Christine Lagarde, the head of the ECB, presented the mixed state of the economy, while talking about the actions taken by the bank in connection with the ongoing coronavirus pandemic. Below we present some key takeaways from the ECB Lagarde press conference.

- ECB expects that the economy will shrink in Q4 as services sectors has been severely hit and inflation remains on very low levels. Also incoming data suggest more pronounced near-term impact of pandemic

- Increase in PEPP program reflects fallout from pandemic in economic activity and it can be recalibrated if warranted.

- Policymakers approved more long-term loans on cheap terms for another year until June 2022, and announced four additional pandemic emergency longer-term refinancing operations to be offered in 2021.

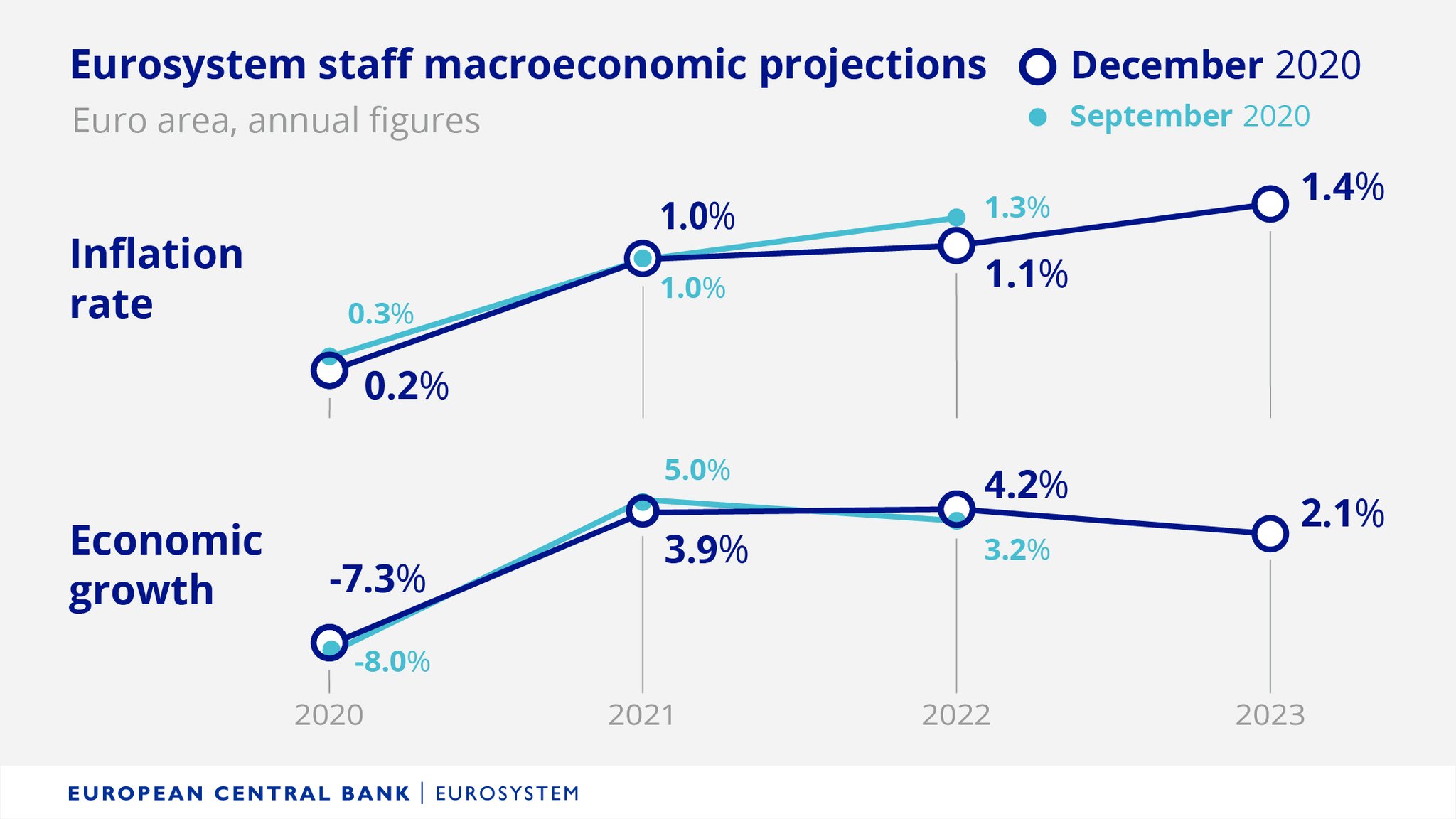

- The outlook for economic activity has been revised down in the short term, with GDP seen expanding by just 3.9 % in 2021 compared to 5 % predicted in September. Inflation projections for 2020 and 2022 were also revised down to 0.2 and 1.1 % from 0.3 and 1.3 %, respectively.

- Lagarde also said, that the fiscal message should be targeted and risks of delayed recovery warrants fiscal support.

Macroeconomic forecasts:

Source: ECB

Source: ECB

- During the Q&A session Lagarde said, that there are good reasons to believe immunity could be reached by the end of 2021.

- The service sector should not be impaired by the end of 2021

- Lagarde expects that 4Q GDP will shrink around -2.2% as the duration of 2nd wave is stronger than seen

- PEPP volume intended to preserve favorable financing conditions. The 9 month PEPP extension was a compromise. The ECB did not discuss bank dividends.

- ECB is planning to adjust purchases on basis of what is needed to maintain favorable financing conditions and will tailor purchases to keep financial conditions loose. The compass will be "favorable financial conditions".

- Lagarde admitted that inflation is "disappointingly low". Inflation has to do with low price of energy and German VAT, lower wages, and exchange-rate appreciation.

- ECB expects that inflation will rise to 1% in 2021 from 0.2% in 2020.

The trend on EURUSD remains upward. Source: xStation5

The trend on EURUSD remains upward. Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.