- Worse sentiment on the stock market

- US500 reached key short-term support

- USD strongest among the majors

- Investors await the Fed

Despite the positive start of the European session, the major indices closed lower, German DAX lost 0.05%, France's CAC 0.7%, UK's FTSE 100 0.8% and Spain's Ibex 0.45%. The beginning of the trading session on Wall Street did not go well and the main indexes also are trading lower.

Looking at the forex market, US dollar is the strongest of the majors. The USD is followed by the JPY and CHF. The AUD and NZD are the weakest. That combination is indicative of "risk off" flows. The potential Omicron acceleration could lead to some reevaluation of economic growth/stock indices/commodities growth. However, the risk of a new variant was ignored last week.

A meeting of the US Federal Reserve this week could boost the dollar further if the central bank decides to take a more hawkish stance on the unwinding of its bond-buying programme and the timing of interest rate rises. The Bank of Canada reaffirmed their 2% inflation target today. Macklem's commentary highlights that they are in no mood to keep rates particularly low, a sign that rate hikes are planned for the "middle quarters" of 2021, which is their guidance. CAD loses nearly 0.6% to USD today.

Crude oil came under pressure today. WTI and Brent are trading about 1% lower. Natgas also is below the baselline despite an attempt to rebound today. Gold, on the other hand, is trading up slightly, with silver gaining 0.65%.

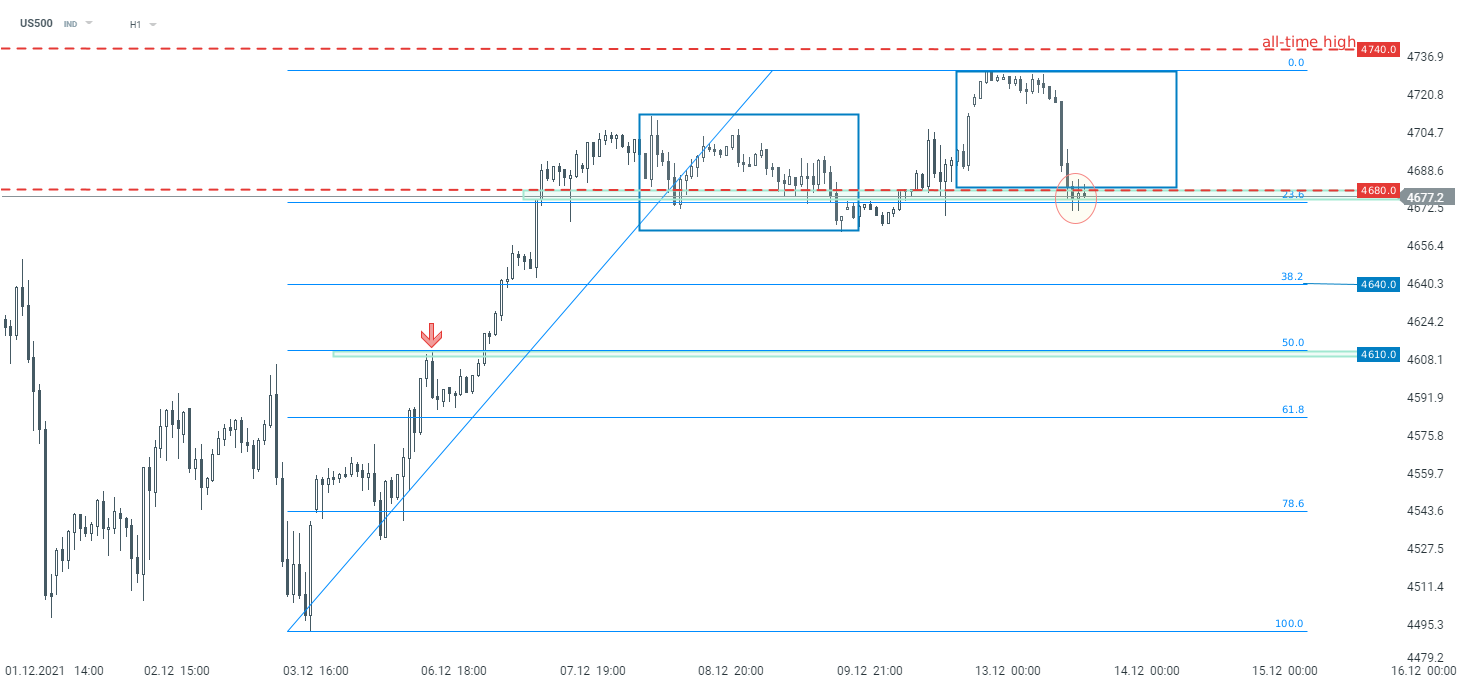

Despite the long term upward trend, the US500 did not manage to reach an all - time high today, and the downward correction started. The current downward correction stopped at the 4,680 pts support, which is marked with the lower limit of local 1:1 structure (blue rectangle) and 23,6% Fibonacci retracement of the recent upward move. If the current sentiment prevails, another attack on the all-time high at 4,740 pts is possible. However breaking below this support may lead to a trend reversal on US500.

US500 reached the key support near 4,680 pts, H1 interval. Source: xStation5

US500 reached the key support near 4,680 pts, H1 interval. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.