- Wall Street indices launched today's cash session little changed but have turned lower later on

- S&P 500 and Nasdaq trade 0.1% lower each while Dow Jones drops 0.2%. Small-cap Russell 2000 index trades over 1% lower

- European stock market indices finished today's trading higher but off the daily highs. German DAX gained 0.5%, French CAC40 moved 0.7% higher, FTSE MIB added 0.1% while UK FTSE 100 traded 0.1% lower

- Lack of Middle East escalation as well as downbeat reports on US oil and oil derivatives demand are pushing crude prices lower

- Brent dropped below $80 per barrel for the first time since late-July

- Lack of Middle East escalation is also causing outflows from safe haven assets. Gold drops for the third day in a row and tests $1,950 per ounce area

- Cryptocurrencies traded higher today - Bitcoin gained 0.5%, Ethereum traded 0.8% higher while Dogecoin surged 3%

- EUR and CHF are the best performing major currencies while JPY and AUD lag the most

- ECB Lane said that the Bank has not made enough progress on underlying inflation

- ECB Makhlouf said that while core inflation remains a challenge, it is in a much, much better place now

- ECB Vujcic said he expects inflation to decline towards ECB target in 2025

- ECB Nagel said that discussion on rate cuts are not helpful and it is too early for them given still-high inflation

- ECB Kazaks said that he cannot exclude possibility that further rate hikes may be needed

- Fed Chair Powell delivered opening remarks at Fed Research Conference today but his speech included no mentions on the outlook for the monetary policy

- European Union supports opening talks on Ukraine membership with conditions

- CAD gained slightly after BoC minutes showed that some member felt rates would more likely than not need to increase further

- Canadian building permits plunged 6.5% MoM in September (exp. -1.5% MoM)

- US wholesale sales increased 2.2% MoM in September (exp. 0.9% MoM) while wholesale inventories were 0.2% MoM higher (exp. 0.0% MoM)

- Final German CPI inflation for October came in at 3.8% YoY, matching flash release

- AtlantaFed GDPNow model estimates annualized real US GDP growth in Q4 2023 at 2.1%

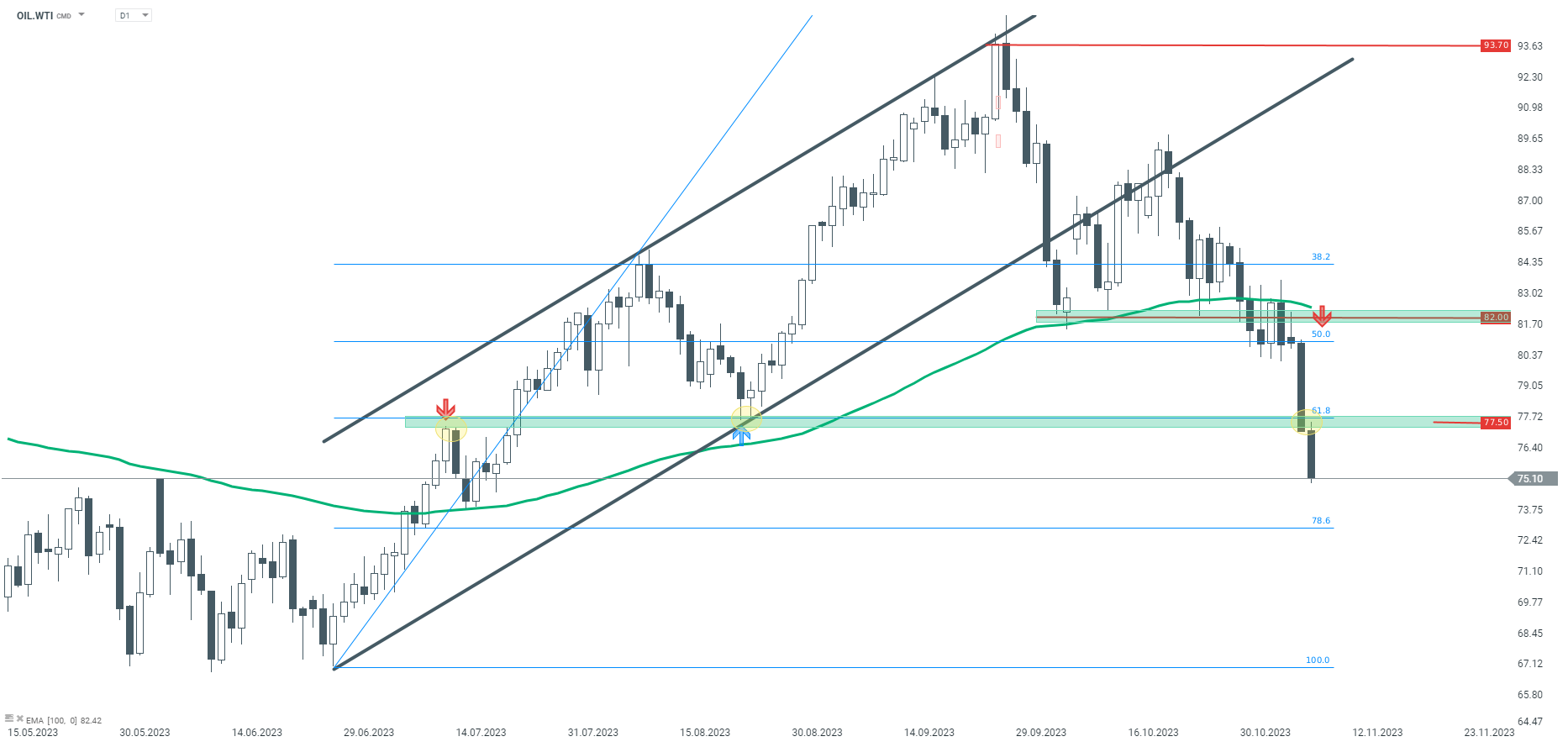

Wednesday is another day marked with oil weakness. WTI (OIL.WTI) broke below the $77.50 support zone, paving the way for an even deeper decline. Source: xStation5

Wednesday is another day marked with oil weakness. WTI (OIL.WTI) broke below the $77.50 support zone, paving the way for an even deeper decline. Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.