- European indices finished today's session lower, snapping a four-day winning streak, with German DAX dropped 1.0%, led by an over 6% loss in Mercedes Benz after the carmaker cut prices on some of its EQE and EQS models in China due to changing market demand for top-end electric vehicles.

-

Polish officials said yesterday's missile strike on its territory appears to be an accident by Ukraine

-

ECB may favor 50 basis point rate hike in December rather than 75 basis point, according to Bloomberg sources

-

Downbeat sentiment prevails on Wall Street, where Dow Jones is trading slightly below the flat line, while S&P500 and NASDAQ fell 0.65% and 1.25% respectively as investors digested Target's poor quarterly results and gloomy financial outlook. These figures also pushed down other retailers, including Macy's, Kohl's, Nordstrom, and Gap, deep in the red.

-

On the data front, US retail sales unexpectedly rose 1.3% MoM in October which suggests that US consumers continued to spend despite the weakening economy. However after adjusting for inflation, retail sales reached high in March 2021 & are down 0.3% over the last year. Among other economic releases, industrial production unexpectedly declined.

-

FED Daly said interest rates in the range of 4.75%-5.25% seem appropriate. Holding off future rate hike isn't an option for now;

-

Fed George believes it would make sense to slow pace of rate hikes next year

-

Goldman Sachs now sees the Fed hiking to 5.00-5.25%. Previously banks analysts expected a peak at 4.75-5.00%

-

OIL.WTI fell over 2.0% as flows through the Druzhba pipeline which carries Russian oil to Hungary had resumed following a brief outage. Meanwhile, EIA data showed US crude stocks fell more than expected while gasoline and distillate inventories rose.

-

Gold pulled back from recent high around $1786 and is currently trading around $1772.0 area, while silver again failed to break above key resistance at $22.00 as the dollar attempted to erase some of the recent losses.

-

Downbeat moods prevail on the cryptocurrency market. Bitcoin again moved towards $16400 level, while Ethereum is testing key support at $1200.

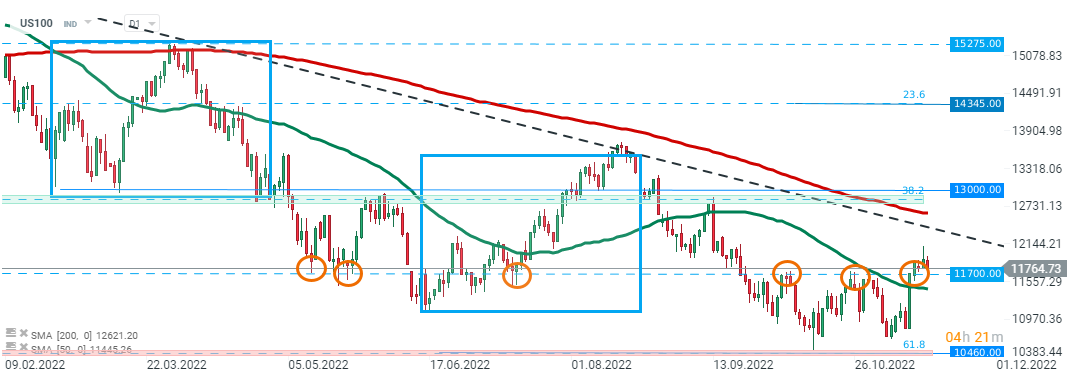

Despite slightly negative sentiment US100 still manages to trade above key support at 11700 pts, which is marked with previous price reactions. As long as the index sits above this level, another upward impulse may be launched towards the downward trendline. On the other hand, should a break lower occur, downward move may deepen towards recent lows at 10460 pts. Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.