Summary:

- Beginning of trading has not brought a clear direction

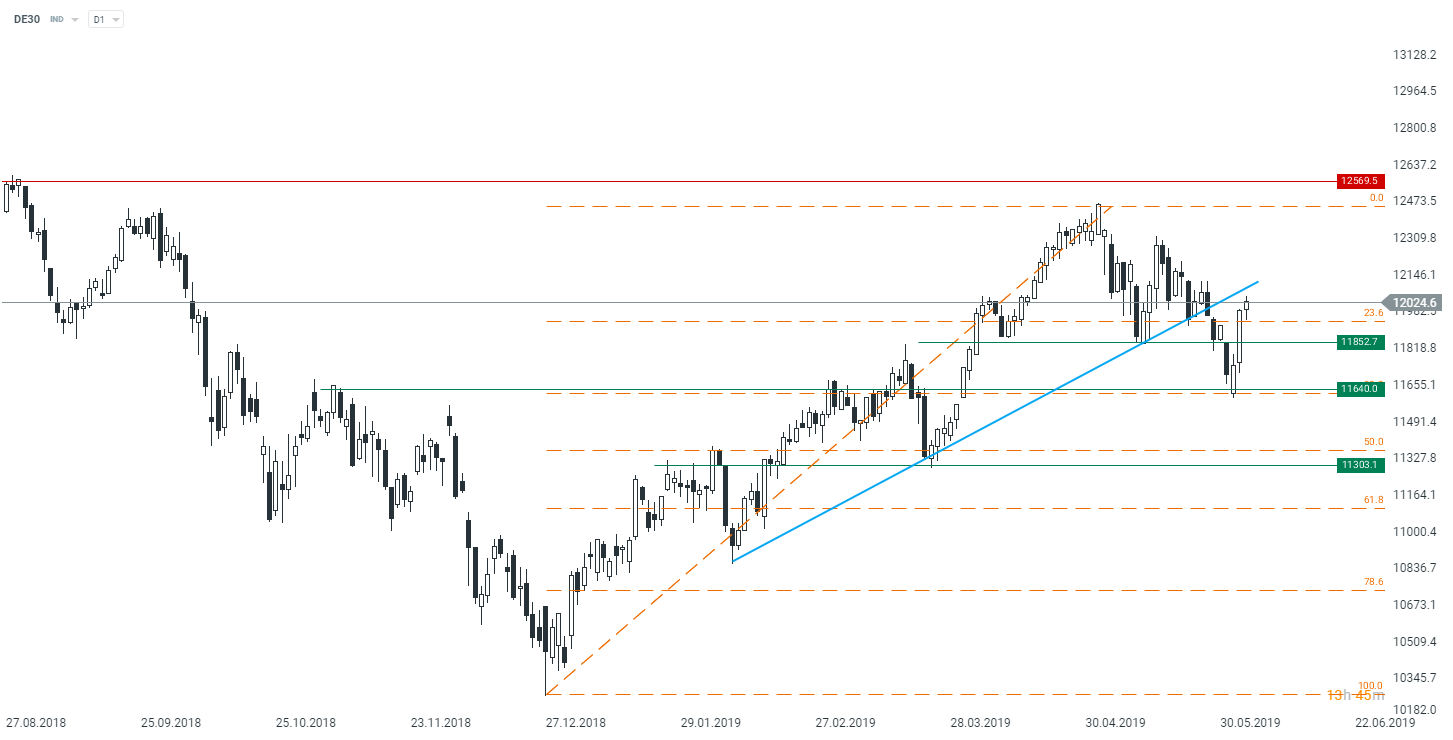

- DE30 is closing the important technical resistance

- SAP (SAP.DE) among top performers after its US peer presented a rosy outlook

The start of Wednesday’s trading has not brought a clear direction in major equity markets in Europe. Nevertheless, after the first 30 minutes of trading major indices have turned higher except the Italian FTSE MIB (ITA40). Let us recall that the weaker performance of the Italian stock market may have something to do with a clash between the country and the European Commission over undue indebtedness of the former. In recent hours we have been offered news that Salivini and Di Maio discussed an option of breaching the EU’s 3% budget deficit rule. If this the case and Italy plays down the rules set by the EC, it could face the excessive debt procedure, being rather a costly outcome for Italy. The thread deserves more attention over the next days as it may affect expectations regarding economic growth in the Eurozone.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appMeanwhile, Tuesday brought a widespread recovery in equity markets across the globe being, in part, spurred by Federal Reserve Chairman Jerome Powell who suggested readiness to act (make monetary policy more expansionary) if necessary. On the other hand, better moods in equities did not translate into other markets as neither FX or bonds saw any noteworthy reprieve (bonds, JPY remain in demand). Thus, the ongoing rebound could turn out to be short-lived and it may begin losing momentum once investors realize that the economic slowdown means lower margins, lower profits and thereby a reason for lower valuations (irrespective of lower rates that may arrive as a result).

The current technical situation looks really interestingly as the price keeps moving toward the broken blue trend line. Notice that the downtrend gathered momentum once the mentioned blue line was broken, hence investors might look at this level eagerly. Should the line be broken once again, it could encourage buyers to step in which could give rise to an extended rally toward this year’s high. On the other hand, a failure in breaking above this line could see the price falling back toward the recent low nearby 11640 points. Source: xStation5

The current technical situation looks really interestingly as the price keeps moving toward the broken blue trend line. Notice that the downtrend gathered momentum once the mentioned blue line was broken, hence investors might look at this level eagerly. Should the line be broken once again, it could encourage buyers to step in which could give rise to an extended rally toward this year’s high. On the other hand, a failure in breaking above this line could see the price falling back toward the recent low nearby 11640 points. Source: xStation5

Looking into the DE30 breakdown one may notice that SAP shares (SAP.DE) are among the top performers, which is a result of its US cloud software peer Salesforce.com confirmed the rosy outlook for further growth. The US company also said that sales would be between $3.94 billion to $3.95 billion in the period ending in July. In turn, its updated full fiscal year forecast showed revenue should be up to 23% higher compared to the last year.

The second hot stock this morning is Wirecard (WDI.DE) after the company informed that it would enable NK, one of Swedish most famous department stores, to accept leading Chinese mobile payment methods. The NK has roughly 9 million visitors per year in Stockholm and Gothenburg.

SAP and Wirecard are the best performing stocks this morning in the DE30. Source: Bloomberg

SAP and Wirecard are the best performing stocks this morning in the DE30. Source: Bloomberg

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.