Q3 operating income $1.28 billion, forecast $1.27 billion

- Q4 revenue projected $5.8-6.4 billion, forecast $6.4 billion

- Strong growth in data centers in Q4.

- Additional weakening of demand in embedded markets in Q4.

Key macro readings of the day:

10:30 BST: UK, final PMI data for October. Prediction: 45.2; earlier: 44,

13:15 BST: USA, ADP report. Predictions: 150 thousand Previously: 89 thousand.

13:40 BST: Switzerland, speech by SNB Jordan

14:30 BST: Canada, final PMI data for industry. Last reading: 47.5

14:45 BST: US, final PMI data for industry. Prediction: 50 Previously: 49,8

15:00 BST: USA, final ISM PMI data for industry. Predictions: 49. earlier: 49

- Employment sub-index. Predictions: 50 Previously: 51,2

- Sub-index of prices paid. Predictions: 44.9 Previously: 43,8

- New orders sub-index. Previously: 49,2

15:00 BST: USA, JOLTS data for September. Predictions: 9.25 million. Earlier: 9.61 million

15:30 BST: USA, EIA data on crude oil inventories. Predictions: 1.6 bbl. Earlier: 1.37 bbl.

- Gasoline inventories. Prediction: -0.5 bbl. Previously: 0.16 bbl.

- Distillate inventories. Prediction: -1.7 bbl. Previously: -1.69 bbl.

19:00 BST: US, FOMC decision on interest rates. Predictions: 5,25-5,5%. Earlier: 5,25-5,5%.

19:30 BST: USA, post-meeting press conference.

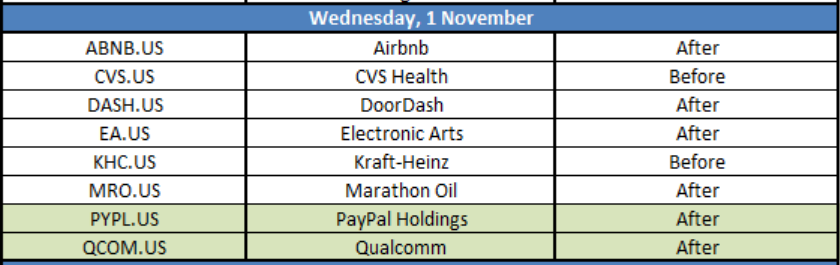

Key quarterly reports from US companies in today's session.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.