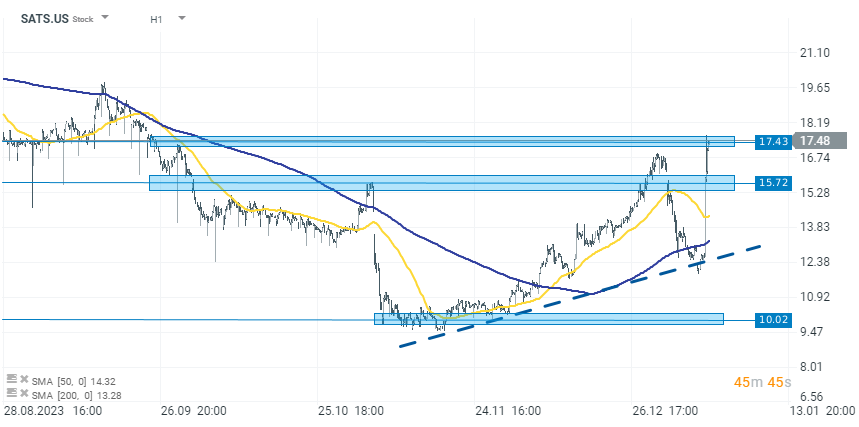

EchoStar (SATS.US), a leading provider of technology and connectivity solutions, has seen its stock soar over 38% today following the announcement of its merger completion with DISH Network Corporation. This merger has significantly enhanced EchoStar's strategic, financial, and operational flexibility, positioning it as a global leader in both terrestrial and non-terrestrial wireless connectivity.

The merger integrates DISH Network's satellite technology, streaming services, and 5G network with EchoStar's satellite communications, optimizing the combined company's strategic and financing capabilities. EchoStar has acquired a range of wireless spectrum licenses through a newly formed subsidiary, EchoStar Wireless Holding L.L.C., enhancing its resource allocation for strategic goals. This move, along with the designation of various subsidiaries as "Unrestricted Subsidiaries" and the transfer of a $4.7 billion receivable to EchoStar Intercompany Receivable L.L.C., aims to bolster EchoStar's position as a premier provider of terrestrial mobile, satellite connectivity, and content services.

Source: xStation 5

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Arista Networks closes 2025 with record results!

AI scare trade broadens out as we wait for key inflation update

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.