-

European stock markets trade mixed

-

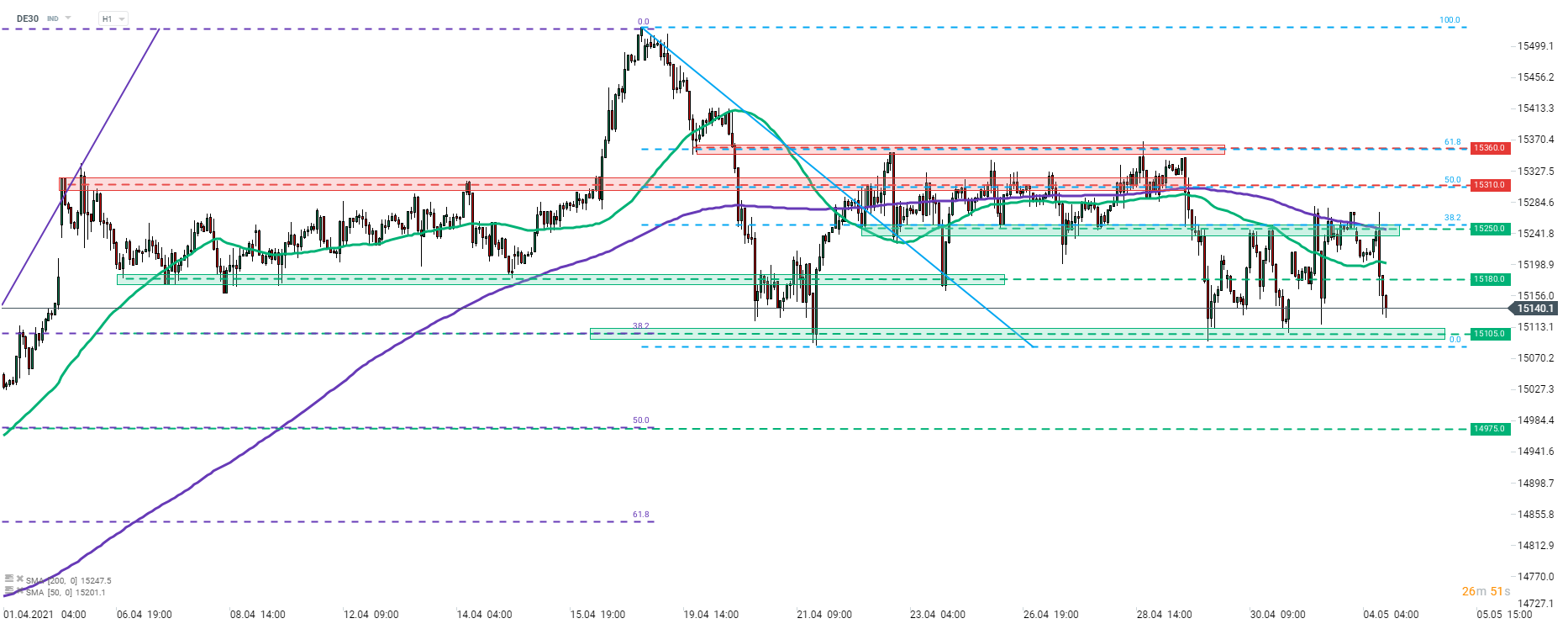

DE30 among Europe's top laggards

-

Infineon, Vonovia and HelloFresh reported results

European stock markets trade mixed on Tuesday. Shares from UK, France, Russia and Spain gain while other blue chips indices from the Old Continent. German DAX is one of the worst performing European indices, dropping around 0.6& at press time. Russian and Spanish indices are European outperformers today.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appDE30 continues to trade sideways. However, the German index has been mostly trading in the lower part of April's trading range recently. 200-hour moving average and 38.2% retracement of the mid-April downward impulse acted as a ceiling for the index recently. DE30 experienced some heavy selling after the opening of the European cash session and looks to be heading for a test of 15,105 pts support area. This area has acted as a strong support recently so bears should beware of potential reversals. On the other hand, breaking below it could pave the way for a drop towards 50% retracement of the upward impulse launched in the late-March 2021 (14,975 pts).

Company News

Vonovia (VNA.DE) reported Q1 results today. Revenue increased from €998.8 million in Q1 2020 to €1.15 billion now. Adjusted rental income increased 2.9% YoY, to €782.6 million. Adjusted EBITDA reached €506.1 million while adjusted net income increased from €197.5 million in Q1 2020 to €234.7 million now. Company expects full-year revenue at €4.9-5.1 billion and adjusted EBITDA of €1.98-2.03 billion.

Infineon (IFX.DE) reported revenue for the calendar Q1 at €2.7 billion, in-line with analysts' estimates and company's own guidance. Company expects sales in the calendar Q2 2021 to reach €2.6-2.9 billion. Full-year revenue forecast remains unchanged at around €11 billion. Net income increased from €178 million in Q1 2020 to €203 million now. Infineon said that strong results were driven by the automotive segment and that it expects light vehicle demand to exceed 85 million units this year. Company also said that semiconductor shortages are likely to cause car production to be 2.5 million units lower in the first half of 2021.

HelloFresh (HFG.DE) reported Q1 revenue at €1.44 billion, up from €699.1 million in Q1 2020 (exp. €1.44 billion). Adjusted EBITDA came in at €159.2 million, up from €64.1 million in Q1 2020 (exp. €159.4 million). Adjusted net income reached €101.6 million (exp. €98.6 million). While results were in-line with market estimates, HelloFresh stock is dropping hard today. Investors seem concerned about HelloFresh's ability to maintain momentum once lockdowns are lifted.

HelloFresh (HFG.DE) plunged following a release of Q1 earnings. Stock has been trading 8% lower at one point of today's session. However, share price is recovering and it looks like a pin bar candlestick pattern may be painted at the support zone marked with 38.2% retracement. In theory, it would signal that downward correction may be about to end. Source: xStation5

HelloFresh (HFG.DE) plunged following a release of Q1 earnings. Stock has been trading 8% lower at one point of today's session. However, share price is recovering and it looks like a pin bar candlestick pattern may be painted at the support zone marked with 38.2% retracement. In theory, it would signal that downward correction may be about to end. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.