- European stocks near records

- FOMC minutes did not surprise the markets

- US500 hit new all-time high

- Crude oil price fell sharply

European indices finished today's session higher near record-high levels after the European Commission revised upwards its Eurozone GDP and inflation forecasts for 2021 and 2022. DAX 30 added 1.17%, CAC 40% rose 0.31% and FTSE100 finished 0.71% higher. Meanwhile US indexes are trading higher after the Federal Reserve’s FOMC minutes showed FED officials felt that substantial further progress on the economic recovery was generally seen as not having yet been met suggesting the Fed would keep its monetary support for now. The S&P 500 and Nasdaq hit a fresh record high as big tech stocks gained after the yield on the benchmark 10-year Treasury note edged lower towards 1.3%, hovering around its lowest level since mid-February.

There is little volatility in the Forex market today. Mixed moods persist towards the end of the session. Only the NZDUSD currency pair deserves attention, where we observe a 0.3% increase. The GBPUSD and AUDUSD pairs both rise around 0.1%. The US dollar appreciates slightly against CAD, EUR and CHF, however moves oscillate here around 0.1%.

Much more was happening in the crude oil market today, where we could observe another day of declines. Brent crude oil fell by 1.9%, while WTI is trading over 2% lower. The declines intensified after information about a potential increase in production by the UAE. It's worth noting, however, that the WTI price hit the key support at $ 72.50.

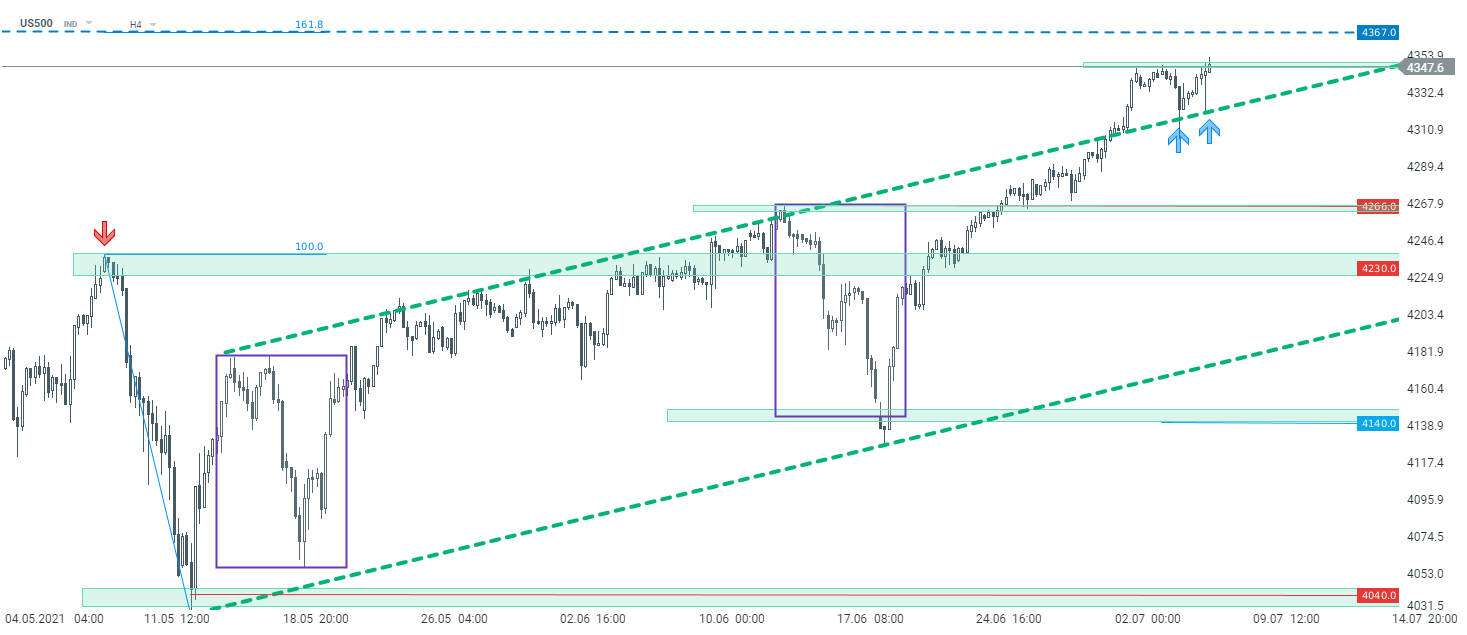

US500 bounced off the upper limit of the previously broken ascending channel, which confirms that the uptrend remains intact. If the current sentiment prevails, there is a chance that the upward impulse will accelerate towards the resistance at 4367 pts, which is marked by the 161.8% external Fibonacci retracement. Source: xStation5

US500 bounced off the upper limit of the previously broken ascending channel, which confirms that the uptrend remains intact. If the current sentiment prevails, there is a chance that the upward impulse will accelerate towards the resistance at 4367 pts, which is marked by the 161.8% external Fibonacci retracement. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.