- European indices finished today's session mostly higher, with the benchmark Stoxx 600 adding 0.1% and the German DAX rising nearly 0.5%, thanks to solid performance of stocks from tech and oil sectors.

-

FTSE 100 extended losses for a third consecutive session, dragged by healthcare and materials stocks.

-

Ahead of the first anniversary of the Russian invasion of Ukraine, NATO Chief Stoltenberg said that the alliance has observed indications that China is perhaps considering sending weapons to Russia. Meanwhile Germany’s Chancellor Scholz informed Chinese representatives that sending weapons to Russia is not acceptable.

-

Wall Street indices launched today's session higher, supported by upbeat earnings from Nvidia and Alibaba. However moods soured later in the session after as investors digested a slew of economic data.

-

US Q4 GDP was downwardly revised, while the core PCE price index, the Fed's preferred inflation measure, was adjusted to show a softer slowdown. Meanwhile weekly jobless claims fell unexpectedly, adding to concerns that the labor market remains tight.

-

Yesterday's FOMC minutes were considered as moderately hawkish. Fed members were in favor of further monetary policy tightening and some policymakers voted for a 50 bp hike, which may indicate that the number of hawks may increase ahead of the next FED meeting.

-

JPMorganChase CEO Jamie Dimon said that US economy is doing quite well and although we slightly lost control over inflation, soft landing is still possible

-

Macroeconomic concerns pushed FX traders towards the US dollar and the Japanese yen, while the British pound, Aussie and the Swiss franc lag the most. EURUSD is currently testing support at 1.0580, a level not seen since early January 2023.

-

Precious metals continue to move lower amid a stronger dollar. Gold breaks below major support at $1820, while silver is moving towards recent lows at $21.15.

-

Energy commodities are trading higher. Nagas moved further away from recent lows at $2.0 after US utilities pulled 71 bcf (billion cubic feet) of gas from storage during the week ended February 17, 2023, slightly more than market expectations of a 67 bcf drop.

-

Oil prices jumped nearly 2.0% despite the latest EIA report showed that US inventories rose by 7.648 million barrels to 850.6 million in the week ending February 17th, the highest level since September.

-

Bitcoin weakens again and sinks below $24,000. At the same time Tezos, which yesterday announced a partnership with Google Cloud, struggles to uphold recent bullish momentum. Other projects are also facing downward pressure.

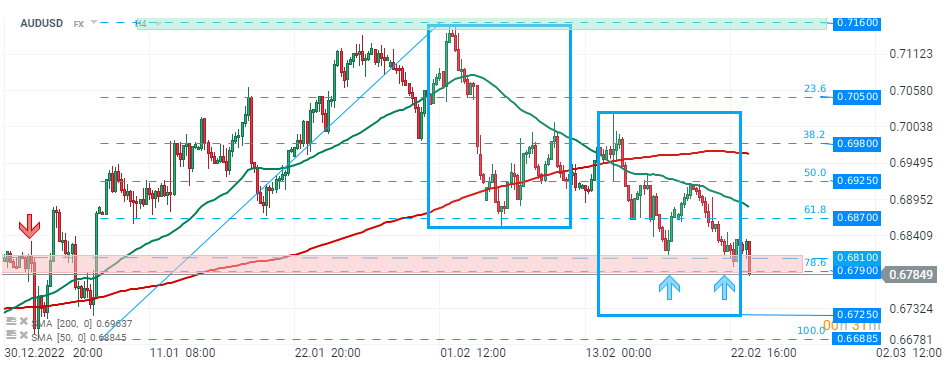

AUDUSD - Australian dollar is one of the worst performing G10 currencies today. Pair broke below the crucial support zone around 0.6800, which potentially opens the way towards the lower limit of the 1:1 structure at 0.6725. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.