European indices closed today's session in mixed moods, with DAX 30 index down 0.4%, while CAC40 and FTSE100 finished slightly above the flat line as investors continued to evaluate risks from high inflation and rising interest rates. The annual inflation rate in the U.K. jumped to 7% last month, a level not seen since March 1992. Similarly, Germany's March inflation reached 7.3%, the highest since 1981. The focus is now turning to Thursday’s ECB meeting to see if policymakers offer a more hawkish tone given strong inflationary pressures. Also sentiment remained clouded by the Russia-Ukraine war, which showed no signs of de-escalation. Today US intelligence and the Ukrainian side indicate that Russia is preparing to attack the Donbas region.

Upbeat mods prevail on Wall Street where three major indices managed to erase early losses, helped by decline in US Treasury yields, which proved some relief for the tech sector. Investors also digested a rather weak start of the earnings season. JPMorgan posted disappointing quarterly results, dragging its shares down over 3%. Overall analysts have lowered their estimates regarding companies results due to rising commodity prices and ongoing war in Ukraine. Earnings for S&P 500 companies are expected to increase only 4.5% in Q1, which would be the lowest growth since Q4 of 2020, according to FactSet. On the data front, producer price inflation surged 11.2% YoY, the most in a data series going back to November 2010 boosting expectations that FED will raise interest rates at a faster pace. Meanwhile President Biden has accused Russian forces of committing acts of genocide in Ukraine, while Treasury Secretary Yellen urged Chinese government to persuade Kremlin to cease its aggression in Ukraine and warned that staying neutral could jeopardize China’s standing in the global economy.

The Canadian dollar strengthened after the Bank of Canada raised interest rates by 50 basis points to 1% and decided to stop reinvesting maturing assets later this month.

WTI crude price rose over 3% to above $103 per barrel, while Brent jumped above $108.00 in volatile trading on Wednesday, as investors try to assess signals of weakening demand in Asia and potential supply concerns. Because of the sanctions and trade disruptions Russian oil and gas condensate production fell below 10 million bpd on Monday, the lowest since July 2020, while China's crude imports from Russia dropped 9% in the first two months of 2022. Elsewhere US crude oil inventories jumped by 9.382 million barrels to 421.8 million barrels, the most since March 2021, while gasoline and distillate stocks fell sharply.

Precious metals move higher on Wednesday - gold is testing $1980 level, while silver jumped to $25.75 amid concerns of an escalation in the Ukraine conflict. Meanwhile upbeat moods prevails on the cryptocurrency market. Bitcoin price approaches $41,000 while Ethereum tested $3100 level, which shows that correlation with NAsdaq is still strong.

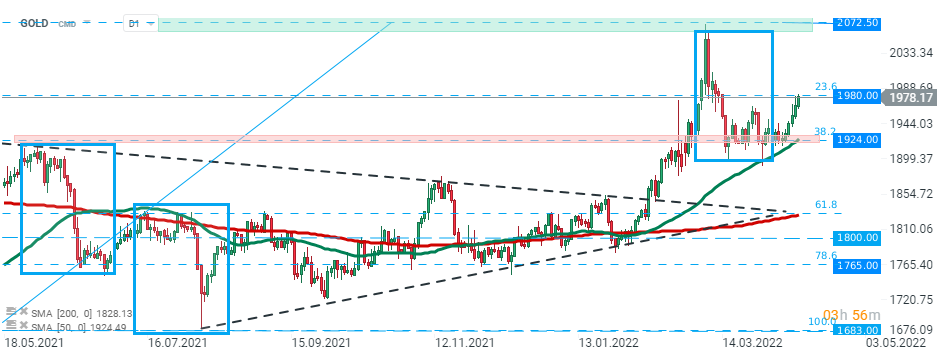

Gold price rose sharply since the beginning of April and is currently testing major resistance at $1980. Break higher could pave the way towards the recent high at $2072.50. However if sellers manage to regain control, nearest support to watch lies at $1924. Source: xStation5

Gold price rose sharply since the beginning of April and is currently testing major resistance at $1980. Break higher could pave the way towards the recent high at $2072.50. However if sellers manage to regain control, nearest support to watch lies at $1924. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.