Relief on the markets caused by Fed and US Treasury intervention into SVB collapse and Signature Bank regulatory shutdown was short-lived. European markets went in a freefall mode after a flat opening of the European cash session. Panic was reignited after First Republic Bank shares plunged 60% in the US premarket session, showing the problems are far from over. German DAX is dropping over 3%, breaks below the 15,000 pts mark and reached the lowest level in 2 months! US index futures erased all of the gains made during the Asian session- S&P 500 futures (US500) trade flat compared to Friday's cash close.

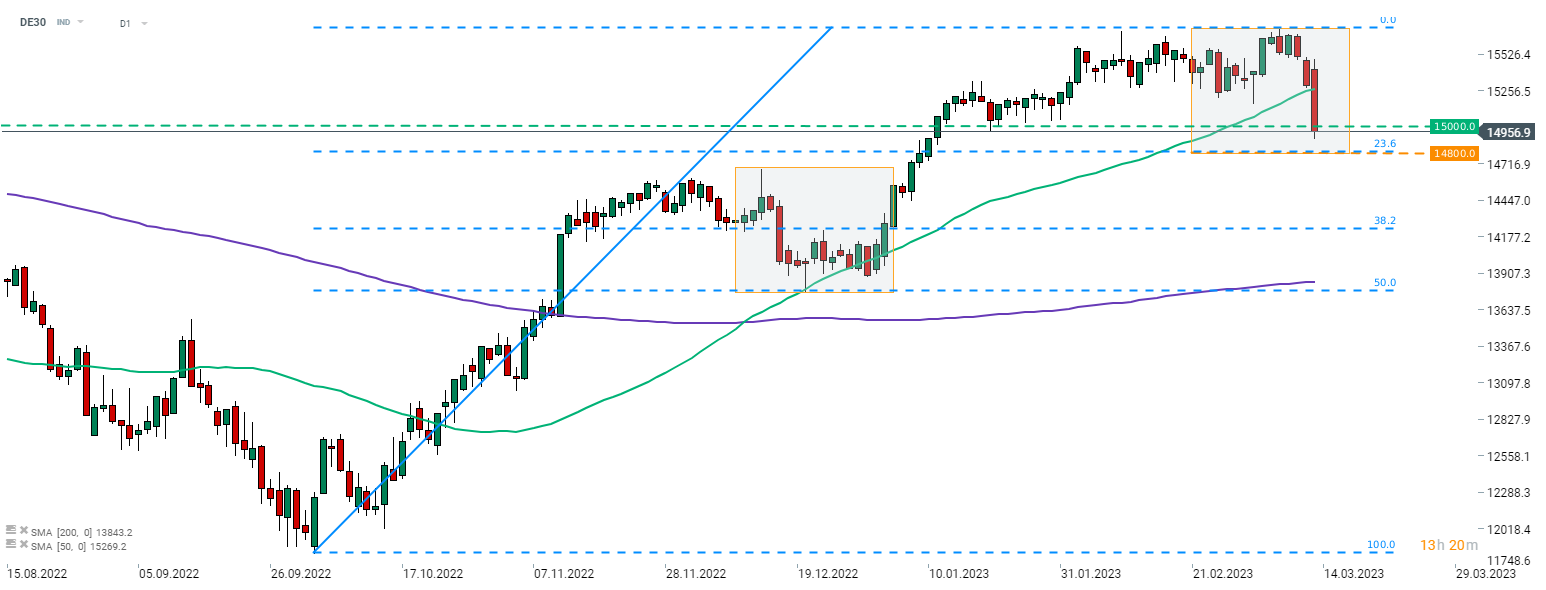

DE30 breaks below 15,000 pts for the first time since mid-January 2023 as concerns over the condition of US banks continue to pressure global markets. Key support to watch can be found in the 14,800 pts area - the lower limit of the Overbalance structure and 23.6% retracement of the upward impulse. Source: xStation5

DE30 breaks below 15,000 pts for the first time since mid-January 2023 as concerns over the condition of US banks continue to pressure global markets. Key support to watch can be found in the 14,800 pts area - the lower limit of the Overbalance structure and 23.6% retracement of the upward impulse. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.