- European indexes are experiencing a mixed session

- Sentiment is supported by a strong finish in yesterday’s U.S. session

- The Euro is having a balanced session

- Eurozone PMI data is weak, particularly in the manufacturing sector

At the beginning of today's cash session in Europe, stock indexes opened higher, buoyed by improved sentiment following yesterday’s Fed conference. Although the conference itself was relatively neutral, and the Fed's 2024 forecasts (dot-plot) were even more hawkish, markets took it positively, and U.S. indexes reached new historic highs. This positive sentiment then transferred to Asian markets, where a very strong session was observed with gains across all major markets. A similar pattern was anticipated for the opening of the cash session in Europe. However, initially better sentiment was quickly dampened by drastically weak (again) PMI data for the manufacturing sector in leading EU economies - France and Germany.

In the Eurozone, there is a clear divergence in PMI reports; services are improving, but manufacturing remains behind, indicating deep slowdown and dramatic sentiment among businesses. Overall, however, the economy is nearing stabilization by the end of Q1. The weakness of the manufacturing sector is especially evident in Germany, where production and new orders continue to fall.

Start investing today or test a free demo

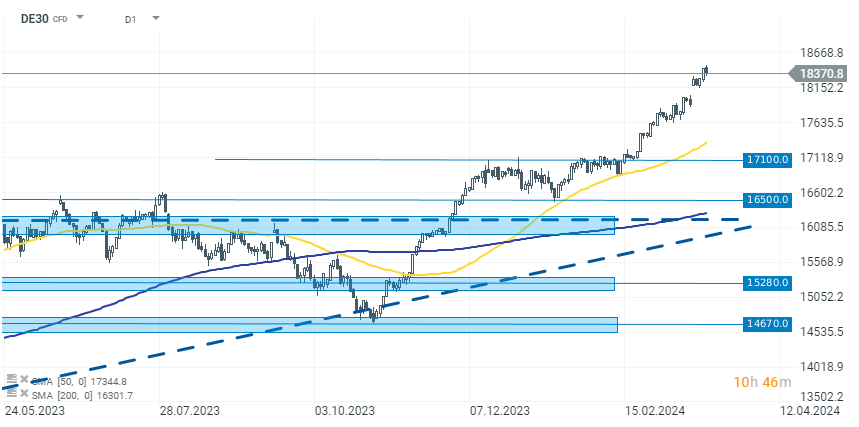

Open account Try demo Download mobile app Download mobile appWeak data from EU economies are not a good sign for investors. The Eurozone has been struggling with poorer macro data for some time. The results of high-interest rates are becoming more visible, putting pressure on the ECB, which may consider the first rate cuts as early as June. However, the effects of weak publications do not impact all EU stock exchanges. Today, markets with companies having significant exposure to European countries are losing the most. However, indexes such as the German DAX are trading at historical highs. Most companies in it have globally diversified operations, so weak data from Germany does not necessarily translate to the businesses of these companies.

Today, DAX is down by 0.33%, but the trading opened at historic highs above 18400 points. At the time of publication, a slight pullback on the index is observed, returning below the level of 18360 points.

Source: xStation 5

Company news

Hyundai (HYUD.DE) is one of the better-performing companies on the German stock exchange today. At the time of publication, its shares have risen by 6.20% to $54.60.

Source: xStation 5

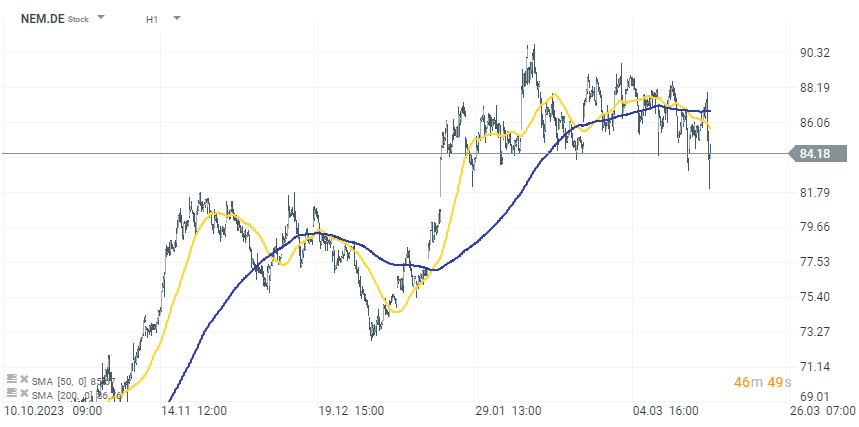

Nemetschek (NEM.DE), on the other hand, is one of the worst-performing German companies today, although its shares have lost only 3.80%, indicating a small scale of declines in today's session. The company published its data for 2023 and provided forecasts for 2024 that are pretty good despite market reaction. Following a successful financial year in 2023, the Nemetschek Group is looking forward to a promising 2024, aiming for a continuation of highly profitable growth. In 2023, Nemetschek achieved or surpassed all its financial targets, reporting an 8.0% growth in revenue (currency-adjusted) and a 30.3% EBITDA margin, at the upper end of the increased guidance range.

Source: xStation 5

EBM-Papst, a specialist in fan technology, plans to sell its industrial drive technology division to Siemens (ENR.DE). An agreement between the two parties has been signed, as announced today. The purchase price details were not disclosed. The deal involves approximately a business that hires 650 employees located in St. Georgen, Lauf an der Pegnitz, and Oradea, Romania, who will join Siemens after the sale's completion, expected in mid-2025. This division focuses on developing, producing, and selling drive system solutions, including those for driverless transport systems.

Argenx (ARGX.BE) is among the top gainers on the Belgium stock market (+13%) after a European biotechnology firm, has published its 2023 Annual Report, showcasing significant financial results and progress in its product lines. The report highlights the commercialization of VYVGART across various global markets, specifically for treating myasthenia gravis. The company is concentrating on widening the approvals and commercialization of its products.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.