-

DAX to undergo a massive makeover

-

New criteria for inclusion in the index

-

Expansion to a 40-member format

-

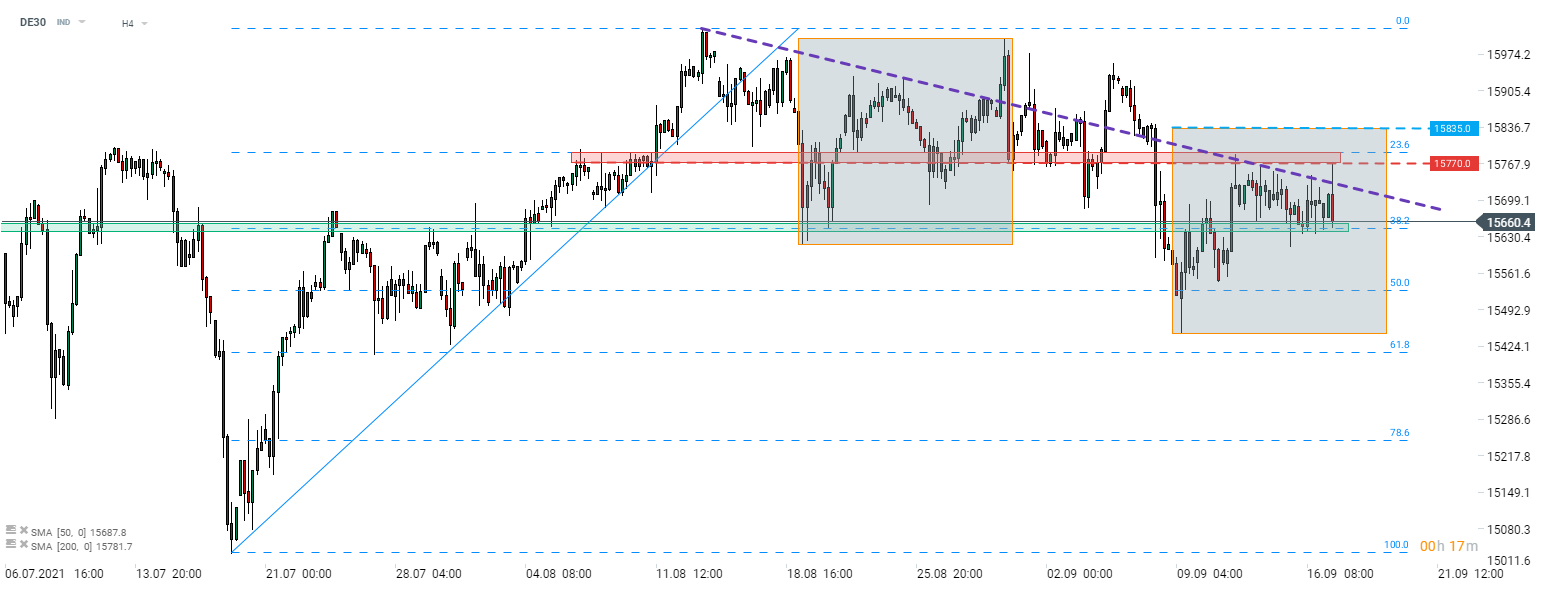

DE30 trades sideways in tight range

German DAX will undergo a massive makeover after a close of today's session. Criteria for inclusion in the index will change as well as the size of the index. Some see this change as an opportunity for the German index to stop being viewed as a cyclical benchmark and become more growth-oriented, just like indices from Wall Street. Let's take a closer look at what will change and whether it will have an impact on the market or not.

Qualification criteria changes

German blue chips index DAX has been maintained in a 30-member format since its inception July 1, 1988. Criteria needed to be met for the inclusion did not change either and stock that wanted to qualify for index membership had to be one of the largest on the German stock exchange in terms of market capitalization and trading volume. However, it was decided that events like the collapse of Wirecard, due to accounting irregularities, should be addressed and a new set of criteria was developed.

While market capitalization will remain to be one of key factors for inclusion, trading volume will no longer have such a high priority. Apart from that, more emphasis will be placed on ensuring that only quality companies make their way into the index. Only companies that have generated positive EBITDA in the two most recent financial years will be able to qualify for DAX membership. Wanna-be DAX members will also need to have an internal audit committee in place as well as a record of timely releases of its financial reports.

New members

Another big change, and for sure more visible for investors, is expansion of the index from its current 30-member format to a new 40-member format. Including more stocks in the German index is said to make it a better reflection of the economy. Whether this is the case or not remains to be seen but what's certain is that the expansion will make the index more diverse as new companies come from sectors that have been underrepresented in the index.

-

Airbus (AIR.DE)

-

Puma (PUM.DE)

-

Porsche Automobil Holding (PAH3.DE)

-

HelloFresh (HFG.DE)

-

Zalando (ZAL.DE)

-

Siemens Healthineers (SHL.DE)

-

Sartorius (SRT.DE)

-

Qiagen (QGEN.US)

-

Brenntag (BNR.US)

-

Symrise (SY1.DE)

While the list of new members includes some cyclical stocks, like Airbus or Porsche Automobil Holding, the majority of new index components can be seen as growth stocks. Moreover, in many cases those new members are "pandemic winners", who experienced significant share price growth in 2020, that allowed them to meet market capitalization criteria. Addition of more tech stocks to DAX can help it become less cyclical and more growth oriented, like US and Asian indices, who have consistently outperformed German index recently.

Basic data on 10 new DAX members. Year-to-date returns are based on yesterday's closing prices (16 September 2021). Source: Bloomberg, XTB

Basic data on 10 new DAX members. Year-to-date returns are based on yesterday's closing prices (16 September 2021). Source: Bloomberg, XTB

Impact on traders

While expanding DAX index to 40 members is expected to make the index a better reflection of the German economy, the change itself will not have an impact on the index' level. The index will be adjusted so that post-change index level will equal to pre-change index level at the moment of implementation (close of the Friday session). However, this does not mean that there will be no price gaps at the launch of the session on Monday. There can be price gaps but they will result from market conditions, not changes to the index.

In XTB we have decided not to adjust names of DAX-related instruments to the new number size of the index. As a result, names of instruments like DE30 and DE30.cash will not be changed to reflect the new 40-member format of the index. Positions that will be held by traders on those instruments at the close of Friday's trading will not be altered over the weekend in any way.

Technical Analysis

DE30 has traded sideways this week between support marked with the 38.2% retracement of the upward move launched in mid-July (15,650 pts area) and resistance marked with the 23.6% retracement (15,770 pts area). While the index struggled to deliver a large move in either direction in the past few days, a point to note is that there seems to be a bearish bias in the market. Index struggles with breaking above the downward trendline and continues to trade within the range of the Overbalance structure, marking the largest correction in the current downward impulse. DE30 bulls need to push the index above the upper limit of the Overbalance structure at 15,835 pts to make the outlook somewhat more favourable for longs. Nevertheless, it should be also noted that the index trades less than 2.5% below its all-time highs and a move above the upper limit of the Overbalance structure would require price gain of just around 1%.

Source: xStation5

Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.