• Ireland goes back into lockdown

• Wall Street rises ahead of stimulus talks deadline

• US Justice Department filed an antitrust lawsuit against Alphabet Inc's Google

European indices finished today's session in mixed moods as concerns about increasing number of COVID-19 cases in Europe mounted after Ireland decided to re-impose lockdown. Meanwhile many others EU countries, including Germany, Italy, France, imposed stricter restrictions. On the corporate front, IAG and Easy stocks gained over 5% after one-hour Covid-19 tests for passengers traveling to destinations that require pre-departure tests became available at Heathrow airport. Meanwhile other European companies including UBS, Swedbank, Logitech, Reckitt Benckiser, Orion and Sartorius Stedim posted better than expected quarterly figures. During today's session DAX 30 fell 0.8%, CAC 40 lost 0.1% and FTSE 100 finished 0.8% higher.

Major US indexes are trading near 1% higher, trying to recover yesterday losses, as investors are hoping for more stimulus from Washington, with Senate Republicans preparing to vote on a bill to help small businesses which are affected by the pandemic. Also 48 hours deadline imposed by Democrats is set to expire tonight. House of Representatives Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin will also talk again on Tuesday, after a 53-minute telephone conversation on Monday "continued to narrow their differences" about the coronavirus aid package, a Pelosi spokesman said on Twitter. On the corporate front, earnings from Travelers, Procter & Gamble, ProLogis and Philip Morris surprised on the upside while IBM's results disappointed as revenues continued to decline in recent quarter. U.S. Justice Department sued Google, claiming that the tech-giant uses its market power to fend off rivals and said nothing was off the table, including a breakup of the company. Netflix Inc. and Texas Instruments will both provide their quarterly results after the market closes.

U.S. crude futures managed to erase early losses and are trading 0.32% higher at $40.95 a barrel, while the international benchmark Brent contract rose 0.14% to $42.68. During yesterday's meeting, OPEC+ Joint Ministerial Monitoring Committee made no decision regarding any changes to a plan to further ease oil output cuts from January. OPEC Secretary Muhammed Barkindo pointed out that OPEC and associated countries will not allow oil prices to fall amid the second wave of coronavirus. At the moment OPEC+ will comply with a deal to reduce output by 7.7 million bpd through December. Investors will now await the API report due later in the day.

Elsewhere, gold futures rose 0.3% to $1,910/oz, while silver is trading 0.75% higher at $25.68/oz.

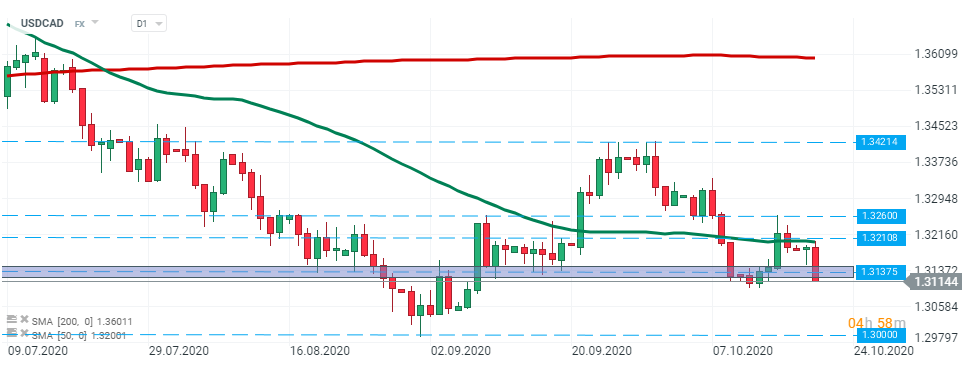

USDCAD – during today’s session currency pair bounced off the 50 SMA (green line) and broke below the major support located at 1.3137. If the current sentiment prevails, the downward move could be extended to the 1.30 handle. Source: xStation5

USDCAD – during today’s session currency pair bounced off the 50 SMA (green line) and broke below the major support located at 1.3137. If the current sentiment prevails, the downward move could be extended to the 1.30 handle. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.