-

European indices finished today's cash trading mixed with majority of blue chips indices from Western Europe deviating less than 0.3% from yesterday's closing prices

-

DAX futures (DE30) climbed back above 16,000 pts and reached the highest level since January 2022

-

Wall Street indices launched today's trading lower. However, losses were being erased as the session went on and now S&P 500, Nasdaq and Russell 2000 are trading in positive territory. Dow Jones trades slightly lower on the day

-

Asian session as well as the first half of the European session was marked with USD strengthening, which put pressure on precious metals and energy commodities

-

USD started to lose ground in the afternoon allowing silver to recover from losses and gold to reapproach $2,000 area

-

Netflix dropped 4% after company released disappointing Q1 2023 earnings report that showed slowdown in subscriber growth

-

IBM and Tesla are set to report Q1 2023 financials after close of the Wall Street session today

-

Bloomberg reported that Bank of Japan is unlikely to tweak its yield curve control policy at April meeting

-

Cryptocurrencies were trading lower today with Bitcoin dropping below $29,500 mark and Ethereum moving below $2,000 area

-

GBP and NZD are the best performing major currencies while JPY and CAD lag the most

-

Final CPI inflation data from euro area for March confirmed flash reading and showed headline CPI dropping from 8.5 to 6.9% YoY while core gauge ticked higher from 5.6 to 5.7% YoY

-

Japanese industrial production increased 4.6% MoM in February (exp. 4.5% MoM)

-

UK CPI inflation decelerated from 10.4 to 10.1% YoY in March (exp. 9.8% YoY). Core gauge stayed unchanged at 6.2% YoY (exp. 6.0% YoY)

-

Canadian housing starts data for March came in at 213.9k (exp. 240k)

-

Oil recovered part of the losses after the DOE report showed a massive 4.58 million barrel draw in US inventories (exp. -2.5 mb)

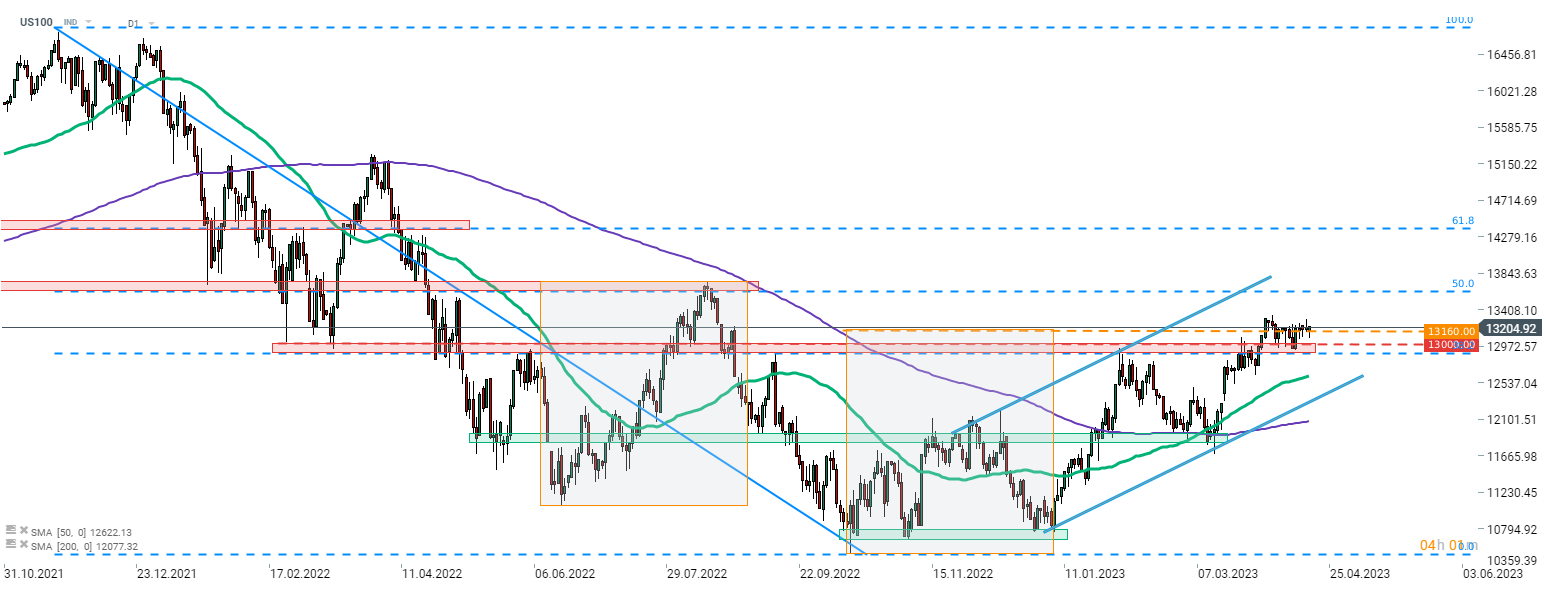

Nasdaq-100 (US100) continues to struggle in the vicinity of the upper limit of an Overbalance structure. Recent price action signals indecisiveness with the index trading mostly sideways over the past 2-3 weeks. However, earnings reports from Tesla, IBM and others may provide fuel for the move of the tech-heavy index. Source: xStation5

Nasdaq-100 (US100) continues to struggle in the vicinity of the upper limit of an Overbalance structure. Recent price action signals indecisiveness with the index trading mostly sideways over the past 2-3 weeks. However, earnings reports from Tesla, IBM and others may provide fuel for the move of the tech-heavy index. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.