Inflation is clearly declining around the world, although it is still treated as a big problem by most central banks, so high interest rates must be maintained. Nevertheless, for some regions it can be seen that the battle against inflation is almost won. Will we be able to say this about the United States?

Expectations are quite optimistic looking at year-on-year changes, but still show an increase in inflation on a monthly basis:

- CPI for May is expected to fall to 4.1% YoY against the previous reading of 4.9% YoY

- Core CPI is expected to fall to 5.3% YoY against a previous reading of 5.5% YoY

- Monthly CPI is expected to rise by 0.2% MoM against a previous reading of 0.4% MoM

- Monthly core CPI is expected to rise by 0.4% MoM against a previous reading of 0.4% MoM

- The spread of expectations for the headline reading is small, indicating between 4% and 4.2%

As can be seen, the magnitude of the decline in headline inflation is expected to be sizable, mainly due to the negative impact of energy and food prices, although a sizable potential impact of the decline in services prices can also be seen. This in turn could lead to a higher decline in core inflation. Expectations for core inflation on a monthly basis alone are quite high, given the fall in services prices and the small fall in used car prices.

Key inflation charts:

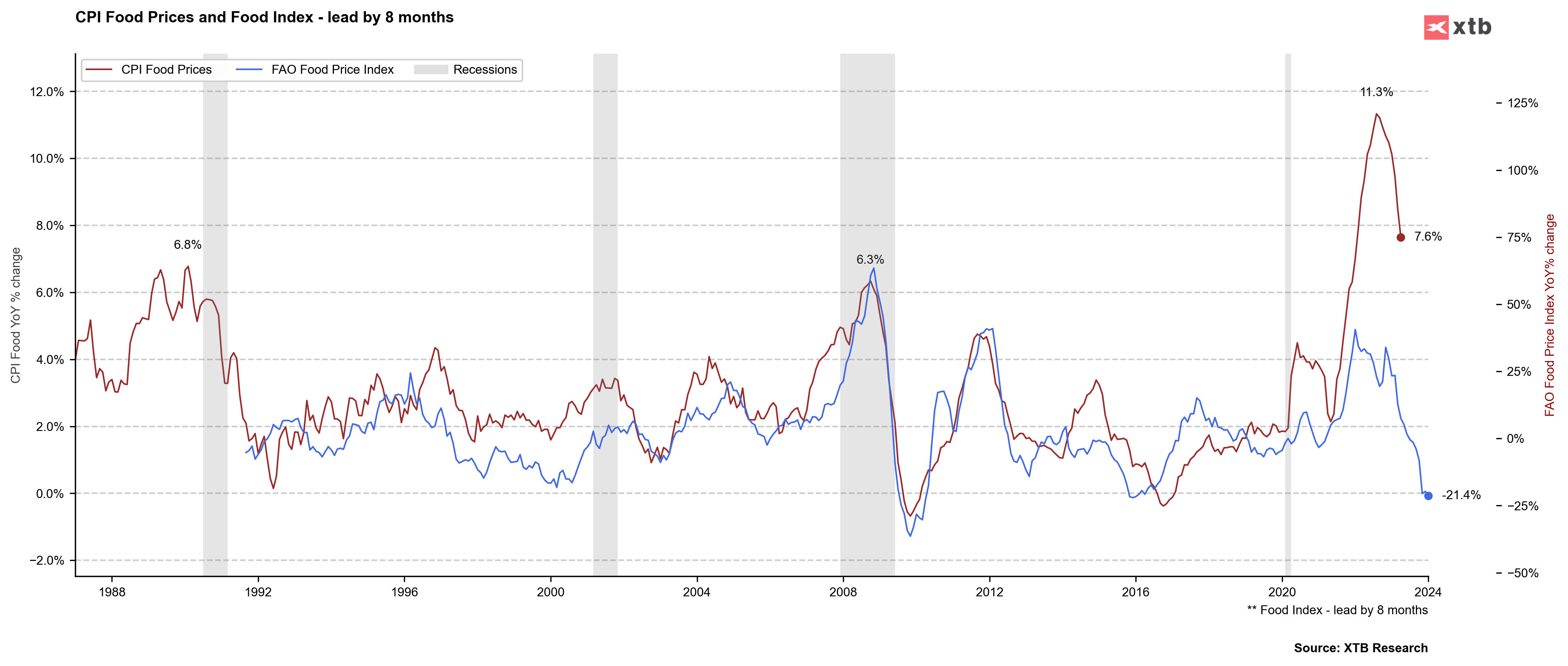

Food inflation has the potential for a massive drop, given changes in the FAO price index, which is falling at its strongest since late 2015 and early 2016. Source: Bloomberg, XTB

Food inflation has the potential for a massive drop, given changes in the FAO price index, which is falling at its strongest since late 2015 and early 2016. Source: Bloomberg, XTB

The price sub-index from the ISM services index remains above 50 points, but suggests a significant drop in headline inflation. Gasoline prices for May this year were also significantly lower than a year ago. The largest base effect related to energy prices will be for June, so the July increase may depend on the next inflation reading. Source: Bloomberg, XTB

The price sub-index from the ISM services index remains above 50 points, but suggests a significant drop in headline inflation. Gasoline prices for May this year were also significantly lower than a year ago. The largest base effect related to energy prices will be for June, so the July increase may depend on the next inflation reading. Source: Bloomberg, XTB

Inflation and the FOMC

We will learn the Fed's next decision tomorrow and it is expected that this could be the first holdout on a hike since March last year. The market only gives a 30% chance of a hike, but already sees a 60% probability for a hike in July. If, however, the Fed finds that the fight against inflation is having a positive effect, then there is a chance for the dollar to fall further and for Wall Street to accelerate towards its highs.

EURUSD

EURUSD is accelerating gains ahead of the CPI and Fed release and is breaking through the 1.0800 level. A decline in inflation to around 4% and a higher decline in core inflation could see the pair exit towards the 50.0 retracement of the recent downward momentum. EURUSD has maintained the range of the January-March correction, so in theory an attempt at a continuation of the long-term rise can be expected. However, for the moment, US yields still remain relatively high, which may suggest that the market still believes in the next Fed decision. If inflation surprises with a higher reading and the Fed clearly indicates that it may raise rates in July, then EURUSD could return to the 1.0700 level. Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.