-

European indices trade mixed

-

DE30 pulls back from 15,210 pts area

-

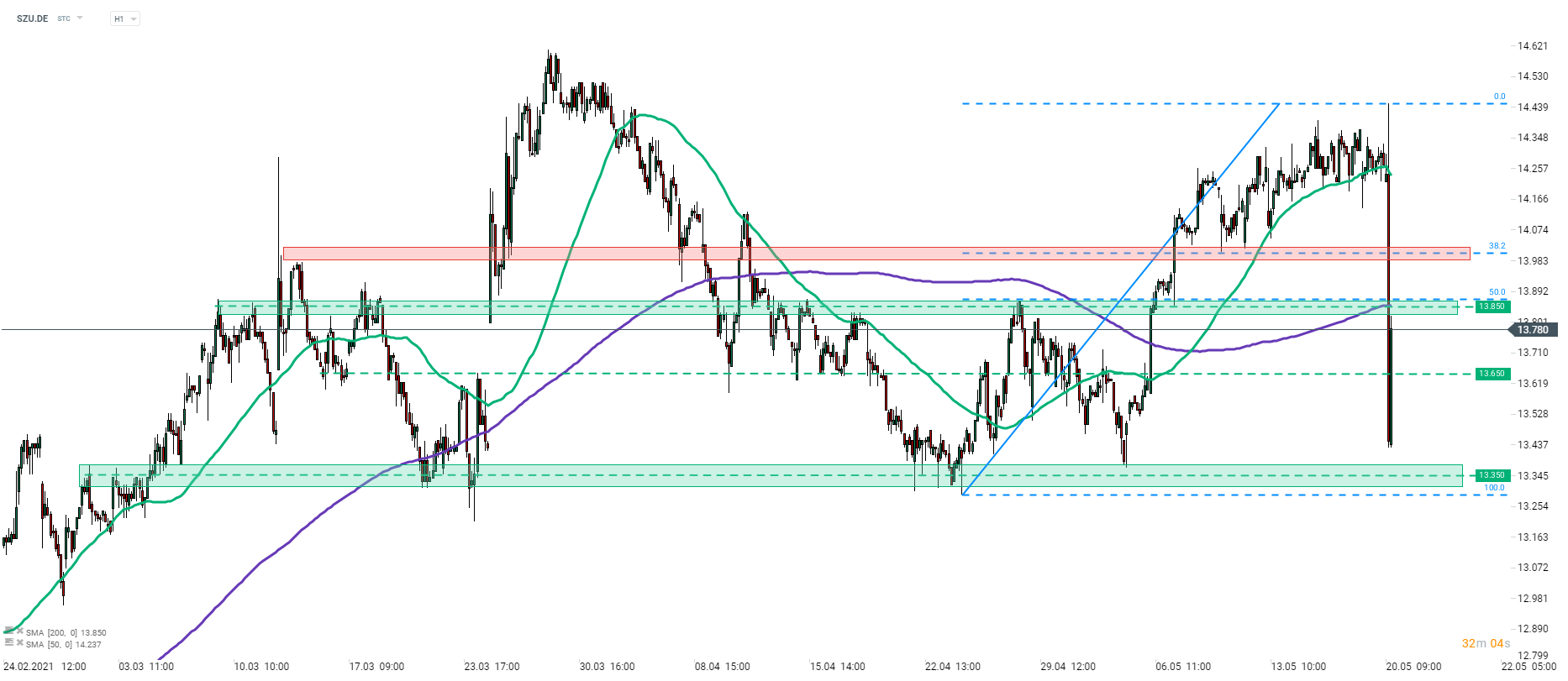

Suedzucker drops after 2022 fiscal forecasts

European stock markets trade mixed on Thursday. French CAC40 (FRA40), German DAX (DE30) and Dutch AEX (NED25) gain, UK FTSE100 (UK100) trades flat, while Italian FTSE MIB (ITA40), Spanish IBEX (SPA35) and Polish WIG20 (W20) drop. Today's economic calendar is quite empty with US jobless claims being the top release (1:30 pm BST).

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appDAX futures (DE30) gained during the Asian session but German index erased most of the gains following the cash session open. Index pulled back from the resistance area at 15,210 pts, marked with previous price reactions and the 30-period EMA (blue line, H1 interval). DE30 painted a lower high and maintained a downtrend structure. However, traders should pay close attention to whether the index paints a lower low. Having said that, the support zone near recent lows 15,010 pts is a key area to watch. Breaking below would pave the way towards the 14,850 pts area. On the other hand, should bulls regain control, the first near-term resistance to watch is the aforementioned 15,210 pts area.

Company News

Deutsche Telekom (DTE.DE) presented a 3-year growth plan. As part of the plan, adjusted earnings per share are expected to increase almost 50% by 2024, to €1.75. Company also said that 40-60% of earnings will be paid out as dividends. Company also said that it looks for a path to "US majority at attractive conditions", most likely relating to an option to buy additional shares in its US subsidiary T-Mobile US from SoftBank Group.

Suedzucker (SZU.DE) reported results for 2021 fiscal year (March 2020 - February 2021). Company reported 0.1% YoY higher revenue at €6.68 billion. EBITDA increased 25% YoY, to €597 million, while operating profit was 103% YoY higher at €236 million (exp. €171 million). Dividend of €0.20 per share was recommended. Company expects operating profit of €300-400 million in fiscal 2022 and sales of €7.0-7.2 billion.

Deutsche Bank (DBK.DE) said that it aims to facilitate €200 billion in financing for ESG investments by the end of 2023. This is two years earlier than previously planned. Deutsche Bank facilitated aggregate €71 billion for ESG investments by the end of Q1 2021. German lender also aims to have at least 30% of women in top leadership positions by 2025 as well as cut fuel consumption of its German fleet of 5,400 cars.

Suedzucker (SZU.DE) plunged today following the release of fiscal 2021 results and fiscal 2022 forecasts. Stock is trading over 5% lower on the day and has broken below the major support zone at €13.85, marked with 200-hour moving average, previous price reactions and 50% retracement of recent upward impulse. Key support to watch in case sell-off continues can be found in the €13.35 area. Key resistance to watch is the aforementioned 50% retracement area. Source: xStation5

Suedzucker (SZU.DE) plunged today following the release of fiscal 2021 results and fiscal 2022 forecasts. Stock is trading over 5% lower on the day and has broken below the major support zone at €13.85, marked with 200-hour moving average, previous price reactions and 50% retracement of recent upward impulse. Key support to watch in case sell-off continues can be found in the €13.35 area. Key resistance to watch is the aforementioned 50% retracement area. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.