Summary:

- European stocks see a flat start to Monday’s trading

- This week could be crucial for stock investors due to the ECB meeting scheduled for Thursday

- Bayer (BAYN.DE) may get a substantial reduction of its $2 billion Roundup-related fine

The beginning of the new trading week has been quite mild with major indices trading pretty flat despite quite notable losses seen in Asia - the Shanghai Composite has dipped 1.3% while the Hang Seng has fallen 1.1% so far today (both market have yet to close). However, looking ahead one may be almost sure that this week is going to be turbulent for stocks, bonds and currencies alike given what we have in the economic calendar. As far as Europen stock markets are concerned there is no doubt that the ECB may significantly affect them even as it is poised to hold rates unchanged.

What’s been already priced in? Looking at market-based expectations one may notice that there is a 40% probability for a cut at the meeting this Thursday (of course, we talk about a 10 bps deposit rate cut), however, not only the rate decision itself will be eagerly watched. First and foremost, market participants will probably focus on a possible announcement with regard to the resumption of quantitative easing as soon as this autumn. Moreover, the current forward guidance extension is also on the cards which could make any rate hikes even more distant. On top of that, one may suppose that Mario Drahi will be grilled about the latest revelations regarding possible changes to the ECB’s inflation target policy. Do note that a revamp of this policy could carry serious ramifications for future monetary policy - a symmetrical target would mean that the ECB would be legally allowed to tolerate price growth both slightly under and above 2%. Having this in mind one may conclude that a rate increase would become as distant as the road to the Moon.

Start investing today or test a free demo

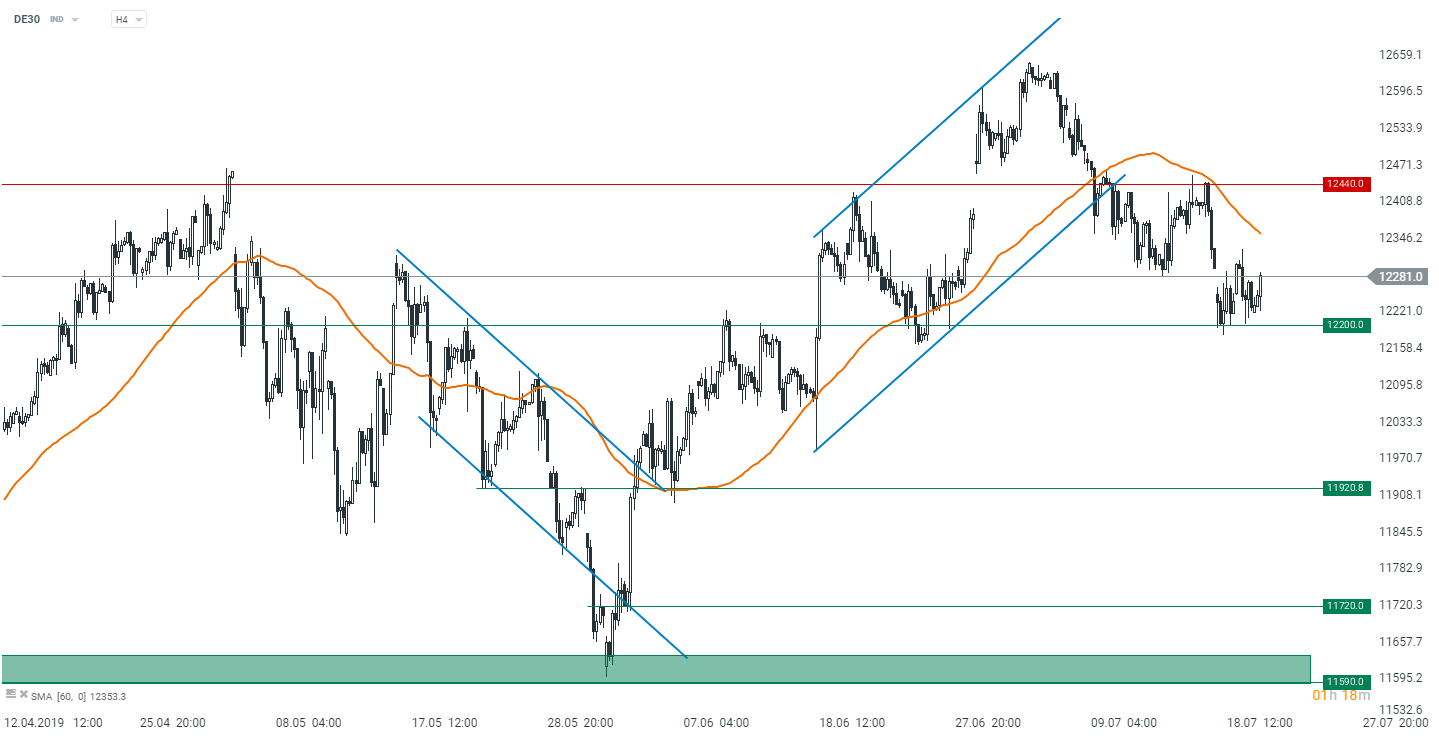

Open account Try demo Download mobile app Download mobile app Looking at the daily time frame of the German DAX one may arrive at a conclusion that bulls are in a good position to try to push higher as they managed to stay above 12 200 points last week. However, the ECB meeting poses the major risk for this scenario given that expectations for monetary easing seem to lofty. From a pure technical standpoint one may notice that bulls would have to deal with the 60-period MA if they want to come back toward 12 440 points. That could turn out a hard nut to crack for them, albeit the ECB may provide an important impulse. Source: xStation5

Looking at the daily time frame of the German DAX one may arrive at a conclusion that bulls are in a good position to try to push higher as they managed to stay above 12 200 points last week. However, the ECB meeting poses the major risk for this scenario given that expectations for monetary easing seem to lofty. From a pure technical standpoint one may notice that bulls would have to deal with the 60-period MA if they want to come back toward 12 440 points. That could turn out a hard nut to crack for them, albeit the ECB may provide an important impulse. Source: xStation5

Focusing on particular stocks it is worth mentioning Bayer (BAYN.DE) after the encouraging news regarding a Roundup-related lawsuit. Namely the company may see a 90% reduction of the $2 billion verdict it was hit in the most recent trial over its weedkiller. This is possible after the Oakland judge said that the $2 billion fine was beyond the limits allowed by legal precedent. Therefore, under her ruling, total damages could end up in the range between $20 million and $100 million. Let us remind that this sum will be paid to the couple accusing the company of getting a cancer caused by a weedkiller Roundup. The company’s shares are trading prettly flat despite the positive news.

In turn, Muenchener Rueckvrschrng (MUV2.DE) shares are down more than 1% after being downgraded by Jefferies to underperform from hold. The price target was lowered to 193 EUR from 208 EUR.

The German index has seen a mild start to the new trading week. Source: Bloomberg

The German index has seen a mild start to the new trading week. Source: Bloomberg

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.