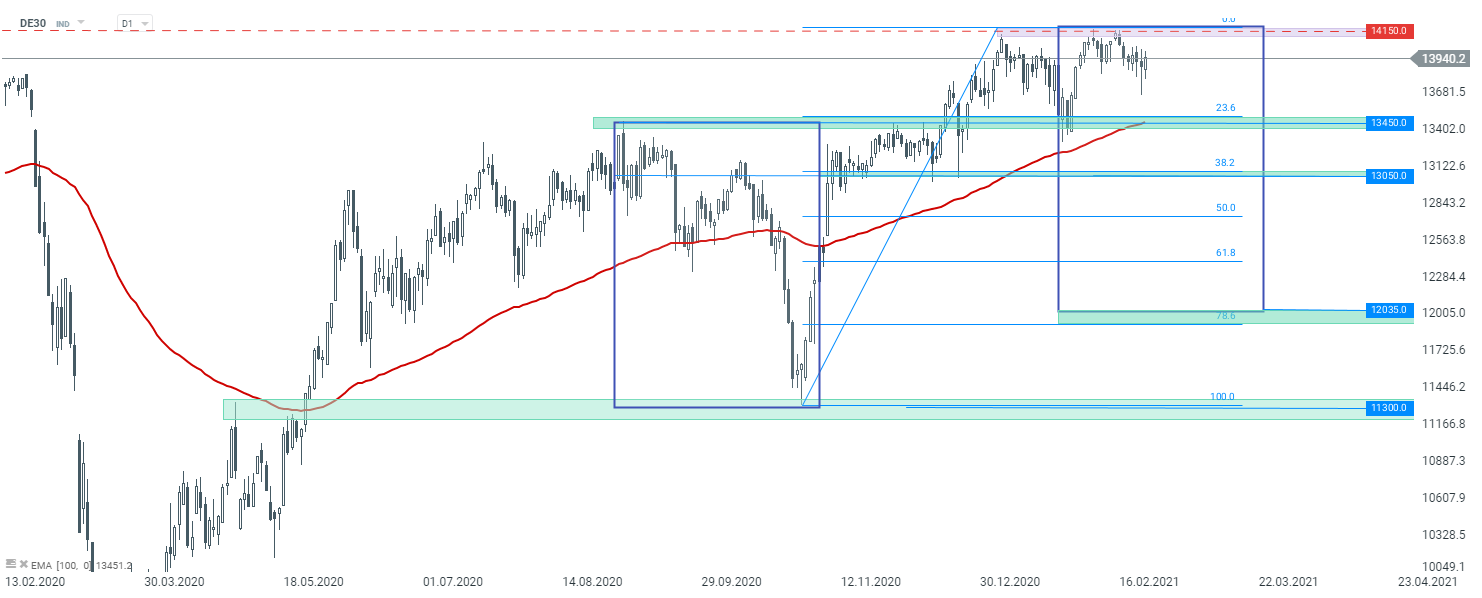

DE30

A slightly deeper downward correction could have been observed on stock markets over the past few days. German index had a problem with breaking above the 14,150 pts handle and the upward move was stopped. Looking at the daily time frame, we can see that the main sentiment remains upward. However, in case downward move deepens, the first support to watch can be found at the 13,400 pts area, where the previous price reactions as well as 23.6% Fibonacci retracement are located. Should DE30 break below it, the way towards the next support at 13,050 pts will be left open.

