European Central Bank will announce monetary policy decision today at 1:15 pm BST, followed by President Lagarde press conference at 1:15 pm BST. ECB members have suggested recently that they pay attention to inflation data and Fed decision when making next move. Inflation data from majority of euro area countries surprised to the upside while Fed has silently signaled a pause in the rate hike cycle. Will ECB continue with 50 bp rate hikes or will it slow pace down to 25 bp moves?

Market prices in 75 basis point of tightening before peak

Markets is currently seeing an only 15% chance of a 50 bp rate hike from ECB today. On the other hand, market is still seeing around 75 basis points of additional tightening before pausing cycle in September. The latest ECB minutes showed that some central bankers opted for a pause in rate hike cycle or at least a smaller higher amid recent banking sector issues. On the other hand, turmoil in Europe has been quickly brought under control but inflation remains an issue in spite of a drop in energy prices.

Markets are seeing a very small chance of a 50 bp rate hike today but still expects 75 bp of tightening until cycle pause. Source: Bloomberg

Will size of the hike matter?

While initial market reaction would likely depend on the size of the hike, the size itself will not matter in the longer run. A 25 bp rate hike could see EUR drop and indices gain slightly while 50 bp rate hike would see EUR recover some of morning losses and intensify sell-off on the equity markets. Nevertheless, ECB is likely to remain moderately hawkish going forward with rates likely peaking at 3.75 or 4.00%. In no case we expect Lagarde to announce a pause in rate hike cycle in Europe, what should provided some support for the common currency while reaction on the stock markets may be mixed. On one hand, policy tightening is taking toll on European companies but on the other, situation in Europe looks to be more stable than in the United States. The fact the European indices trade close to record highs while US indices are still far off further supports this view.

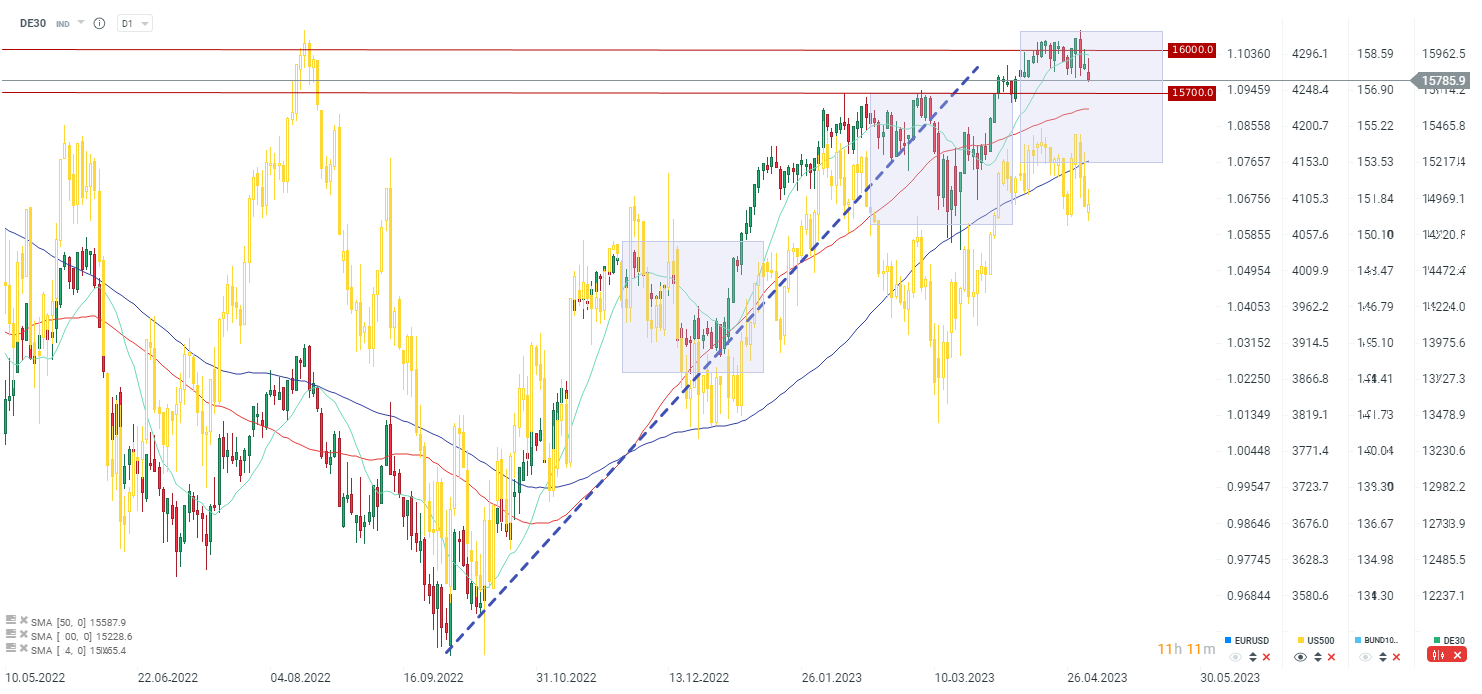

DE30 pulls back from the 16,000 pts area and is currently trading around 3% below all-time highs above 16,300 pts. The first important support to watch can be found in the 15,700 pts area, near local lows from February and March. In case of a break lower, a pullback towards the 15,200 pts area cannot be ruled out. The lower limit of the Overbalance structure can be found in this area. Source: xStation5

DE30 pulls back from the 16,000 pts area and is currently trading around 3% below all-time highs above 16,300 pts. The first important support to watch can be found in the 15,700 pts area, near local lows from February and March. In case of a break lower, a pullback towards the 15,200 pts area cannot be ruled out. The lower limit of the Overbalance structure can be found in this area. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market update: recovery takes hold, but investors remain on edge

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.