Today at 1:30 pm GMT, we will learn about the PCE inflation data. This is a key measure from the Fed's perspective. Expectations for today's reading:

-

The PCE inflation is expected to remain at 2.6% year-over-year.

-

The core PCE inflation is expected to drop to 3.0% year-over-year, from the level of 3.2% year-over-year.

-

Monthly PCE inflation is expected to increase by 0.2% month-over-month, in line with achieving the Fed's inflation target in the forecast term. Recently, monthly PCE inflation fell by 0.1% month-over-month.

-

Core monthly PCE inflation is also expected to rise by 0.2% month-over-month, after an increase of 0.1% month-over-month in November.

The market fears that if there is a stronger drop in inflation, especially core inflation, expectations of interest rate cuts for March might rise again, and next week the Fed could change its stance to be more dovish. On the other hand, attention should be paid to risk factors for potential inflation rebound. This includes the recent rise in oil prices due to tensions in the Middle East. Additionally, there has been a significant increase in sea freight rates. Moreover, the US economy remains in very good condition, as illustrated by the GDP data for the fourth quarter, although at the same time, regional Fed indicators suggest a slowdown at the beginning of this year.

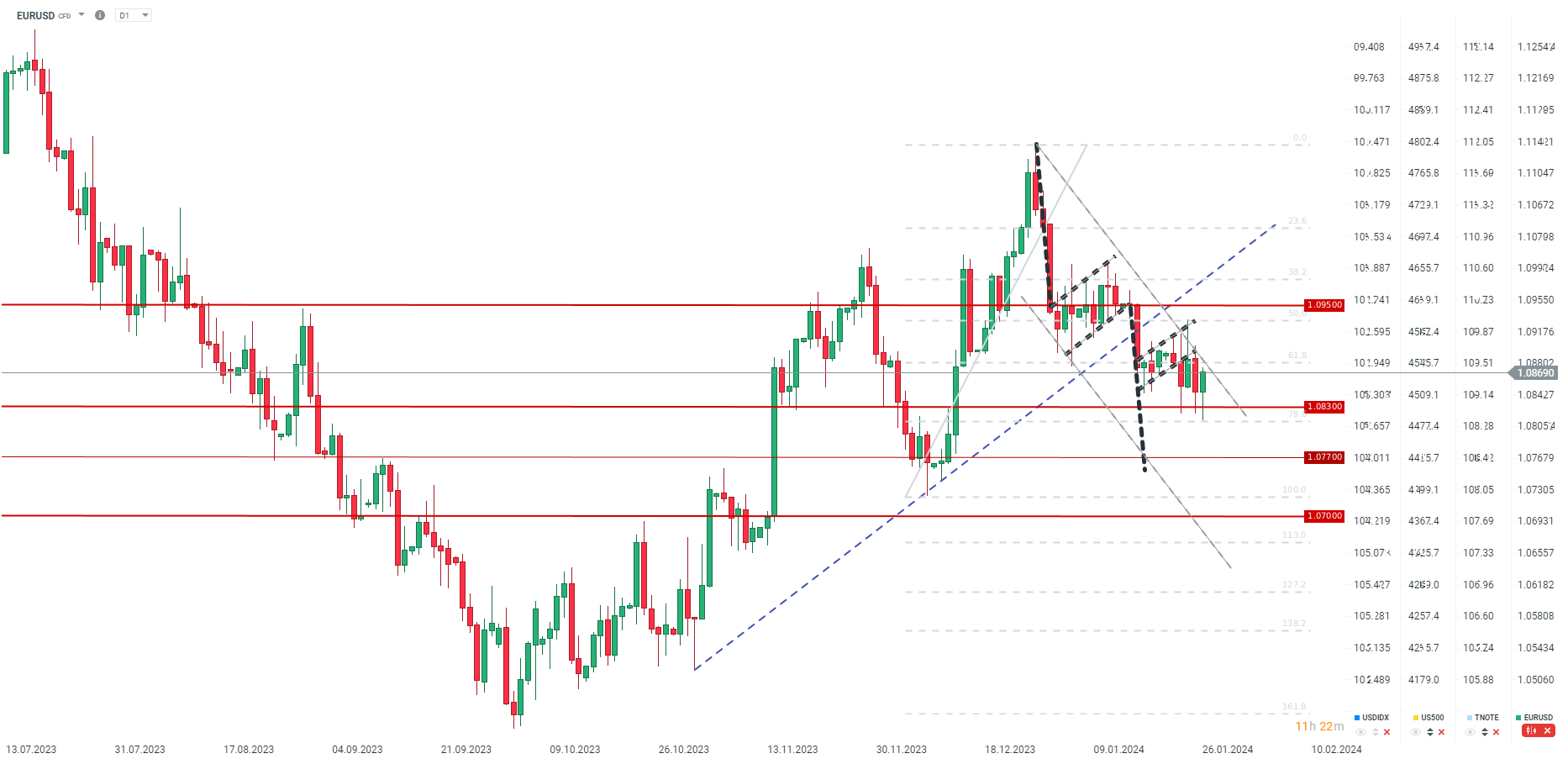

EURUSD has clearly rebounded since the start of the European session, although initially, the pair tested areas close to the 1.0800 level. The key resistance level is around the 61.8% retracement and the upper limit of the downward trend channel. If PCE inflation shows lower readings than expected, even a rise above 1.0900 cannot be ruled out. This level is key from the perspective of the trend for EURUSD next week.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.