DE30 D1 interval. Source: xStation5

DE30 D1 interval. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

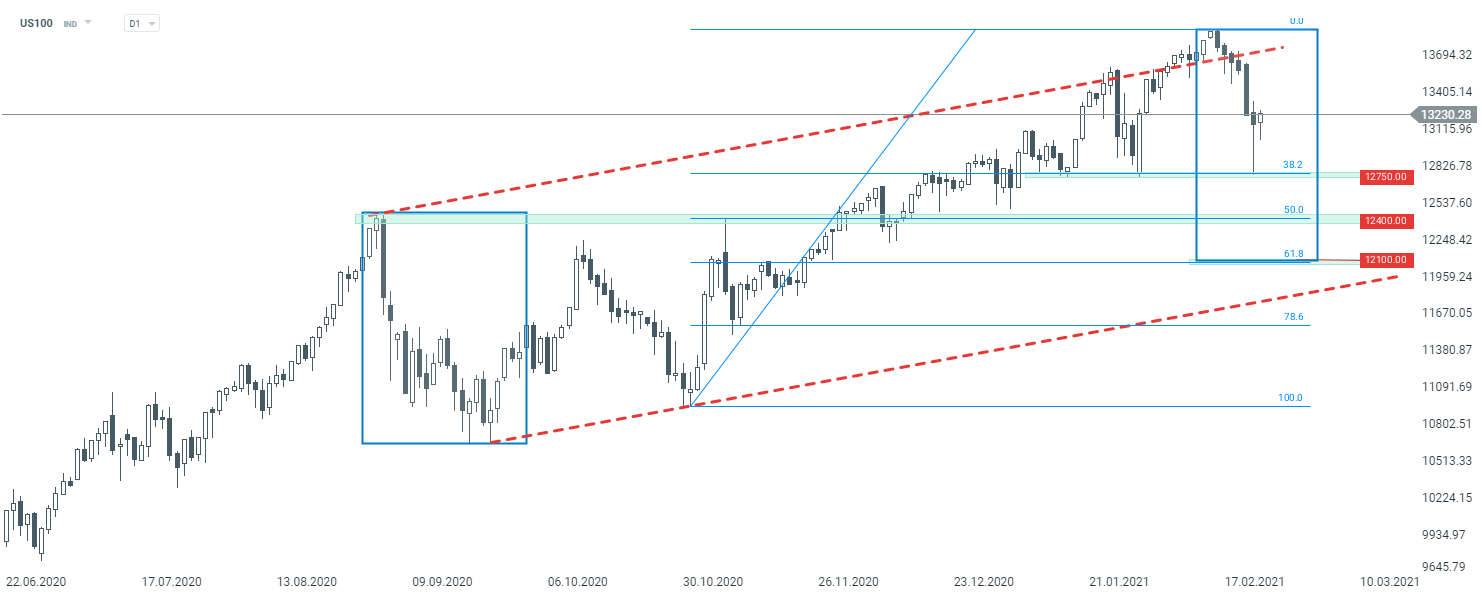

US100

The US tech index Nasdaq (US100) also experienced a downward correction during the last few sessions. Looking at the daily interval, we can see that the sell-off stopped at the first key support resulting from the 38.2% Fibonacci retracement and previous price reactions (12,750 pts). However, the correction is still small compared to the last upward wave, so further deepening cannot be ruled out. If the current sentiment prevails, the correction move mayextend to the zone at 12,400 pts or even 12,100 pts, where the lower limit of 1:1 structure and the 61.8% Fibonacci retracement are located.

US100 D1 interval. Source: xStation5

US100 D1 interval. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

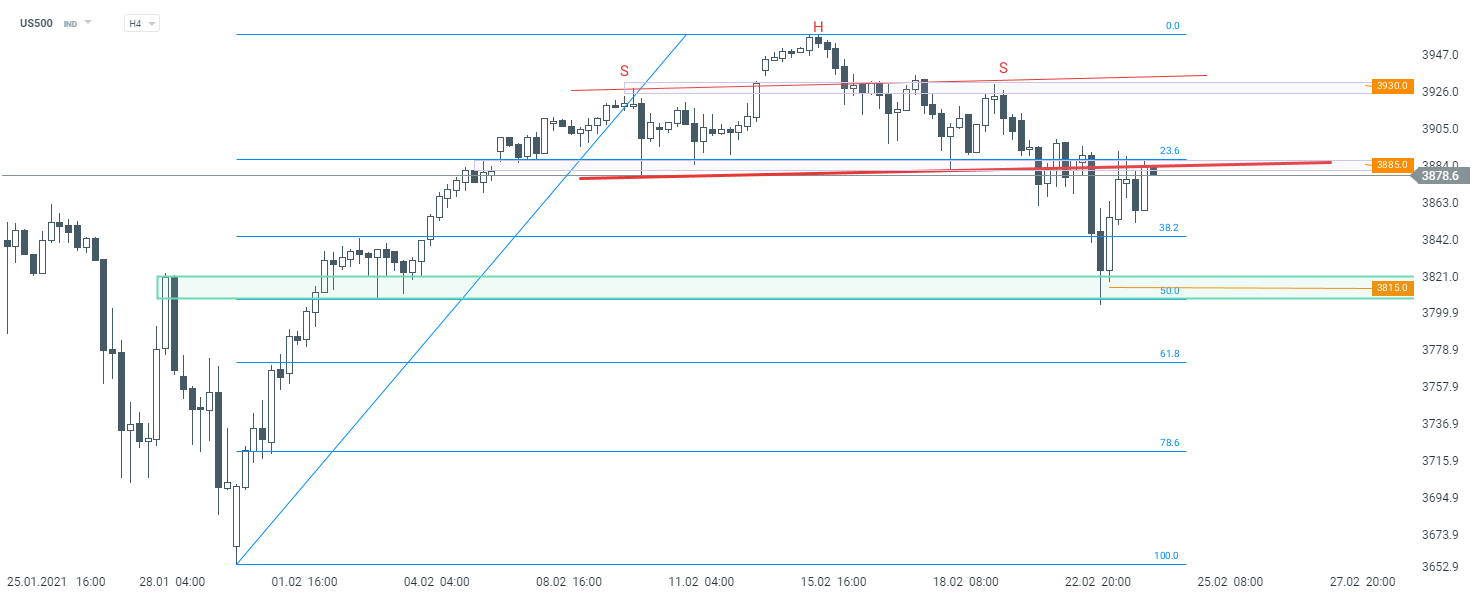

US500

Last but not least, let’s take a look at the US500 chart. Looking at the H4 interval, one can see that head and shoulders formation (which often heralds a trend reversal) surfaced on the chart. Following a break below the neckline of aforementioned formation, the index launched a sharp downward move. Buyers regained control at the horizontal support at 3,815 pts. The area at 3,885 pts is the key resistance to watch for now. As long as the price sits below it, further downward move is the base case scenario.

US500 H4 interval. Source: xStation5

US500 H4 interval. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.