- European bourses rebounded slightly after recent sell-off

- Wall Street resumes move lower

- Gold broke above $1850, Bitcoin rebounds

European indices finished today's session higher, following their worst sell-off since June 2020, as solid quarterly figures from Ericsson and Logitech lifted market sentiment slightly. DAX gained 0.75%, FTSE 100 jumped 1.04% and CAC40 finished 0.74% higher. On the data front, German business morale improved in January for the first time in seven months. Nevertheless ongoing geopolitical tension regarding potential military invasion in Ukraine limited the upward move.

Yesterday major Wall Street indices staged a massive reversal and managed to finish the day higher, however today sellers took the initiative once again after a set of mixed quarterly results and weak US CB Consumer Confidence data. At one point, Dow Jones fell over 2%, the S&P dropped 2.7%, and the tech-heavy Nasdaq Composite plunged 3.0% as higher yields negatively affected tech stocks. Nividia stock fell 5% and Amazon more than 3.0%. On the corporate front, GE stock dropped 6% after the company posted mixed quarterly results and 2022 guidance. J&J rose as much as 2% after the company outlined an expectation of $3 billion in Covid vaccine sales in 2022. On the other hand, American Express shares jumped over 7% on upbeat quarterly results. Microsoft will present its quarterly figures after market close. Tomorrow investors focus on the Fed's policy meeting and will look for updates on when the central bank will raise interest rates and by how much.

Mixed moods prevail today in commodity markets amid a slightly stronger dollar while the US 10-year Treasury rose to 1.78%. Gold jumped above $1,850.00 level while silver pulled back to support at $23.60. WTI oil rose more than 1% and tested $85.50 level while Brent jumped to resistance at $87.00. Major cryptocurrencies launched today's session in positive moods. Bitcoin jumped above $37 000 level while Ethereum is currently approaching $2500 level.

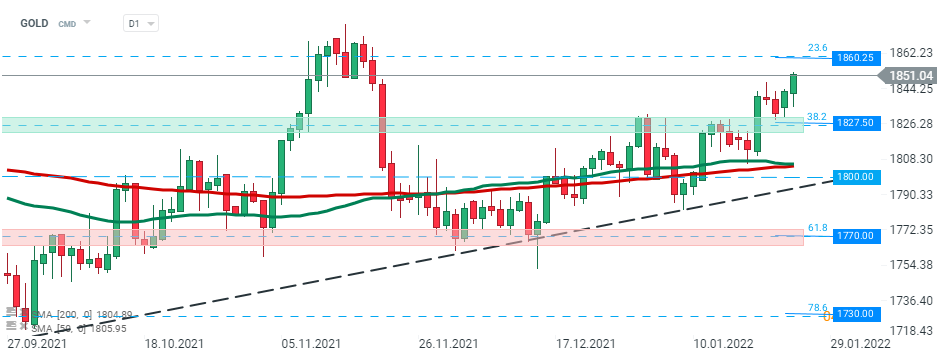

Gold price erased early losses and rose over 0.60% and is currently trading at $1850 which is the highest level since November 2021. If current sentiment prevails, the upward move may accelerate towards resistance at $1860 which coincides with 23.6% Fibonacci retracement of the upward move launched in March 2021. On the other hand, if bullish momentum fades away, the nearest support to watch lies at $1827.50 and is marked by 38.2% retracement. Source: xStation5

Gold price erased early losses and rose over 0.60% and is currently trading at $1850 which is the highest level since November 2021. If current sentiment prevails, the upward move may accelerate towards resistance at $1860 which coincides with 23.6% Fibonacci retracement of the upward move launched in March 2021. On the other hand, if bullish momentum fades away, the nearest support to watch lies at $1827.50 and is marked by 38.2% retracement. Source: xStation5

NFP preview

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.