- Today's inflation reading from the U.S. was in the market's spotlight before the scheduled tomorrow Fed decision and Jerome Powell speech at 7:30 PM GMT. The reading did not bring a significant surprise. Y/y inflation came in at 3.1% versus 3.1% forecast and 3.2% previously. On a monthly basis, it rose 0.1% despite an expected 0% growth rate, and core inflation pointed to 4% y/y, in line with forecasts

- 10-year treasuries yields are falling and the U.S. dollar is weakening today after the main macro reading. EURUSD is trading below 1.08, where strong supply has restarted.

- AUD and CAD are weakening against the USD, while the best performing of the G10 group is the Japanese yen

- U.S. Treasury Secretary and former Fed Chair Janet Yellen stated dovish that inflation expectations are under control and a rise in real interest rates could influence further Federal Reserve policy. Yellen currently sees no reason why inflation should miss its target, and stressed that the U.S. economy is on its way to a 'coveted' soft landing

- Indexes overseas are trading higher. The Nasdaq 100 gains 0.4%, the Dow Jones is trading 0.2% higher and the S&P 500 adds 0.25%. Apple shares are trading with modest gains. The latest iOS update is expected to make it easier for the company to combat product theft, at the point of sale

- Oracle (ORCL.US) shares are trading near a 12% sell-off, wiping out nearly $25 billion in market capitalization, after third-quarter results missed expectations, pointing to lower-than-forecast revenues, including in its cloud computing segment. The stock wasn't helped by a more than 40% year-on-year increase in net income and is now trading at its lowest since May, this year

- Stock indexes from Europe halted gains. Germany's DAX closed today in the region of its benchmark, as did London's FTSE100. The CAC40 lost 0.11%, and we saw larger declines on indexes in Spain or Portugal. Nevertheless, it seems far too early to think about a change in stock market sentiment, although a downward correction could occur at any time given the recent strong gains on European trading floors

- Germany's ZEW index rose to 12.8 on expectations of 8.7, with a previous reading of 9.8. The improvement, seen mainly in the outlook, may be related to expectations of faster rate cuts in the face of falling inflation

- Oil prices resumed declines on concerns about demand for crude, with both Brent and WTI losing more than 3%

- Precious metals are trading mixed, with gold and silver losing slightly in evening trading, while palladium and platinum are gaining more than 1%

- Cryptocurrencies are trading in mixed sentiment. Altcoins are doing better against Bitcoin, which is trading around $41,500. Record highs are being recorded by Cosmos, which is currently trading nearly 20% higher. The crypto market is evaluating a possible 'fight' scenario against the decentralized finance sector, following unfavorable comments from US Senator Elizabeth Warren to the industry

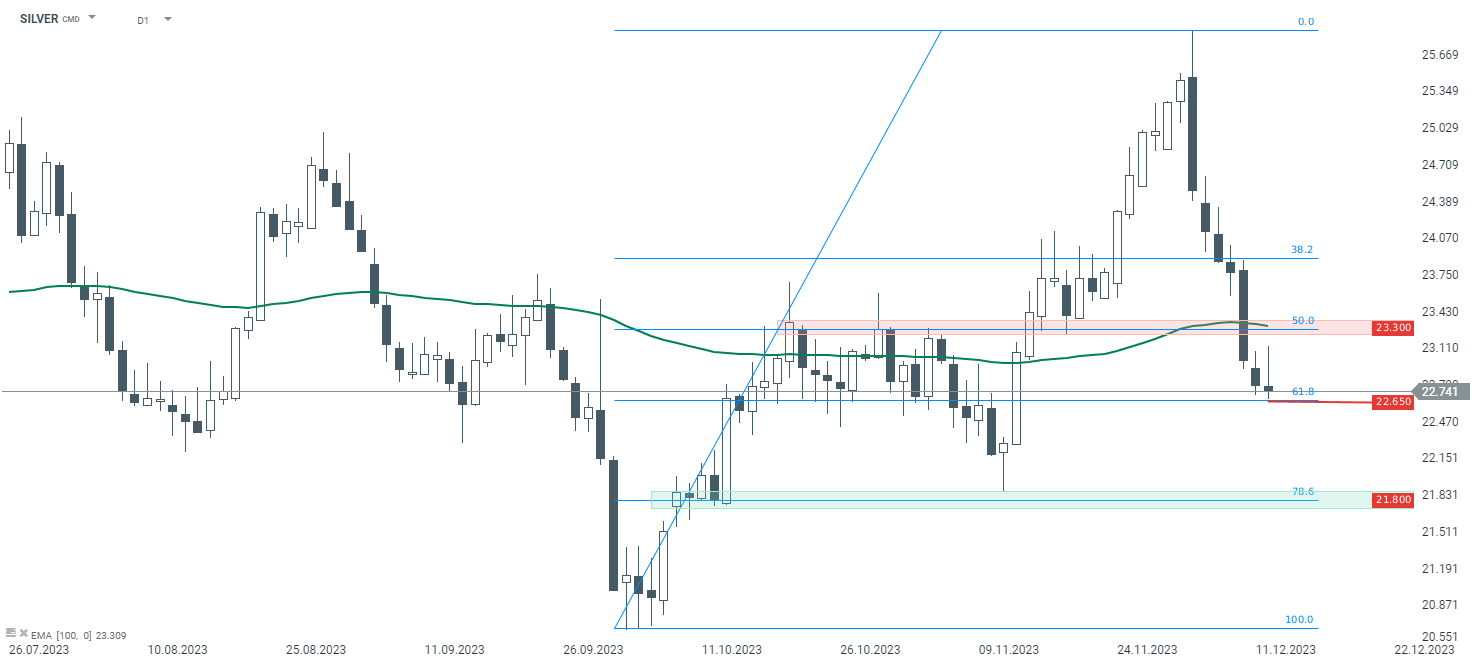

SILVER tests 61.8 Fibo support zone. In the case of falling below $22,65, we can see next critical support at $21.80. Source: xStation5

SILVER tests 61.8 Fibo support zone. In the case of falling below $22,65, we can see next critical support at $21.80. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.